March 25th Macroeconomic Index: China Assesses US 'Section 301' Investigation Impact on Shipbuilding, RMB Falls Sharply

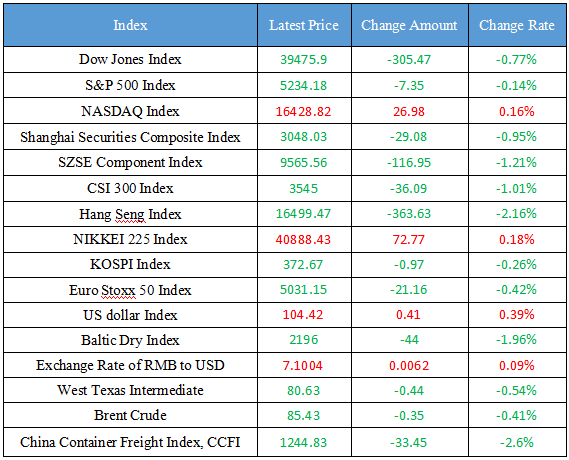

Latest Global Major Index

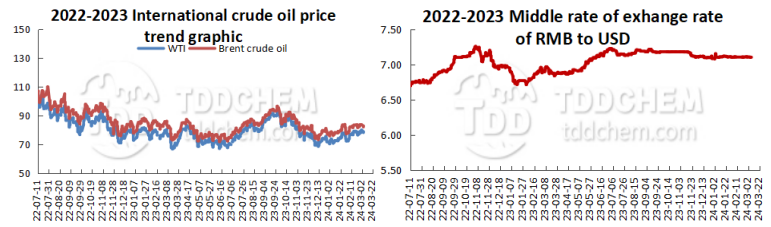

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The Ministry of Commerce is assessing the possibility of a "Section 301 investigation" by the United States on China's shipbuilding industry

2. Ministry of Commerce: The actual amount of foreign capital used from January to February this year continued the characteristics of scale fluctuation and structural optimization last year

3. The stop-loss order of the offshore hedge fund was triggered, and the RMB fell sharply by 500 points in the short term

4. National Development and Reform Commission: Support Guangzhou Nansha to boldly carry out cutting-edge disruptive scientific and technological innovation

International News

1. India stopped receiving Russian oil from tankers of Russian state-owned shipping companies

2. Egypt and many other countries have called for an immediate and comprehensive ceasefire in the Gaza Strip

3. Russia launched the largest attack on Ukraine's energy infrastructure, hitting Ukraine's largest dam

4. Rengo, a Japanese trade union, confirmed the biggest wage rise in history

Domestic News

1. The Ministry of Commerce is assessing the possibility of a "Section 301 investigation" by the United States on China's shipbuilding industry

China's Ministry of Commerce (MOFCOM) recently held discussions with major domestic shipyards to assess the possible impact and discuss countermeasures regarding the application of the five major U.S. labor unions to the U.S. Trade Representative (USTR) to initiate a Section 301 investigation into China's maritime, logistics and shipbuilding industries. A representative of the shipyard at the meeting told reporters that the outcome of the meeting was to set up a response team and legal team at the national level, and comprehensively assess the impact of the US investigation. The shipyard representative said that both the Ministry of Commerce and the company said that they would closely monitor the movements of the USTR, but because the main customers of China's shipbuilding industry are not in the United States, even if the United States imposes sanctions on Chinese shipbuilders through the "Section 301" investigation, the impact will be very limited. (Caixin)

2. Ministry of Commerce: The actual amount of foreign capital used from January to February this year continued the characteristics of scale fluctuation and structural optimization last year

The person in charge of the Department of Foreign Investment of the Ministry of Commerce introduced the absorption of foreign investment in the country from January to February 2024. The actual amount of foreign capital used in January and February this year continued the characteristics of last year's fluctuation in scale and structural optimization. In terms of scale, from January to February last year, China's actual use of foreign capital reached a record high of 268.44 billion yuan, although it has declined this year, it is still at the third highest level in nearly 10 years. In particular, from January to February this year, the number of newly established foreign-funded enterprises reached 7,160, a year-on-year increase of 34.9%, which is also the highest level in the past five years, showing that multinational companies are still optimistic about the development opportunities of the Chinese market and continue to increase their "investment in China".

3. The stop-loss order of the offshore hedge fund was triggered, and the RMB fell sharply by 500 points in the short term

Zhang Meng, a rate and foreign exchange strategist at Barclays China, told reporters: "The initial trigger for the depreciation of the yuan should be the strong trend of the dollar against all currencies overnight. In addition, there is also some impact on the central parity of the yuan, and the market is readjusting its expectations, as the central bank could have kept the central parity at around 7.099 (as it has been for some time), but the mid-parity on March 22 was 7.1004, and then the onshore exchange rate fell below 7.2, triggering the stop loss of some hedge funds, which may be related to options. A number of foreign exchange traders told reporters that the stop loss of some overseas hedge funds was triggered, resulting in a short-term weakening of the RMB against the US dollar, but the overall market is not panicking, and the recent depreciation of the yen is actually greater. (Yicai)

4. National Development and Reform Commission: Support Guangzhou Nansha to boldly carry out cutting-edge disruptive scientific and technological innovation

The National Development and Reform Commission held a special press conference on March 22 to interpret the "Opinions of the National Development and Reform Commission, the Ministry of Commerce and the State Administration for Market Regulation on Supporting Guangzhou Nansha to Relax Market Access and Strengthen the Reform of the Regulatory System". The "Nansha Opinions" fully respond to local development needs, support Nansha to boldly carry out cutting-edge disruptive scientific and technological innovation, and actively extend market application scenarios, such as carrying out the industrial application of unmanned equipment, building an unmanned system industry incubation base in the Greater Bay Area, and establishing a global cutting-edge scientific research collaboration mechanism in the deep-sea field. (CCTV News)

International News

1. India stopped receiving Russian oil from tankers of Russian state-owned shipping companies

According to foreign media reports, due to US sanctions, all refineries in India are now refusing to accept Russian oil delivered by the tanker Sovcomflot, a Russian state-owned shipping company. Private and state-run processors have stopped receiving cargo from Sovcomflot tankers, and refiners are scrutinizing the ownership of each vessel to ensure they are not linked to the company or other sanctioned groups, the sources said. Reliance Industries, India's largest private refiner, has taken similar action. Last month, the U.S. Treasury Department's Office of Foreign Assets Control designated Sovcomflot and identified 14 crude oil tankers in which the company has an interest. India has been a major buyer of Russian oil since Russia's invasion of Ukraine, but tighter enforcement of U.S. sanctions has disrupted this trade and caused refiners to seek more expensive crudes from other regions such as the United States.

2. Egypt and many other countries have called for an immediate and comprehensive ceasefire in the Gaza Strip

On March 21, U.S. Secretary of State Antony Blinken, who is visiting Cairo, Egypt, held a multilateral meeting with the foreign ministers of Egypt, Saudi Arabia, Jordan and Qatar, as well as the UAE Minister of State for International Cooperation and Secretary-General of the Executive Committee of the Palestine Liberation Organization. The participants called for an immediate and comprehensive ceasefire, increased humanitarian access to the Gaza Strip and the opening of all crossings between Israel and Gaza. Blinken said it would be "a mistake" for Israel to carry out a major military operation in Rafah. He said it was "difficult" to reach a ceasefire agreement between Israel and the Palestinian Islamic Resistance Movement (Hamas) at the moment, but "it is still possible" and that "differences are narrowing" between the two sides.

3. Russia launched the largest attack on Ukraine's energy infrastructure, hitting Ukraine's largest dam

Russia launched the largest missile and drone attack on Ukraine's energy infrastructure since the conflict on Friday, hitting the country's largest dam and causing power outages in several regions, Ukraine said. The Ukrainian Air Force said Russia fired 88 missiles and 63 Shahed drones. Ukrainian Energy Minister Galushchenko said that the airstrike was the largest attack on Ukraine's energy infrastructure. Ukrhydroenergo, a state-owned hydropower company, said the hydraulic structure of the Dnipro hydroelectric dam in Zaporizhzhia and the dam itself were attacked. According to the mayor of Kharkiv, the city's traffic lights stopped working due to a strike on power facilities. According to public broadcaster Suspilne, Ukraine's largest private energy company DTEK, Russia has launched a large-scale attack on the company's energy facilities and hit a number of thermal power plants, and there will be a power outage in the southeastern region of Dnipropetrovsk.

4. Rengo, a Japanese trade union, confirmed the biggest wage rise in history

Rengo, Japan's largest trade union, confirmed on Friday that Japanese companies have agreed to a 5.25 percent wage rise this year, the largest in size and magnitude of comparable data available since 2013. Japanese Prime Minister Fumio Kishida has said that the government expects this wage increase to be gradually passed on to small and medium-sized enterprises, which account for 99.7% of all businesses in Japan and about 70% of the Japanese workforce, but many lack the pricing power to pass on the cost increase to customers. Rengo senior official Akira Nidaira said they would check the popularity of the upward trend in wages at the April 4 meeting.

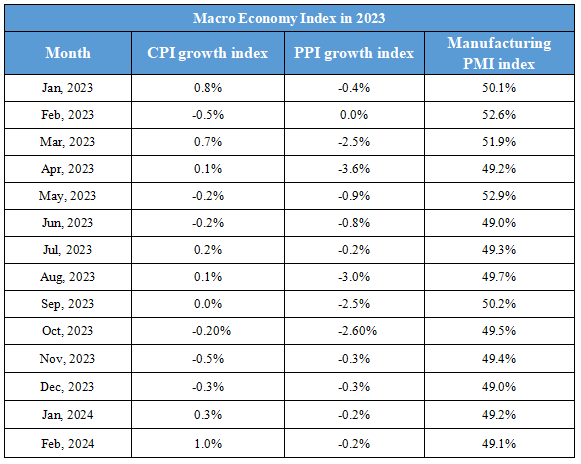

Domestic Macro Economy Index