April 11th, Global and Domestic Economic Highlights

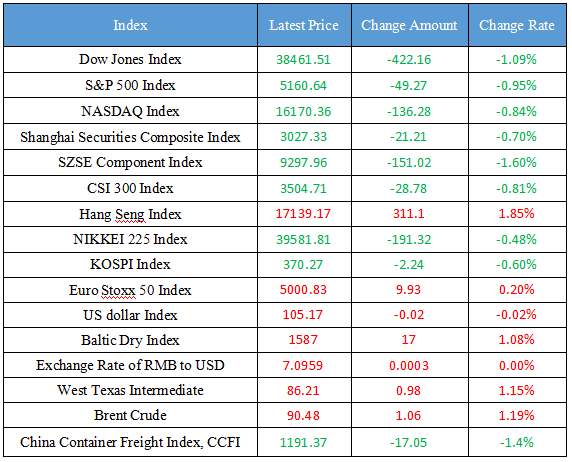

Latest Global Major Index

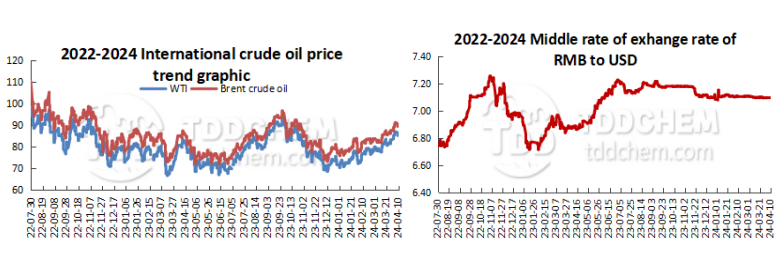

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Ministry of Finance: China's deficit rate in 2024 is moderate and reasonable at 3%

2. The market is warm, the book has improved, and the economic operation has released a continuous positive signal

3. Mao Dongjun, Deputy Director of Beijing Municipal Bureau of Economy and Information Technology: Promote the linkage and scale-based development of the Beijing-Tianjin-Hebei new energy storage industry

4. China Association of Auto Manufacturers: Vehicle exports in March were 502,000 units, reflecting a 37.9% y/y increase

International News

1. A new round of economic offensive against China? The EU's "countervailing" targets at China's wind turbines

2. Governor of the Bank of Japan: The existing monetary policy will not be changed because of the weak yen

3. The International Atomic Energy Agency (IAEA) will convene an emergency meeting on the attack on the Zaporizhzhya nuclear power plant

4. Goldman Sachs strategist: Global economic growth and the prospect of the Federal Reserve cutting interest rates are positive for risk currencies

Domestic News

1. Ministry of Finance: China's deficit rate in 2024 is moderate and reasonable at 3%

In response to a reporter's question on Fitch's downgrade of China's sovereign credit rating, a responsible comrade of the Ministry of Finance said that in the long run, maintaining a moderate deficit scale and making good use of valuable debt funds will help expand domestic demand, support economic growth, and ultimately maintain good sovereign credit. The Chinese Government has always adhered to the multiple objectives of supporting economic development, preventing fiscal risks and achieving fiscal sustainability. The deficit ratio in 2024 will be arranged at 3%, which is moderate and reasonable on the whole, which is conducive to stable economic growth, and can also better control the government debt ratio, so as to reserve policy space for coping with possible risks and challenges in the future.

2. The market is warm, the book has improved, and the economic operation has released a continuous positive signal

The head article of China Securities News pointed out that recently, China's economic operation has released positive signals. From the perspective of consumption, market activity has increased, and from the perspective of books, the earnings of some listed companies have improved in the first quarter. Experts said that the first quarter of the economy "good start" is excellent, laying the foundation for the achievement of the annual economic growth target. With the accelerated implementation of policies such as equipment upgrading and renovation and trade-in of consumer goods, the foundation for economic recovery is expected to be further consolidated. At present and in the coming period, the policy of stabilizing growth and stabilizing expectations will continue to be introduced, which is expected to further consolidate the positive trend of economic recovery.

3. Mao Dongjun, Deputy Director of Beijing Municipal Bureau of Economy and Information Technology: Promote the linkage and scale-based development of the Beijing-Tianjin-Hebei new energy storage industry

Mao Dongjun, member of the party group and deputy director of the Beijing Municipal Bureau of Economy and Information Technology, said at the energy storage international summit and exhibition that Beijing has been vigorously promoting the development of the new energy storage industry for a long time, and proposed to build two new energy storage industry demonstration zones in Changping and Fangshan to provide a broader development space for the energy storage industry. At the same time, it is proposed to support the demonstration and promotion of new technologies and new models such as optical storage, charging and swapping, and vehicle-network interaction, and create innovative solutions for the integration of vehicles, piles and parking area. Mao Dongjun said that in the future, Beijing will accelerate the original achievements of cutting-edge, cross-cutting and disruptive technologies of new energy storage and achieve more breakthroughs from 0 to 1. At the same time, Beijing will focus on advantageous areas, further improve the industrial ecology, improve the level of industry agglomeration, and promote the linkage and large-scale development of the new energy storage industry in Beijing-Tianjin-Hebei area.

4. China Association of Auto Manufacturers: Vehicle exports in March were 502,000 units, reflecting a 37.9% y/y increase

China Association of Automobile Manufacturers: Vehicle exports in March totaled 502,000 units, reflecting a 33% m/m increase and a 37.9% y/y increase. Passenger car exports totaled 424,000 units, reflecting a 34.6% m/m increase and a 39.3% y/y increase. Commercial vehicle exports totaled 78,000 units, reflecting a 24.9% m/m increase and a 31% y/y increase. Vehicle exports from January to March totaled 1.324 million units, reflecting a 33.2% y/y increase. Passenger car exports totaled 1.11 million units, reflecting a 34.3% y/y increase, while commercial vehicle exports totaled 214,000 units, reflecting a 27.5% y/y increase.

International News

1. A new round of economic offensive against China? The EU's "countervailing" targets at China's wind turbines

The European Union announced on the 9th that it would launch an investigation into Chinese wind turbine suppliers suspected of gaining an "unfair advantage" in the European market through foreign subsidies. Hong Kong's South China Morning Post said this is the latest round of economic offensive launched by Brussels against China. According to Agence France-Presse, Margaret Vestager, head of EU competition affairs, said in a speech at Princeton University in the United States on the 9th that "today, we are launching a new investigation into Chinese wind turbine suppliers" and "we are investigating the conditions for the development of wind farms in Spain, Greece, France, Romania and Bulgaria".

2. Governor of the Bank of Japan: The existing monetary policy will not be changed because of the weak yen

As the yen remained at a 34-year low against the dollar, Bank of Japan Governor Kazuo Ueda stressed in his latest speech that the Bank of Japan would not change its policy directly in response to the yen's movements. When asked by an opposition lawmaker on Wednesday whether the Bank of Japan would take action against the yen's decline, Ueda reiterated that he would not consider changing monetary policy at all to deal directly with foreign exchange fluctuations. Kazuo Ueda also reiterated that the Bank of Japan will maintain accommodative monetary conditions for the time being, as underlying inflation remains below the bank's 2% target. At the March meeting, it was decided to end easing policy, including negative interest rates, as the bank was already confident that it would achieve its inflation target.

3. The International Atomic Energy Agency (IAEA) will convene an emergency meeting on the attack on the Zaporizhzhya nuclear power plant

According to Xinhua News Agency, the International Atomic Energy Agency said on the 9th that it would hold an emergency meeting of the Agency's Board of Governors at its headquarters in Vienna on the 11th to discuss the recent attack on the Zaporizhzhya nuclear power plant. In a statement to the media, the IAEA said that Russia and Ukraine had sent letters to the chairmen of the Agency's Board of Governors requesting a meeting of the Board of Governors. The Chair of the Board of Governors of the Agency therefore convened the meeting. In a separate statement issued on the 9th, the IAEA said that it had been informed of another drone attack on the Zaporizhzhia nuclear power plant earlier in the day, and that the attack did not pose a threat to the nuclear safety of the nuclear power plant.

4. Goldman Sachs strategist: Global economic growth and the prospect of the Federal Reserve cutting interest rates are positive for risk currencies

Pro-cyclical currencies that typically perform well in a high-growth environment, such as the Australian dollar to the Swedish krona, could benefit from positive economic trends and monetary policy easing this year, said Isabella Rosenberg, macro strategist at Goldman Sachs. "The Fed's rate cuts in a non-recessionary environment and the positive changes in economic growth in other parts of the world suggest that now may be a better time to go long risky currencies. Goldman Sachs forecasts that the Australian dollar will rise to 0.70 against the US dollar (now reported at 0.66) over the next six months, while the USD/SEK will fall to 10 (now reported at 10.57) over the same period.

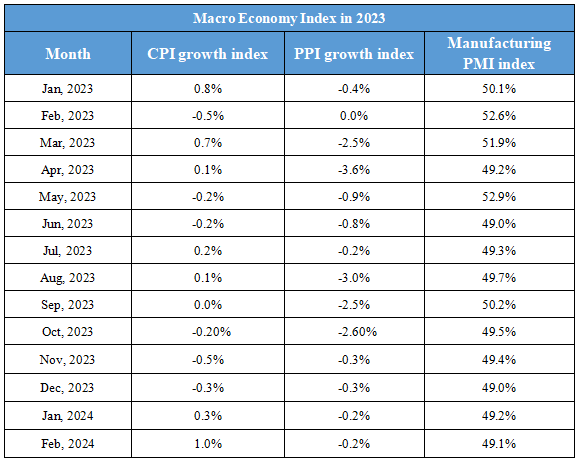

Domestic Macro Economy Index