On April 26th, Global Markets and Domestic Policies Show Mixed Signals

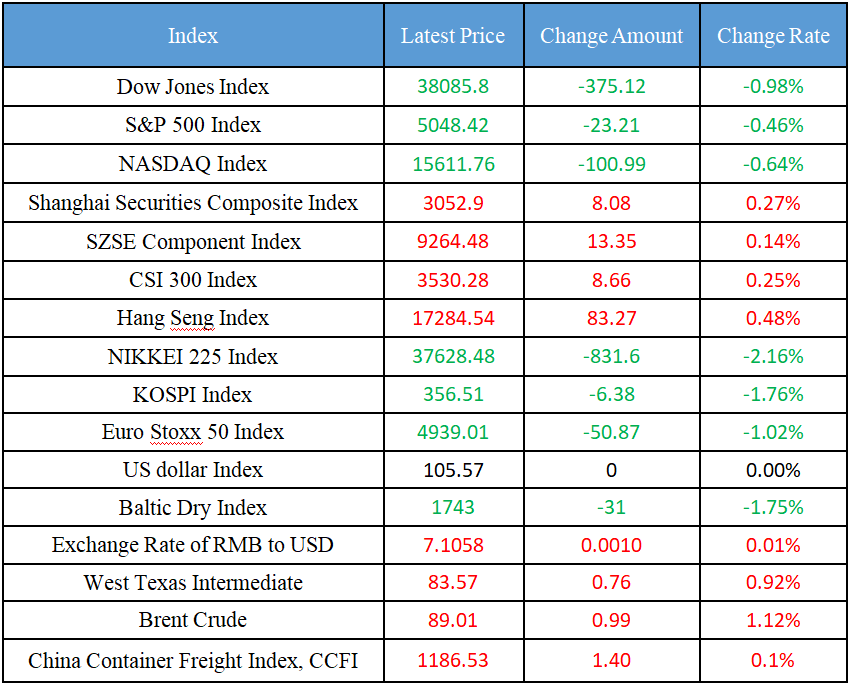

Latest Global Major Index

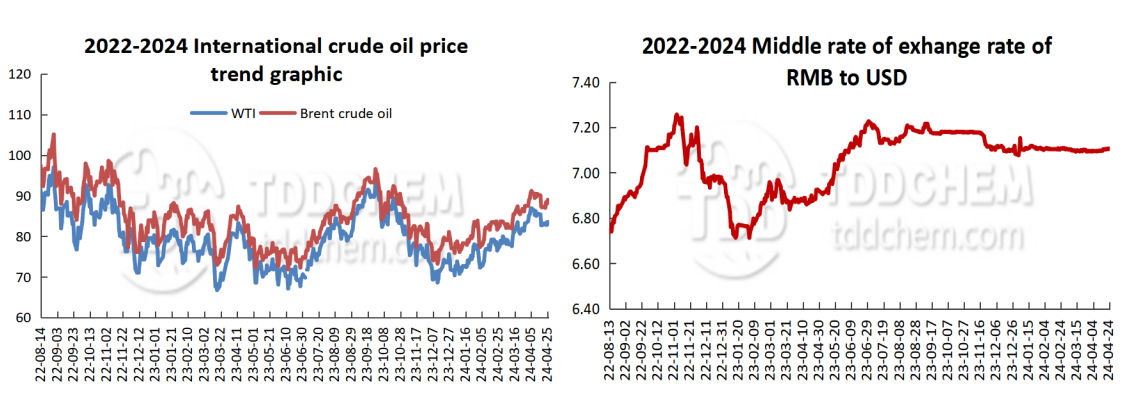

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. CFFEX held the 2024 Market Business Work Symposium to enhance the intrinsic stability of the financial futures market

2. Shanghai Futures Exchange: Adjust and optimize risk control measures in a timely manner to ensure that the timeliness of measures stabilizes market expectations

3. Shanghai Futures Exchange: Prevent systemic risks caused by large price fluctuations and prevent overheating of transactions

4. Power Investment Energy: Terminate residential photovoltaic projects

5. The central government issued 1.416 billion yuan of disaster prevention and relief funds for agricultural production

International News

1. PCE rebounded sharply, and the three major U.S. stock indexes collectively opened lower

2. Institutions: The slowing economy and the rebound in inflation have put the Fed in a difficult position

3. The U.S. economy is cooling down, and the labor market is slowing down or easing inflationary pressures

4. U.S. bonds fell due to weakening price pressures in the first quarter, and expectations of interest rate cuts were suppressed

5. After the release of U.S. GDP data, the probability that the Fed will keep interest rates unchanged in May and June has increased slightly

Domestic News

1. CFFEX held the 2024 Market Business Work Symposium to enhance the intrinsic stability of the financial futures market

China Financial Futures Exchange held the 2024 Market Business Work Symposium. At the meeting, the participants exchanged views on topics such as implementing the spirit of the Central Financial Work Conference and the new "National Nine Articles" to better serve the high-quality development of the capital market. The participating market-making institutions said that they will continue to improve their market-making business capabilities, strengthen risk prevention and compliance management, strive to create a good market ecology, and contribute to the high-quality development of the financial futures market. The relevant person in charge of CFFEX said that in the next step, CFFEX will continue to improve the management system and system of market makers in the financial futures market, continue to strengthen the supervision of market making institutions, and strive to enhance the internal stability of the financial futures market, so as to better serve the high-quality development of the capital market.

2. Shanghai Futures Exchange: Adjust and optimize risk control measures in a timely manner to ensure that the timeliness of measures stabilizes market expectations

In the face of subsequent market development and changes, the Exchange stated that it will use scientific and technological means to improve the efficiency of first-line supervision, increase the supervision of accounts that fail to truthfully declare the actual control, strictly investigate clues of violations of laws and regulations that undermine the price formation mechanism and infringe on the legitimate rights and interests of all parties, and severely crack down on violations of laws and regulations in accordance with the law. According to the market risk situation, adjust and optimize risk control measures in a timely manner, and implement policies according to products and times to ensure that the timeliness of measures stabilizes market expectations. Taking the needs of entity enterprise risk management as the driving force and source of reform and innovation in the futures market, we will further optimize the institutional mechanism, improve the quality of operation, enhance the service capacity of the exchange, better promote the function of the futures market, and help build a modern industrial system around the convenience of trading and the adequacy of delivery.

3. Shanghai Futures Exchange: Prevent systemic risks caused by large price fluctuations and prevent overheating of transactions

Since the beginning of this year, precious metals and non-ferrous metals such as copper and tin have risen significantly in the global context, which has attracted attention from all walks of life. In the face of subsequent market development and changes, the Exchange stated that it will adhere to the general tone of seeking progress while maintaining stability, focus on strengthening supervision, preventing risks and promoting high-quality development, adhere to the principle of marketization and rule of law, prevent systemic risks caused by large price fluctuations, prevent overheating of transactions, ensure the safe and stable operation of the market, and provide a safe and reliable place for price discovery, risk management and resource allocation for the economy and society.

4. Power Investment Energy: Terminate residential photovoltaic projects

Power Investment Energy announced that it intends to terminate the household photovoltaic project of Tongliao Tongdian New Energy Co., Ltd., the comprehensive smart energy project of Huatugula Town, and the Shandong 100MW household photovoltaic project of Shandong Narentai New Energy Co., Ltd.

5. The central government issued 1.416 billion yuan of disaster prevention and relief funds for agricultural production

On April 25, the Ministry of Finance, together with the Ministry of Agriculture and Rural Affairs, issued 1.416 billion yuan of disaster prevention and relief funds for agricultural production from the central government to support Heilongjiang, Jiangsu, Anhui, Shandong, Henan and other 30 provinces (autonomous regions and municipalities directly under the central government) and Beidahuang Agricultural Reclamation Group to speed up the prevention and control of pests and diseases in agriculture, especially food crops. Focus on the local purchase of pesticides, medical equipment and other materials, as well as unified prevention and control operation services to give appropriate subsidies, timely guide all localities to further strengthen monitoring and early warning, and carry out wheat, rice, corn diseases and pests, as well as locusts and red fire ants in agricultural areas, to provide strong support for the annual grain harvest.

International News

1. PCE rebounded sharply, and the three major U.S. stock indexes collectively opened lower

At the opening of U.S. stocks, the Dow fell 408 points, the S&P 500 fell 1.41%, and the Nasdaq fell more than 2%. Meta Platforms(META. O) plunged 14% as the company's Q2 revenue guidance fell short of expectations. The crypto sector fell, with Riot Platform down 6.4% and Marathon Digital (MARA. O) fell 6.2% and Coinbase (COIN. O) fell 3.2% on the news that the SEC is said to be expected to refuse to approve spot Ethereum ETFs next month.

2. Institutions: The slowing economy and the rebound in inflation have put the Fed in a difficult position

Brian Jacobson, chief economist at Annex Wealth Management, said GDP growth was lower than expected, but in terms of consumer spending, the services sector was growing but the goods were declining. Despite the overall weakness, domestic spending by households remains healthy. Unfortunately, spending on things like insurance and health care seems to be crowding out other spending. And the inflation data is not encouraging. The annualized rate of price growth in the services sector accelerated again to 5.4%, which made it a bit difficult for the Fed. Economic growth is starting to slow, while inflation has rebounded. This is the paradox that central bankers are most worried about.

3. The U.S. economy is cooling down, and the labor market is slowing down or easing inflationary pressures

The preliminary annualized rate of real GDP in the United States in the first quarter was 1.6%, lower than economists' expectations. This follows a series of data in recent weeks that showed that the US economy has maintained strong growth. Sustained economic growth has created persistent price pressures, which increases the likelihood that inflation may stabilize around 3% rather than the Fed's 2% target. At the same time, investors' expectations of interest rate cuts were upended. However, there are yet another signs that the economy is cooling. Low-income Americans are saving far less than they were before the pandemic. Mortgage rates recently rebounded above 7%, leading to the biggest monthly decline in home sales in more than a year in March. Average hourly earnings rose at the slowest pace since June 2021 in March. Many economists still believe that if the labor market slows, these phenomena will expand, slowing inflation.

4. U.S. bonds fell due to weakening price pressures in the first quarter, and expectations of interest rate cuts were suppressed

U.S. Treasury prices fell as investors focused on signs of sticky price pressures in the U.S. Q1 GDP data, which further weakened expectations for the Federal Reserve to cut interest rates this year. While the economy grew worse than most economists expected in the second quarter, another overheated data on underlying inflation, as well as lower-than-expected weekly jobless claims, provided precedent for bond traders. The yield on the two-year Treasury note rose about 5 basis points to around 4.98%. Swap traders now expect the Fed to cut rates by only about 35 basis points for all of 2024, well below the more than six 25 basis point cuts they expected earlier this year. Bob Doll, chief investment officer at Crossmark Global Investments, said he doesn't think the Fed will raise interest rates, but looking at Treasury yields, we've seen the yield on the 10-year Treasury go up to 4.65%.

5. After the release of U.S. GDP data, the probability that the Fed will keep interest rates unchanged in May and June has increased slightly

According to CME "Fed Watch": the probability that the Fed will keep interest rates unchanged in May is 99.7% (98.4% before the release of the data), and the probability of a 25 basis point rate hike is 0.3%. The probability that the Fed will keep interest rates unchanged until June is 86% (79.9% before the release of the data), the probability of a cumulative 25 basis point rate cut is 13.8%, and the probability of a cumulative 25 basis point rate hike is 0.2%.

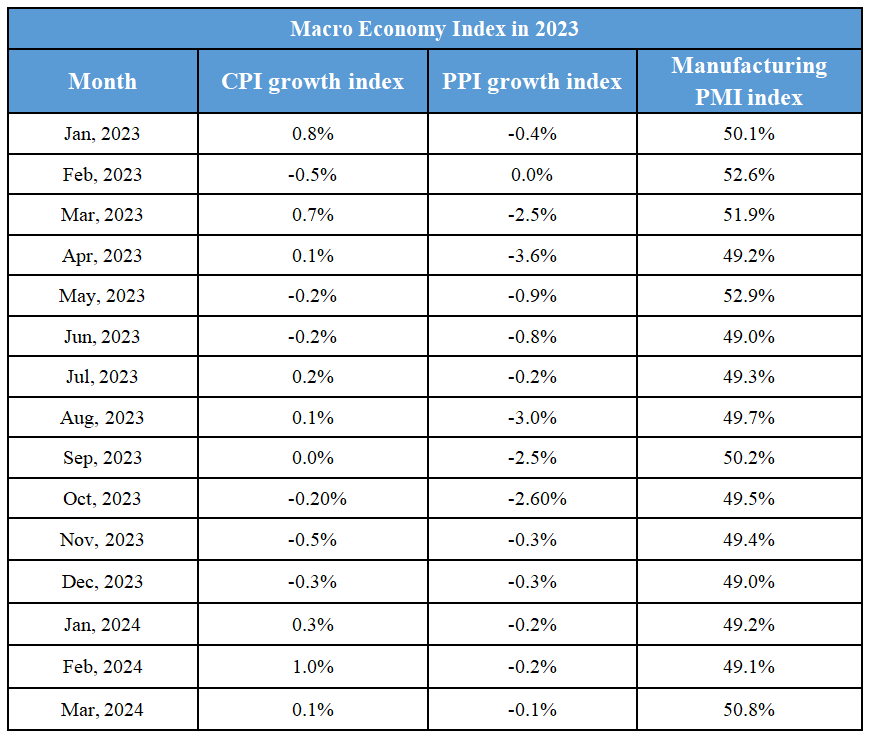

Domestic Macro Economy Index