April 12th Global Macro Economic Update

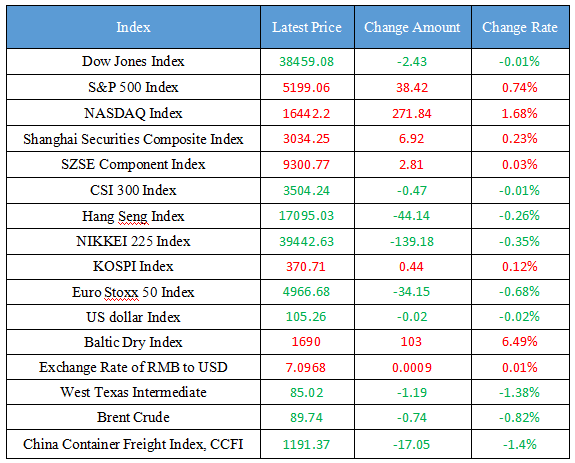

Latest Global Major Index

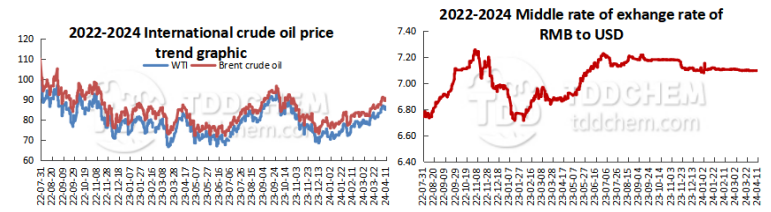

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Since April, small and medium-sized banks in many parts of the country have announced a reduction in the interest rate on time deposits

2. National Health Insurance Administration: The scale of residents' medical insurance participation is basically the same as that of the same period in 2023

3. China’s enterprise user number of commodity barcode and commodity data rank first worldwide

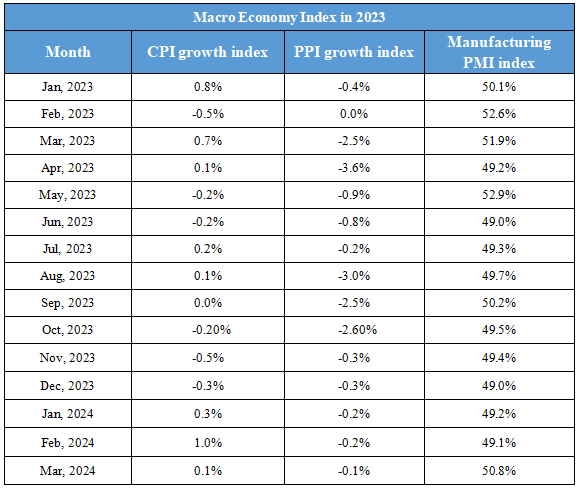

4. China's CPI year-on-year growth rate narrowed to 0.1% in March, and the year-on-year decline in PPI expanded to 2.8%

International News

1. ADB expects the Asia-Pacific economy to continue to grow strongly

2. Many institutions predict the possibility of the Federal Reserve cutting interest rates

3. Explosions were heard in many places in Ukraine, and Russia shot down Ukrainian drones in many places

4. Canalys: The global wearable wristband market is expected to grow by 7% in 2024

Domestic News

1. Since April, small and medium-sized banks in many parts of the country have announced a reduction in the interest rate on time deposits

According to the Financial Times, which is in charge of the central bank, since April, small and medium-sized banks such as urban commercial banks, rural commercial banks and village and township banks in many places across the country have announced a reduction in the interest rate on fixed deposits. In fact, since March, banks have successively adjusted the interest rates of deposit products, including time deposits. Through research, the reporter found that the small and medium-sized banks intensively lowered the interest rate of fixed deposits, involving deposit products covering 3 months, 6 months, 1 year, 2 years, 3 years and other multi-term varieties, and the interest rate reduction range is generally 5 to 45 basis points. After the small and medium-sized banks have intensively lowered their deposit interest rates, the general question among the public is whether the deposit interest rates will continue to fall? In this regard, industry experts said that whether the deposit interest rates will be further lowered depends on whether the loan interest rates will continue to fall. At the same time, from the perspective of commercial banks, in addition to reducing costs by controlling the interest rate of fixed deposits, more attention should also be paid to the control of high-cost liabilities.

2. National Health Insurance Administration: The scale of residents' medical insurance participation is basically the same as that of the same period in 2023

On April 11, at the press conference held by the National Health Insurance Administration, the relevant person in charge introduced that from the latest situation at the end of March 2024, the scale of residents' medical insurance participation is basically the same as that of the same period in 2023, and there is no so-called "wave of withdrawal from medical insurance" in some media. According to reports, on the basis of excluding nearly 40 million people in provinces (autonomous regions and municipalities directly under the central government) in 2022, 16 million people continued to be excluded from inter-provincial duplicate insurance in 2023, and after considering the impact of "deduplication", the actual net increase in the number of insured people in 2023 was about 4 million, and the quality of insurance was further improved.

3. China’s enterprise user number of commodity barcode and commodity data rank first worldwide

According to the statistics of China Article Coding Center, by the end of March 2024, the total number of enterprise users of China's commodity bar code has exceeded 580,000, ranking in the leading position in the world for many years; China has the world's largest commodity database, relevant data show that as of April 7, 2024, the total number of consumer goods registered to use commodity bar code in China has reached 195.9 million.

4. China's CPI year-on-year growth rate narrowed to 0.1% in March, and the year-on-year decline in PPI expanded to 2.8%

Affected by factors such as the seasonal decline of consumption and sufficient supply, the year-on-year growth rate of China's CPI in March fell significantly, and the month-on-month growth rate fell again after three months. With the recovery of industrial production after the holiday, the supply of industrial products is relatively sufficient, and the month-on-month decline in PPI narrowed, and the year-on-year decline expanded slightly. On April 11, the National Bureau of Statistics released data showing that the CPI in March increased by 0.1% year-on-year, significantly narrower than the previous value of 0.7%, and the CPI fell by 1.0% month-on-month in March, and the previous value rose by 1.0%, which turned down again after three months. The core CPI, which excludes food and energy prices, rose 0.6% year-on-year, narrowing by 0.6 percentage points from the previous month.

International News

1. ADB expects the Asia-Pacific economy to continue to grow strongly

The Asian Development Bank released the "2024 Asian Development Outlook" report on the 11th, saying that the Asia-Pacific economy will continue to grow strongly, and the economic growth rate of the Asia-Pacific developing economies is expected to be 4.9% this year. According to the report, despite the uncertainty of the external environment, factors such as the end of the interest rate hike cycle of the world's major economies and the continued recovery of commodity trade will support the economic growth of the Asia-Pacific region, and the overall outlook for the region is positive, with regions such as South Asia, Southeast Asia and East Asia leading economic growth.

2. Many institutions predict the possibility of the Federal Reserve cutting interest rates

CICC: The Federal Reserve may only cut interest rates once this year, and the timing of interest rate cuts may be postponed to the fourth quarter; Huatai Securities: U.S. inflation exceeds expectations again, and three interest rate cuts may be difficult to achieve; Western Securities: The start of the interest rate cut cycle still faces obstacles; Soochow Securities: The downward trend of U.S. inflation has at least temporarily stalled; Kaiyuan Securities: The Federal Reserve may not cut interest rates in 2024.

3. Explosions were heard in many places in Ukraine, and Russia shot down Ukrainian drones in many places

The Ukrainian Air Force posted on social media on the 11th that in the early morning of the same day, Ukraine suffered a new round of missile and drone attacks, and the air defense alarm sounded throughout Ukraine. On the same day, the Russian Ministry of Defense reported that Russian air defense systems shot down 12 Ukrainian drones in Kursk, Belgorod, Tambov and other places.

4. Canalys: The global wearable wristband market is expected to grow by 7% in 2024

According to Canalys' latest research report, the global wearable wristband device market achieved a modest growth of 1.4% in 2023, with shipments reaching 185 million units. Emerging markets contributed particularly well, providing strong impetus for overall growth. In addition, the diversified development of basic watches has also injected new vitality into the industry. Looking ahead, innovation will be the core driver of the revitalization of the wearable market. The boom in AI-driven, health monitoring, and outdoor devices will be the key factors leading the market growth, with Canalys cautiously optimistic about the wearable wristband market in 2024, which is expected to grow by 7%.

Domestic Macro Economy Index