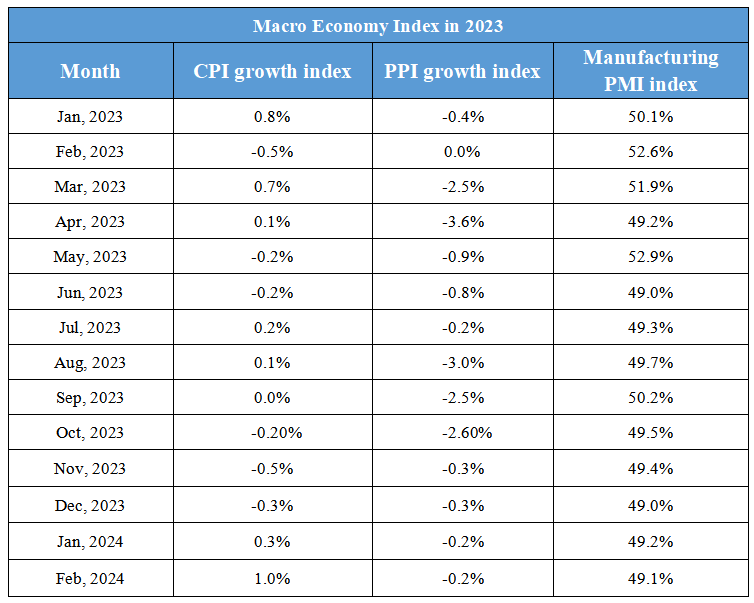

April 7th Macroeconomic Index: China's Economic Prosperity Expected to Rebound Slightly in Q2, GDP Growth Forecast at 5.1%

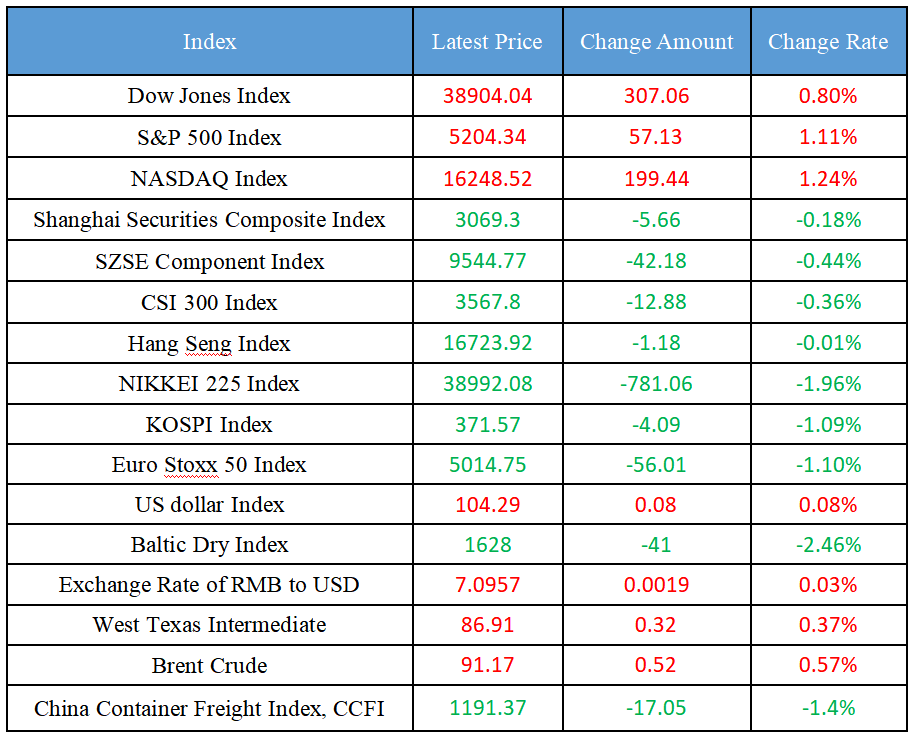

Latest Global Major Index

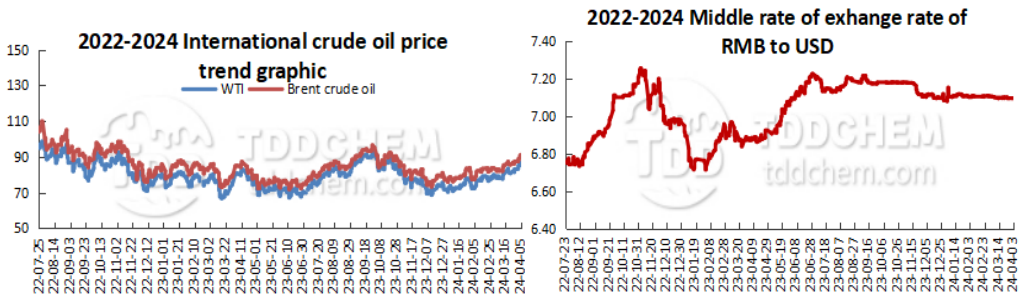

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. National Energy Administration: Help qualified incremental power distribution enterprises to obtain legal business status as soon as possible

2. Ministry of Industry and Information Technology: From January to February, the business income of China's Internet enterprises above the designated size increased by 7.6% year-on-year

3. China's economic prosperity is expected to rebound slightly in the second quarter, and GDP growth is expected to be about 5.1% in the second quarter

4. National Data Administration: A pilot project of data labeling bases will be carried out to promote the development of the artificial intelligence industry

International News

1. The pound is hovering near a four-month low as markets bet on the Bank of England cutting interest rates before the Fed

2. South Korea's foreign direct investment increased by 25% year-on-year in the first quarter of this year, hitting a record high

3. Standard Chartered expects the Federal Reserve to cut interest rates in June, which will push the dollar down

4. The rupiah fell to a four-year low affected by foreign capital outflow and a stronger dollar

Domestic News

1. National Energy Administration: Help qualified incremental power distribution enterprises to obtain legal business status as soon as possible

The relevant responsible comrades of the National Energy Administration answered reporters' questions on the "Implementation Measures for the Division of Distribution Areas for Incremental Distribution Business", saying that in the next step, the National Development and Reform Commission and the National Energy Administration will guide local government departments and power grid enterprises (including incremental distribution enterprises) to do a good job in the division of distribution areas for incremental distribution business; Guide the dispatched agencies of the National Energy Administration to do a good job in the issuance of power business licenses, and help qualified incremental distribution enterprises to obtain legal business status as soon as possible. At the same time, we will pay close attention to the implementation of the Measures, fully listen to the opinions and suggestions of all parties involved in the reform, continue to track the progress of incremental distribution projects, and promote the implementation of pilot projects as soon as possible.

2. Ministry of Industry and Information Technology: From January to February, the business income of China's Internet enterprises above the designated size increased by 7.6% year-on-year

According to the Ministry of Industry and Information Technology, from January to February, China's Internet and related service enterprises above designated size completed Internet business revenue of 246.3 billion yuan, a year-on-year increase of 7.6%, and the growth rate increased by 0.8 percentage points compared with the whole year of 2023. From January to February, the operating costs of China's Internet enterprises above designated size increased by 7.7% year-on-year. The total profit was 16.97 billion yuan, a year-on-year increase of 6.5%, and the growth rate was 6 percentage points higher than that of 2023.

3. China's economic prosperity is expected to rebound slightly in the second quarter, and GDP growth is expected to be about 5.1% in the second quarter

On April 1, the Bank of China Research Institute released the "Economic and Financial Outlook Report for the Second Quarter of 2024" in Beijing. According to the report, in the second quarter, China's economic prosperity is expected to rebound slightly. Consumption will continue to play the role of the "ballast stone" of China's economic growth, and the potential of service consumption is expected to be further released. The trend of industrial transformation and upgrading is obvious, and new quality productive factors continue to be cultivated. The global inventory cycle has entered the replenishment stage, which is conducive to the strengthening of external demand momentum, and the low base of the previous year is superimposed, and the trend of export recovery is expected to continue. GDP is expected to grow by about 5.1% in the second quarter, a rebound of about 0.3 percentage points from the first quarter.

4. National Data Administration: A pilot project of data labeling bases will be carried out to promote the development of the artificial intelligence industry

The first national data work conference was held in Beijing from April 1 to 2. The National Data Bureau recently revealed that next, a pilot data labeling base will be carried out. At the meeting, it was clear that it would explore the construction of a national-level data annotation base, give full play to the role of local supporting support, take the lead in the ecological construction, capacity improvement and scenario application of the data annotation industry, gather leading enterprises, and promote the ecological development of the regional artificial intelligence industry. In addition, the National Data Bureau will carry out a series of pilot experiments, such as deepening the pilot zone for the innovation and development of the digital economy, the comprehensive pilot zone for data elements, the pilot of the data basic system, the pilot for the development and utilization of data resources, and the pilot for the construction of data infrastructure.

International News

1. The pound is hovering near a four-month low as markets bet on the Bank of England cutting interest rates before the Fed

The pound fluctuated near $1.25, a low hit in December, and traders doubled on bets that the Bank of England will cut interest rates more than the Fed this year. The pound is now flat and fluctuated after Monday's losses after data showed a surprise expansion in US manufacturing activity in March for the first time since September 2022. The pound hit a high of $1.2894 in early March and has been under pressure since two of the most hawkish members of the Bank of England abandoned their interest rate hike stance at their latest meeting.

2. South Korea's foreign direct investment increased by 25% year-on-year in the first quarter of this year, hitting a record high

According to data released by the Ministry of Trade, Industry and Energy on the 2nd, the declaration of foreign direct investment (FDI) in South Korea in the first quarter of this year (January to March) was 7.05 billion US dollars, a year-on-year increase of 25.1%, the highest in the same period of the previous year. By sector, the manufacturing sector surged 99.2% year-on-year to US$3.08 billion, while the service sector fell 2.5% year-on-year to US$3.85 billion. By country and region, inflows from the United States and European Union countries decreased by 3.4 percent and 69.8 percent, respectively, to $720 million and $570 million, respectively. During the same period, the amount of foreign direct investment (FDI) fell by 49.6% year-on-year to US$1.85 billion.

3. Standard Chartered expects the Federal Reserve to cut interest rates in June, which will push the dollar down

Standard Chartered said the Fed may be more inclined to ease monetary policy in the second quarter if prices or economic activity cool sufficiently, which will push the dollar "slightly weaker" from the middle of the year". Our base case assumes that the Fed will cut interest rates before or in concert with other central banks, which is negative for the US dollar as improved risk appetite and liquidity conditions will lead to USD selling," the analysts wrote in the note. The optimism of risk assets is not good for the dollar, but if the difference between the Fed rate and other central bank rates is maintained, then the dollar "is likely to weaken moderately rather than collapse."

4. The rupiah fell to a four-year low affected by foreign capital outflow and a stronger dollar

USD/IDR rose as much as 0.5% to 15,963. The rupiah fell to its lowest level against the US dollar since April 2020 due to overseas bond outflows and concerns about Indonesia's widening current account deficit. The broader strength of the US dollar at a time when the repricing of Fed rate expectations was hawkish, also weighed on the rupiah. Bank Indonesia said it would continue to carry out triple intervention to stabilize the rupiah.

Domestic Macro Economy Index