March 28th Macroeconomic Index: China's Land Supply Increases, Gas Production Hits Record High, and Beijing Unveils 50 Key Tasks for High-Quality Development

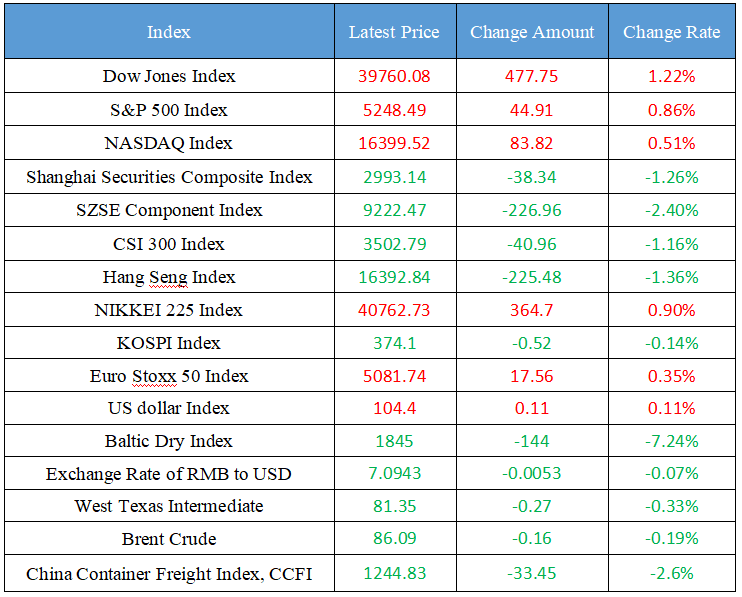

Latest Global Major Index

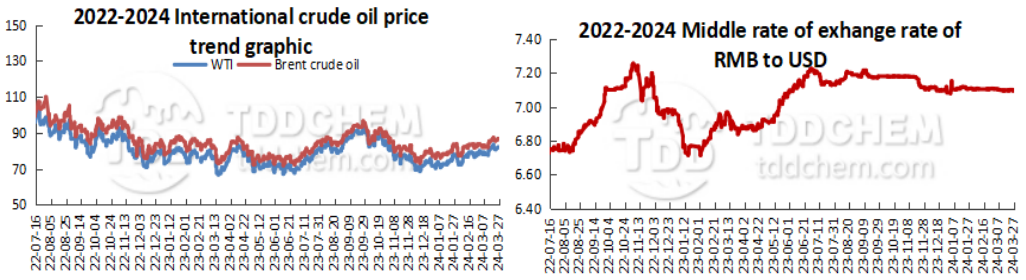

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. From January to February, the total supply of state-owned construction land was 67,000 hectares, an increase of 4.8% year-on-year

2. The daily gas production of China's largest coalbed methane field exceeded 7 million cubic meters

3. To develop new quality productivity, Beijing has released 50 key tasks for high-quality development

4. Ministry of Natural Resources: From January to February 2024, there was 451 new sea-using projects across the country

International News

1. Pan Gongsheng: Asian countries should cooperate to promote the IMF quotas reform

2. The dollar rose to its highest level against the yen since 1990

3. Standard & Poor's: U.S. regional banks face challenges from commercial real estate and downgrade the outlook of many banks

4. The United States has sanctioned a number of entities and individuals related to Iran's Islamic Revolutionary Guard Corps and Houthi rebels

Domestic News

1. From January to February, the total supply of state-owned construction land was 67,000 hectares, an increase of 4.8% year-on-year

On March 27, the Ministry of Natural Resources held a regular press conference to introduce the relevant situation of land supply, sea use approval, real estate registration and other natural resource elements from January to February this year. In terms of land supply, from January to February 2024, the total supply of state-owned construction land nationwide was 67,000 hectares, a year-on-year increase of 4.8%, and the number of residential land transactions nationwide was 4,845 hectares, a year-on-year decrease of 18.8%.

2. The daily gas production of China's largest coalbed methane field exceeded 7 million cubic meters

It was learned from the Shanxi Coalbed Methane Branch of North China Oilfield that as the largest coalbed methane field in China - Shanxi Qinshui Coalbed Methane Field in North China Oilfield, the daily gas production of the wellhead exceeded 7 million cubic meters on the 26th, a record high. The Qinshui coalbed methane field is located in the southeast of Shanxi Province, covering an area of more than 3,000 square kilometers and with an estimated coalbed methane resource of 600 billion cubic meters. In 2006, North China Oilfield obtained the right to deposit coalbed methane in the Qinshui Basin of Shanxi Province, and subsequently built the first coalbed methane field in China with an annual surface pumping capacity of more than 2 billion cubic meters.

3. To develop new quality productivity, Beijing has released 50 key tasks for high-quality development

Beijing recently issued the "Action Plan for Further Promoting the High-quality Development of the Capital City to Achieve New Breakthroughs in 2024", closely following the development of new quality productivity, based on the strategic positioning of the capital city, putting forward 50 key tasks, and moving towards the "new quality productive forces" to promote the high-quality development of the capital to a new level. To promote the construction of the world's major scientific centers and the world's major innovation highlands, Beijing will focus on the national strategic needs, strengthen original and disruptive scientific and technological innovation, fight the battle of key core technologies, and break through the blockages that restrict the development of new quality productive forces. Accelerate breakthroughs in cutting-edge disruptive and key core technologies, and strive to achieve new breakthroughs in key areas such as quantum information, life sciences, high-end instruments and equipment, and general-purpose key components.

4. Ministry of Natural Resources: From January to February 2024, there was 451 new sea-using projects across the country

Wang Yongmei, deputy director and spokesperson of the General Office of the Ministry of Natural Resources, said that from January to February 2024, there were 451 new sea-using projects across the country, a year-on-year increase of 69.55%, a new area of 65,028.3716 hectares of newly confirmed sea, a year-on-year increase of 225.19%, and an investment of 157,550.48 million yuan, a year-on-year increase of 22.16%. Among them, there are 12 projects submitted to the State Council for approval, covering an area of 47734832 hectares, involving an investment of 179,299.73 million yuan.

International News

1. Pan Gongsheng: Asian countries should cooperate to promote the IMF quotas reform

At the sub-forum on deepening Asian financial cooperation at the Boao Forum for Asia Annual Conference 2024 held this morning, Pan Gongsheng, governor of the People's Bank of China, expressed several views on strengthening financial security in Asia. He said that the IMF is an international financial institution based on quotas, and the amount of the quota determines the IMF's crisis relief capacity, and the proportion determines the voting rights of member countries and the scale of access to financing. The adjustment of the share is crucial to the governance representativeness and legitimacy of the IMF. Pan Gongsheng said that all parties will increase their capital in equal proportions to further enhance the IMF's crisis relief capacity. He believes that Asian countries should cooperate to promote the IMF's quota reform and realize the adjustment of quota as soon as possible.

2. The dollar rose to its highest level against the yen since 1990

The dollar rose to its highest level against the yen in about 34 years, and the huge yield gap between Japan and the US is expected to persist despite the end of the Bank of Japan's negative interest rate policy. The depreciation of the yen also raises the risk that the Japanese authorities will intervene in the market in support of the yen. USD/JPY continued to rise during the day, rising to its highest level since 1990, touching 151.97 at one point and now trading at 151.917.

3. Standard & Poor's: U.S. regional banks face challenges from commercial real estate and downgrade the outlook of many banks

S&P Global Ratings said that the asset quality and performance of some regional banks in the United States could be affected by the stress in the commercial real estate market, and downgraded the outlook of five banks to negative from stable. The increasing number of revised loans and loan maturities may signal a decline in asset quality and performance. S&P lowered its outlook for First Commonwealth Financial Corp., M&T Bank Corp., Synovus Financial Corp., Trustmark Corp. and Valley National Bancorp, which have the highest exposure to commercial real estate loans among S&P rated banks. If the Fed starts cutting interest rates, it could ease some of the accumulated pressure on the commercial real estate sector.

4. The United States has sanctioned a number of entities and individuals related to Iran's Islamic Revolutionary Guard Corps and Houthi rebels

On March 26, local time, the U.S. Department of the Treasury's Office of Foreign Assets Control (OFAC) announced sanctions against six entities, one individual and two oil tankers located or registered in Liberia, India, Vietnam, Lebanon and Kuwait, saying that they facilitate commodity transportation and financial transactions for the "Quds Force" under the Iranian Islamic Revolutionary Guard Corps, the Houthis and Allah in Lebanon. The action is the sixth round of sanctions against the Houthi financial services provider Saeed Jamal Network since December 2023, the statement said.

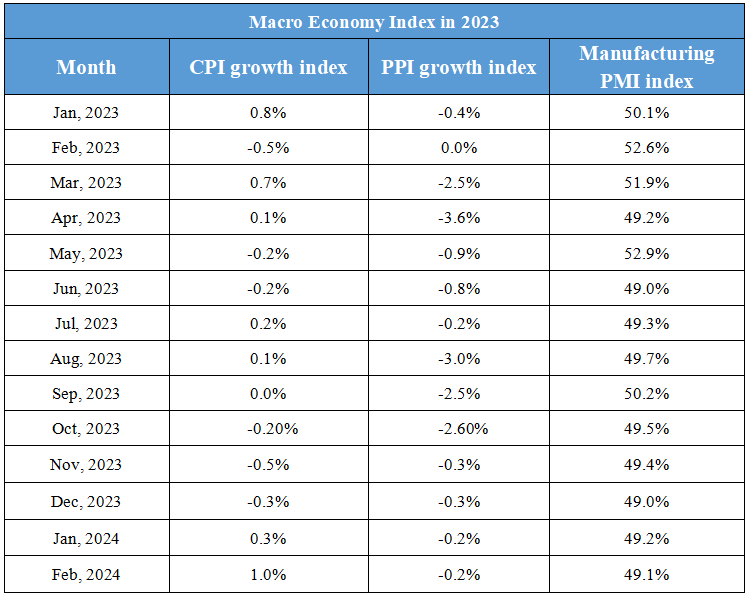

Domestic Macro Economy Index