On April 17th, Global Economic Highlights: China's Q1 GDP Growth and International Developments

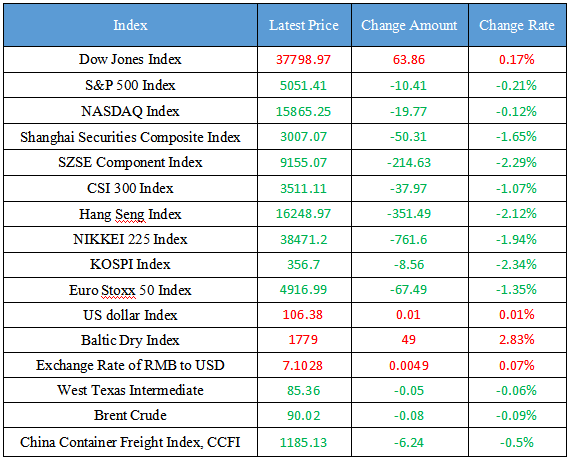

Latest Global Major Index

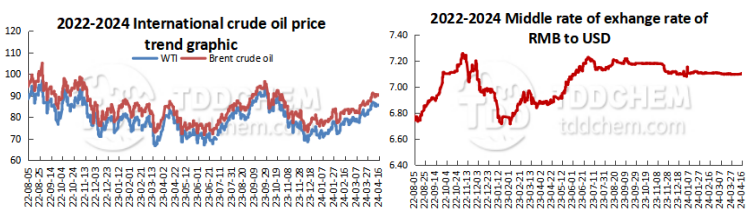

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. China's GDP grew 5.3% year-on-year in Q1

2. National Bureau of Statistics: National fixed asset investment increased by 4.5% from January to March 2024

3. National Bureau of Statistics: While doing an excellent job in the technological transformation and upgrading of traditional industries, we should accelerate the cultivation of emerging industries and future industries

4. The EU plans to launch an investigation into China's medical device procurement, and Mindray responds that it has always participated in market competition in accordance with laws and regulations

International News

1. Iranian officials: Iran will respond appropriately to any hostile actions by the Israeli side

2. UBS strategists: The possibility that the Fed will raise interest rates to 6.5% next year is real

3. The use of the Fed's overnight reverse repurchase agreement fell to less than $400 billion

4. Source: Rusal is concerned that the Anglo-US metal sanctions could jeopardize up to 36% of its sales

Domestic News

1. China's GDP grew 5.3% year-on-year in Q1

On April 15, the National Bureau of Statistics released data showing that preliminary calculations showed that the GDP in the first quarter was 296299 billion yuan, a year-on-year increase of 5.3% at constant prices, and a quarter-on-quarter increase of 1.6% over the fourth quarter of last year. By industry, the added value of the primary industry was 1,153.8 billion yuan, up by 3.3 percent year-on-year, the added value of the secondary industry was 10.9846 trillion yuan, up by 6.0 percent, and the added value of the tertiary industry was 17.4915 trillion yuan, up by 5.0 percent. The National Bureau of Statistics said that on the whole, the national economy had a good start in the first quarter, and the accumulation of positive factors increased, laying a good foundation for achieving the goals and tasks for the whole year. However, it should also be noted that the complexity, severity and uncertainty of the external environment have risen, and the foundation for economic stability and improvement is not yet solid..

2. National Bureau of Statistics: National fixed asset investment increased by 4.5% from January to March 2024

National Bureau of Statistics: From January to March 2024, the national investment in fixed assets (excluding rural households) were 10.0042 trillion yuan, a year-on-year increase of 4.5%, and the growth rate was 0.3 percentage points faster than that from January to February. Among them, the investment in the manufacturing industry increased by 9.9 percent, the growth rate accelerated by 0.5 percentage points, and the infrastructure investment (excluding the production and supply of electricity, heat, gas and water) increased by 6.5 percent, the growth rate accelerated by 0.2 percentage points. On a month-on-month basis, investment in fixed assets (excluding rural households) increased by 0.14% in March. From January to March 2024, private investment in fixed assets was 5,159.7 billion yuan, a year-on-year increase of 0.5%.

3. National Bureau of Statistics: While doing an excellent job in the technological transformation and upgrading of traditional industries, we should accelerate the cultivation of emerging industries and future industries

Sheng Laiyun, Deputy Director of the National Bureau of Statistics, said at the press conference on the operation of the national economy in the first quarter that in the next step, we must continue to accelerate the cultivation and development of new quality productivity, because it is the biggest driving force for China's economic transformation and high-quality development, and it is also the best starting point. Therefore, we must make overall plans, adapt measures to local conditions, and speed up the cultivation of emerging industries and future industries while doing a good job in the technological transformation and upgrading of traditional industries, so as to expand and strengthen the new quality productive forces.

4. The EU plans to launch an investigation into China's medical device procurement, and Mindray responds that it has always participated in market competition in accordance with laws and regulations

According to a report by Bloomberg on the 15th, the European Union will launch an investigation into China's medical equipment procurement, in order to eliminate concerns about the Chinese government's unfair favoritism towards domestic suppliers. It is reported that the main purpose of the survey is to engage in dialogue with China to ensure a fair and ope market. This will be the first time that the EU's so-called International Sourcing Tool (IPI) has been used. After the news came out, Mindray Medical, a leading domestic medical device company, also responded to related matters. According to the company, Mindray has always actively practiced the concept of free trade, strictly abided by the laws, regulations and regulatory requirements of various countries around the world, and participated in market competition in accordance with laws and regulations.

International News

1. Iranian officials: Iran will respond appropriately to any hostile actions by the Israeli side

On April 15, local time, a spokesman for the National Security and Foreign Policy Committee of the Iranian parliament said that Iran warned Israel and asked it to act rationally and that Iran was ready to "use weapons that have not been used so far." The spokesman said Iran's message was peaceful, but it was also prepared for other things. Iran's previous military actions against Israel are legitimate moves, and Israel should put an end to its aggression and criminal acts. Iran does not want tensions in the region, but it is Israel's crimes in Gaza that destabilize the region.

2. UBS strategists: The possibility that the Fed will raise interest rates to 6.5% next year is real

Stubborn inflation and strong economic growth have raised the likelihood that the Fed will raise interest rates rather than cut them, with rates likely to rise as high as 6.5% next year, UBS strategists said. While the bank's baseline forecast is for two rate cuts this year, UBS sees a growing likelihood that inflation will not meet the Fed's target, which will spur monetary policy to pivot to interest rate hikes and trigger a sharp sell-off in equity and bond markets. UBS strategists such as Jonathan Pingle and Bhanu Baweja believe that "if the economic expansion remains resilient and inflation stays at 2.5% or higher, the FOMC is likely to resume raising interest rates early next year, and rates could reach 6.5% by the middle of next year."

3. The use of the Fed's overnight reverse repurchase agreement fell to less than $400 billion

On Monday (April 15), the Fed's overnight reverse repurchase agreement (RRP) was used at $327.066 billion, at least for the first time since May 2021, below the $400 billion mark, a new low since May 19, 2021 ($294 billion on the day), and $407.322 billion in the previous trading day. RRP demand has declined by about $128 billion over the past two trading days due to the U.S. Treasury Department's mid-month coupon auction settlement and liquidity related to the U.S. tax filing deadline. The interest rate paid at the RRP is 5.30%, which helps to temporarily reduce the reserve balance in the banking system.

4. Source: Rusal is concerned that the Anglo-US metal sanctions could jeopardize up to 36% of its sales

Russian aluminum giant Rusal is concerned that up to 36% of the company's sales could be at risk due to sanctions from the United Kingdom and the United States, according to a person familiar with the matter. Rusal's preliminary estimate is that US-Western sanctions could affect its annual sales of at least 1.5 million tonnes, compared with 3.8 million tonnes of production and 4.2 million tonnes of sales last year. As a result, Rusal may be forced to cut production, comparing the situation to the severe damage to demand during the 2008 global financial crisis. This assessment is at odds with the opinion of most Western analysts. These analysts believe that the sanctions imposed on Russian metals last Friday have limited impact on potential supply and demand.

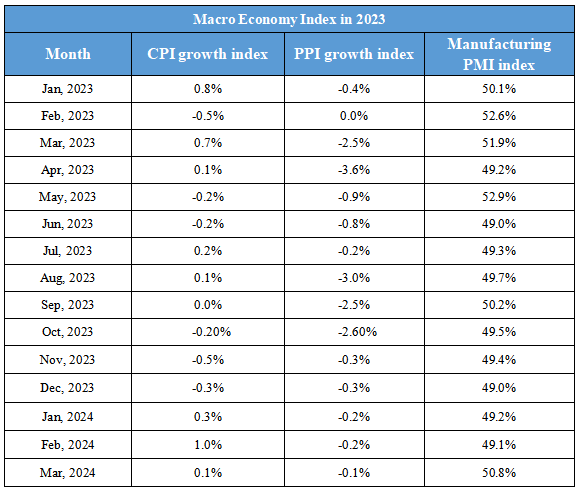

Domestic Macro Economy Index