China Titanium Dioxide Market Analysis in 2020

1.Price analysis

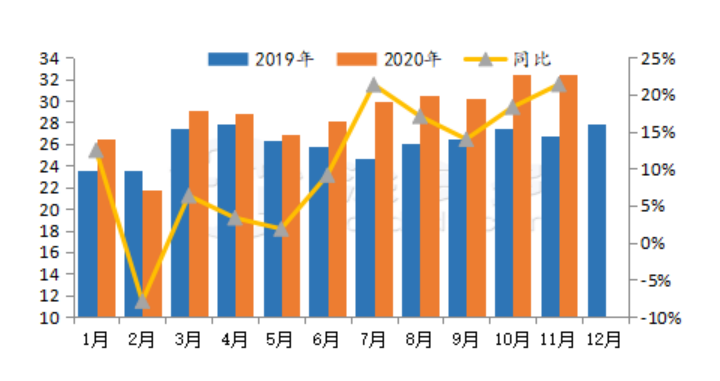

Titanium white prices in 2020 in three stages of rise, fall and rise:

The first stage of steady upward phaseï¼By the rising cost and a significant increase in exports of titanium dioxide prices in January-February steady rise in market prices rose 500 yuan / ton; the end of March by the spread of the global epidemic, corporate exports are blocked, at the end of March the market individual companies have concessions.

The Second stage of panic decline: April prices frequently decline, into June market prices have been about 3,000 yuan / ton range down, the market price decline too fast, some prices have lost money, enterprises cut production, with the gradual recovery of market demand, the end of June prices stopped falling.

The third stage of sustained upward movementï¼By the recovery of exports and domestic demand rebound and costs rose sharply, titanium dioxide prices have continued to rise since July.

As of mid-December market prices have risen 4,000 yuan/ton, or 30%, from the mid-year low, and 1,000-1,500 yuan/ton, or 7%, higher than the same period last year.

2.Production capacity and output analysis

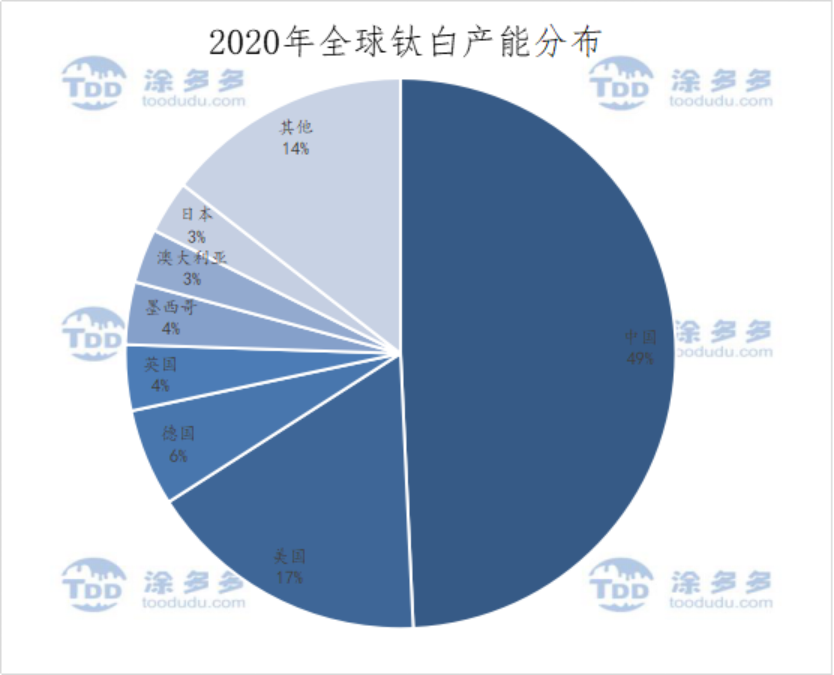

Capacity: According to TDD statistics, China's titanium dioxide production capacity in 2020 at 4.03 million tons, accounting for 49% of the global titanium dioxide production capacity, China accounted for the global titanium dioxide market share is gradually expanding.

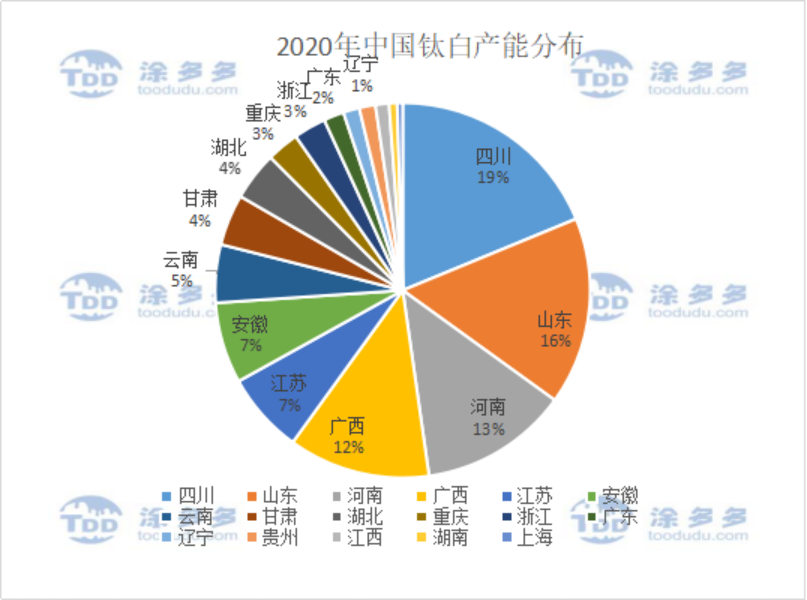

China's titanium dioxide production capacity ranked in the top three regions Sichuan, Shandong, Henan, accounting for 19%, 16%, 13% of the total domestic production capacity, respectively.

Production: According to TDD statistics, China's titanium dioxide production from January to November 3,166,200 tons, has been basically the same as the same period last year, the annual output is expected to be 3,480,000 tons.

Affected by the epidemic, February-March production of titanium dioxide enterprises were affected, in addition to a significant decline in production in February, the rest of the month production has increased in varying degrees.

In the 2 quarter by the low price, the market start some shortage, but because of the release of new production capacity this year, the overall production or increased.

This year's new production mainly new production capacity release, Long Python Bailey Union, China National Nuclear Titanium White, Shandong Dongjia, Guizhou Shengwei, etc.

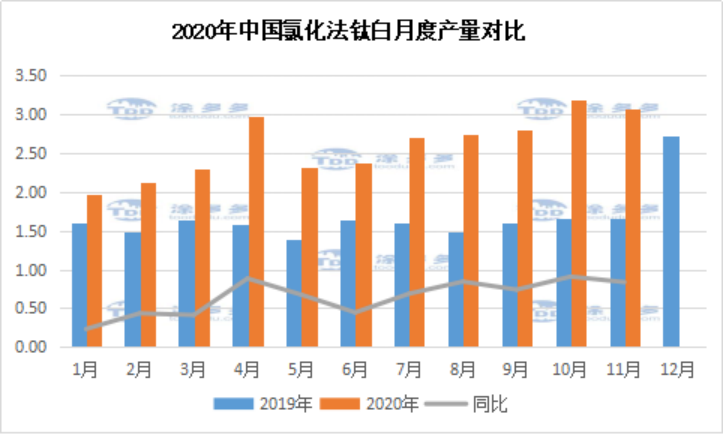

Chloride method: chloride method of titanium dioxide production enterprises 4 (Long Python Bailey, CITIC Titanium, Pangang Vanadium and Titanium, Yibin Tianyuan), with a total capacity of 485,000 tons, accounting for 12% of the total domestic production capacity, of which Long Python Bailey Union accounted for 74% of the entire production capacity of the chloride method.

With the release of chlorinated titanium dioxide project capacity and the resumption of production of the new Long python Bai Li Lian, this year, the chlorinated titanium dioxide production increased significantly, January-November chlorinated titanium dioxide production in 285,700 tons, an increase of 112,100 tons over the same period last year, an increase of 64.54%, accounting for 9% of the total domestic production.

Under construction: According to incomplete statistics, there are more than 20 enterprises in the market for titanium dioxide enterprises under construction, with a total capacity of more than 2 million tons, and 420,000 tons of new production capacity planned for 2021 (including sulfuric acid, chloride, hydrochloric acid method).

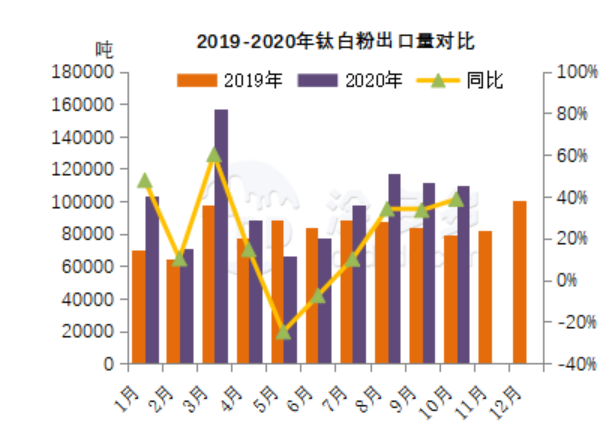

3.Import and export analysis

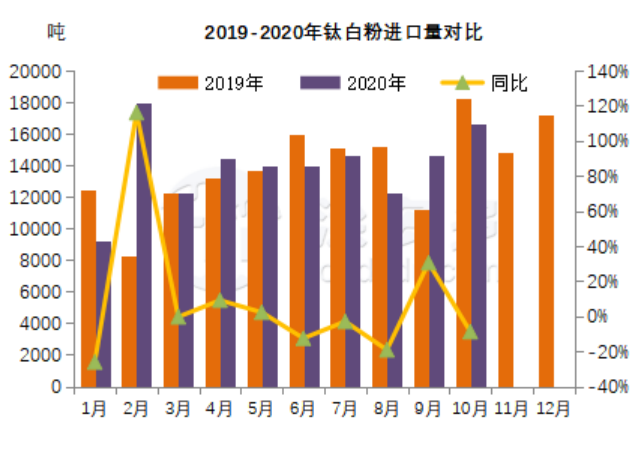

Import data: January-October this year, titanium dioxide imports in 139,700 tons, an increase of 3.08% over last year, the annual import volume is expected to be 170,000 tons; the average monthly import volume in 14,000 tons, less than 10,000 imports in January this year, the most imports in February reached 17,900 tons.

4.Apparent consumption analysis

According to TDD data, the apparent consumption of titanium dioxide in China from January to October was 1,978,600 tons, an increase of 3.8% over the same period last year.

5.Downstream Coating Market Analysis

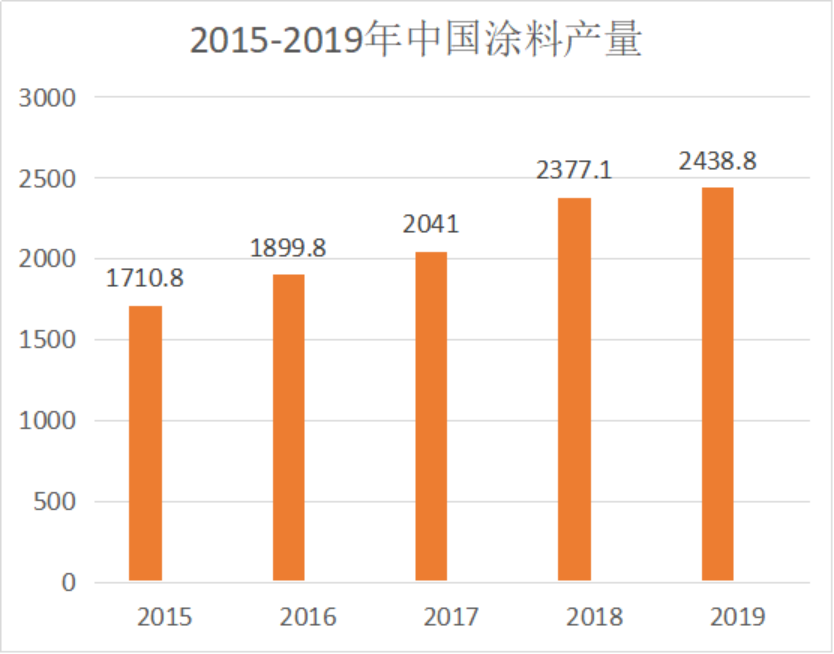

The impact of the epidemic is reflected in the wide variation of different titanium dioxide downstream industries. During the epidemic, the demand for home construction and engineering architectural coatings was strong, while the performance of automotive paint and other industries continued to be sluggish.

This year, the first three quarters of the engineering coating business of Lipan, Carpenter, Baldex, Mead Johnson, Goodco, Orient Rainbow and other companies also achieved growth, and the significant growth in the output of engineering architectural coatings slowed down the decline in the output of the entire coating industry.

According to news reports, on November 11 2020 China Green Paint Painting Exchange, Liu Jie, Acting Secretary General of the China Paint Industry Association, said that from January to September 2020, China's paint production accumulated 17,535,900 tons, down 1.5% year-on-year from 17,798,700 tons in the same period last year; by the end of September this year, most enterprises have surpassed the production of the same period last year by 10%-18% . Downstream market rapid warming nodes are basically in the second and third quarter of the junction period, but also China's epidemic disease prevention and control of the post-stabilization period, the market effect passed to the coating industry, the end of September the overall industry production, profits basically catch up with the same period last year, the main business income rebounded relatively slowly. Overall, the overall production and operation of the industry at the end of 2020 is expected to be on par with the same period last year.

6.Later market forecast

With the control of the epidemic, titanium dioxide domestic and foreign demand has also recovered, titanium dioxide market demand in 2021 will have some improvement; raw material titanium ore supply is tight, prices will continue to remain high, is expected in 2021 China rutile titanium dioxide price range price at 15,500-18,000 yuan / ton.