March 29th Macroeconomic Index: Industrial Enterprise Profits Stable, Shanghai's GDP Ranks Top Globally

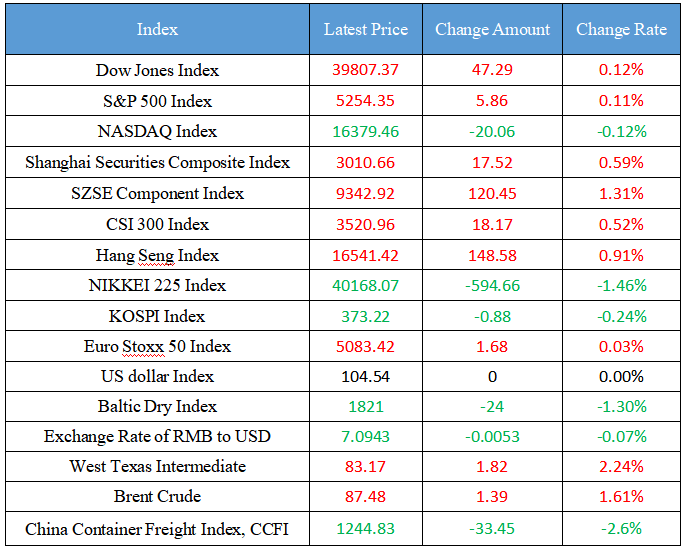

Latest Global Major Index

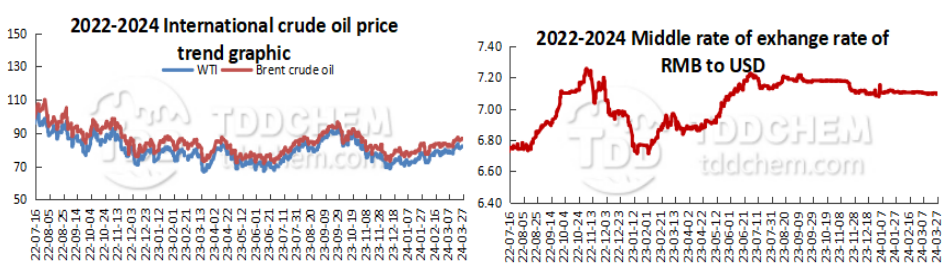

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. CITIC Securities: It is expected that the cumulative growth rate of profits of industrial enterprises will remain stable in the short term

2. In 2023, Shanghai's GDP reached 4.72 trillion yuan, ranking among the top cities in the world

3. Beijing: From January to February, the operating income of industrial enterprises above designated size in the city increased by 9.0% year-on-year

4. State Information Center: The penetration rate of new energy vehicles will continue to increase, and China's auto industry is expected to become stronger

International News

1. Federal Reserve Governor Waller: There is no rush to cut interest rates, and interest rate cuts should be postponed or the potential rate cuts should be cut

2. The German service trade union reached an agreement with Lufthansa not to hold strikes in the future

3. EU member states reached an agreement on a compromise plan to extend the duty-free period for imports of Ukrainian agricultural products

4. Goldman Sachs: Pension funds are expected to sell about $32 billion in the U.S. stock market soon

Domestic News

1. CITIC Securities: It is expected that the cumulative growth rate of profits of industrial enterprises will remain stable in the short term

According to the CITIC Securities Research Report, from January to February 2024, the profits of industrial enterprises above the designated size increased by 10.2% year-on-year, and the growth rate decreased by 6.6 percentage points from the previous value. The main reason for the double-digit growth rate of industrial enterprise profits from January to February was the low base in the same period last year, and the rapid recovery of industrial production in the first two months of this year, which led to the rebound in the revenue growth rate of industrial enterprises. According to CITIC Securities' estimates, in February 2024, the growth rate of nominal and actual inventories of industrial enterprises above designated size increased by 0.3 percentage points compared with the end of last year. From January to February 2024, the profit pattern between upstream, midstream and downstream industries remained stable, with the proportion of midstream profits falling by 1.6 percentage points, and the proportion of upstream and downstream profits increasing by 1.4 and 0.2 percentage points respectively.

2. In 2023, Shanghai's GDP reached 4.72 trillion yuan, ranking among the top cities in the world

The Information Office of the State Council held a series of press conferences on the theme of "Promoting High-quality Development", and Gong Zheng, Deputy Secretary of the Shanghai Municipal Party Committee and Mayor of Shanghai, gave a presentation on "Focusing on the 'Five Centers' and Accelerating the Construction of a Socialist Modern International Metropolis with World Influence". It was learned from the press conference that in 2023, Shanghai's GDP reached 4.72 trillion yuan, ranking among the top cities in the world, the total transaction volume of the financial market reached a new high of 3,373.6 trillion yuan, ranking first in the world, and the total trade in goods at ports accounted for 3.6% of the global proportion. The container throughput of Shanghai Port has reached 49.158 million TEUs, ranking first in the world for 14 consecutive years, and the proportion of R&D expenditure equivalent to the city's GDP reached about 4.4%, ranking among the top five of the world's "best science and technology clusters" for the first time.

3. Beijing: From January to February, the operating income of industrial enterprises above designated size in the city increased by 9.0% year-on-year

According to the Beijing Bureau of Statistics, from January to February, the city's industrial enterprises above designated size achieved operating income of 430.71 billion yuan, a year-on-year increase of 9.0 percent, and total profits of 25.97 billion yuan, a year-on-year increase of 22.6 percent. In terms of scale, the total profit of large and medium-sized enterprises was 23.43 billion yuan, a year-on-year increase of 25.0%. As of the end of February, the accounts receivable of industrial enterprises above designated size were 688.30 billion yuan, up 16.7 percent year-on-year, and the inventory of finished products was 136.79 billion yuan, up 8.9 percent year-on-year.

4. State Information Center: The penetration rate of new energy vehicles will continue to increase, and China's auto industry is expected to become stronger

A report released at the 2024 Academic Annual Conference of the State Information Center predicts that the penetration rate of new energy vehicles will increase from 35.2% in 2023 to 60% in 2033, but the increase in penetration rate will slow down significantly after 2028. In addition, the report points out that three main electrification technology routes will coexist for a long time. In the process of popularization of new energy vehicles, there will be a long-term coexistence of the three main technical routes of BaiBattery Electrical Vehicle (BEV), Plug-in Hybrid Electric Vehicle (PHEV) and Extended-Range Electric Vehicles (REEV). In the short and medium term, the PHEV and REEV markets will grow rapidly due to range anxiety, and the market share of BEVs will increase rapidly with the improvement of infrastructure, batteries and intelligent technology, and the advantages of lower cost and better driving experience will become more prominent.

International News

1. Federal Reserve Governor Waller: There is no rush to cut interest rates, and interest rate cuts should be postponed or the potential rate cuts should be cut

Fed Governor Waller: There is no rush to cut interest rates, and interest rate cuts should be postponed, or the potential size of rate cuts should be reduced. The FOMC will also have to wait for better inflation data "couple months" before deciding to cut interest rates. The data guarantees that the Fed will taper the number of (potentially) rate cuts, or delay easing. It may be appropriate for the Fed to cut interest rates this year, but it hasn't reached that point yet. Labor supply and demand unleash a messaging message. I don't believe the productivity boom that has occurred recently will continue. Waiting longer is less risky than cutting rates too early.

2. The German service trade union reached an agreement with Lufthansa not to hold strikes in the future

On March 27, local time, the German Service Industry Union (Verdi) and Lufthansa reached an agreement on the issue of salary increases for ground staff, and the two sides announced the news in Frankfurt later that day, which means that about 25,000 employees will no longer go on strike. In recent weeks, Lufthansa employees have gone on strike several times, resulting in the cancellation of most flights, each of which has affected the travel of around 100,000 passengers.

3. EU member states reached an agreement on a compromise plan to extend the duty-free period for imports of Ukrainian agricultural products

On March 27, local time, EU member states reached an agreement on a compromise plan to extend the duty-free period for importing Ukrainian agricultural products, and the compromise plan will be submitted to the European Parliament. Earlier, on the 20th of this month, the European Union reached a preliminary agreement on the extension of the tax holiday period for imported Ukrainian agricultural products for one year, but due to the opposition of France, Poland and other countries, the final signing date was postponed.

4. Goldman Sachs: Pension funds are expected to sell about $32 billion in the U.S. stock market soon

Goldman Sachs Group Inc. said that as the quarter draws to a close, pension funds may sell about $32 billion in U.S. stocks to rebalance their positions. Goldman Sachs FICC and equities analysts wrote that this would be the biggest correction since June 2023. While Wall Street's forecasts for pension mobility vary widely, the withdrawal of retirement funds will put additional pressure on the broader market amid thin trading around Easter.

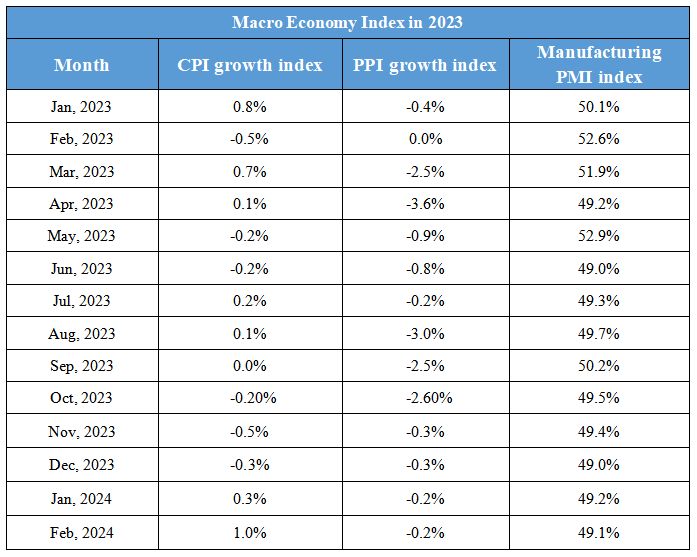

Domestic Macro Economy Index