Global Economic Highlights on March 22nd

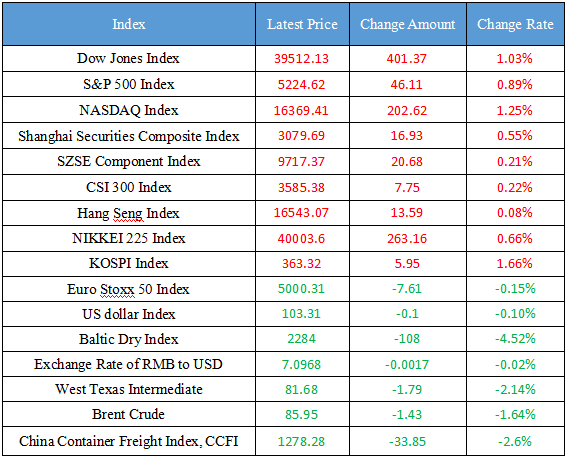

Latest Global Major Index

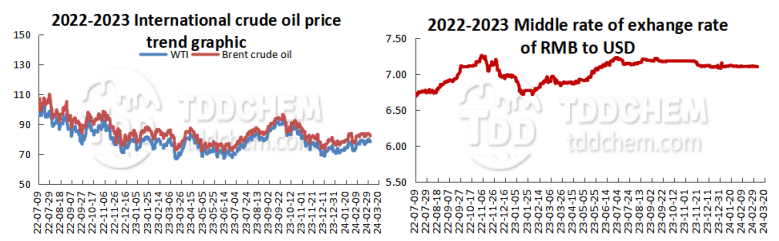

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. In February, the revenue of China's game market was 24.875 billion yuan, a year-on-year increase of 15.12%

2. At the end of 2023, the total assets of financial institutions was 461.09 trillion yuan

3. The International Department of the Central Bank of China: It is working with several other financial management departments to form an institutional arrangement for the cross-border flow of financial data

4. Ministry of Foreign Affairs: China-France relations have a good momentum of development, and the top leaders of the two countries have maintained close strategic communication

International News

1. It is reported that the Ukrainian Foreign Minister will visit India next week

2. UK inflation fell to its lowest level in more than two years

3. Bitcoin fell 11% this week, pointing to the $60,000 mark

4. The United States urges Israel to ensure the security of the Egypt-Gaza border as an alternative to the so-called "destroy Rafah" operation

Domestic News

1. In February, the revenue of China's game market was 24.875 billion yuan, a year-on-year increase of 15.12%

According to the Game Working Committee of the China Audio and Digital Association, the Game Working Committee and Gamma Data released the monthly report on China's game industry in February 2024. According to the report, in February 2024, China's game market achieved a revenue of 24.875 billion yuan, an increase of 2.17% month-on-month and a year-on-year increase of 15.12%. In terms of segments, China's mobile game market performed well, with actual sales revenue reaching 18.255 billion yuan, an increase of 3.21% month-on-month and a year-on-year increase of 17.88%. China's client game market also achieved actual sales revenue of 5.642 billion yuan, an increase of 0.75% month-on-month and 5.94% year-on-year. The actual sales revenue of China's self-developed games in the domestic market was 20.312 billion yuan, an increase of 1.45% month-on-month and 12.87% year-on-year.

2. At the end of 2023, the total assets of financial institutions was 461.09 trillion yuan

According to the data of the Central Bank, preliminary statistics show that at the end of 2023, the total assets of China's financial institutions was461.09 trillion yuan, a year-on-year increase of 9.9%, of which the total assets of banking institutions was 417.29 trillion yuan, a year-on-year increase of 10%, the total assets of securities institutions was 13.84 trillion yuan, a year-on-year increase of 5.6%, and the total assets of insurance institutions was 29.96 trillion yuan, a year-on-year increase of 10.4%. The liabilities of financial institutions were 420.78 trillion yuan, up 10.1 percent year-on-year, of which the liabilities of banking institutions were 383.12 trillion yuan, up 10.1 percent year-on-year, the liabilities of securities institutions were 10.43 trillion yuan, up 5.5 percent year-on-year, and the liabilities of insurance institutions were 27.22 trillion yuan, up 11.4 percent year-on-year. (People's Bank of China)

3. The International Department of the Central Bank of China: It is working with several other financial management departments to form an institutional arrangement for the cross-border flow of financial data

Zhou Yu, head of the International Department of the People's Bank of China, said that there are regulations on cross-border data at the national level, and at the same time, the financial sector is a data-intensive industry, but also an industry with strong supervision, and the cross-border flow of data in the financial sector has its own particularities. Therefore, on the basis of listening to the demands of many multinational financial institutions and conducting full research, the People's Bank of China is working with several other financial management departments to form an institutional arrangement for the cross-border flow of financial data, clarify the catalog of important data in the financial field, and unify the regulatory compliance standard. Through this approach, foreign institutions will be given clearer rules and guidelines. Under the premise of complying with our financial security and data security, we will help foreign financial institutions reduce the cost of cross-border data compliance as much as possible, improve the efficiency of their data transmission, make it faster and more convenient for them to do business in China, and further attract more foreign investment to do business in China. (China.com)

4. Ministry of Foreign Affairs: China-France relations have a good momentum of development, and the top leaders of the two countries have maintained close strategic communication

On March 20, Foreign Ministry spokesman Lin Jian held a regular press conference, in view of Sino-French relations, Lin Jian said that in recent years, China-France relations have developed a good momentum, and the two countries have maintained close strategic communication at the top level, and this year is the 60th anniversary of the establishment of diplomatic relations between China and France. (CCTV News)

International News

1. It is reported that the Ukrainian Foreign Minister will visit India next week

At the invitation of the Indian Foreign Minister, Ukrainian Foreign Minister Kuleba will visit India next week to gain support for his peace plan, two Indian officials with knowledge of the matter. This is the first visit to India by a senior Ukrainian official since the Russia-Ukraine conflict. India, which has close ties to Russia, has ramped up its purchases of Russian oil to record levels since Russia's invasion of Ukraine. However, India has always insisted that there is a need for dialogue between Russia and Ukraine.

2. UK inflation fell to its lowest level in more than two years

Inflation in the UK has fallen faster than expected, reaching its lowest level in two-and-a-half years, which puts the Bank of England on track to lower interest rates later this year. According to the released data, the UK CPI rose 3.4% in February from a year earlier, down from 4% in January. This figure is lower than the median forecast of economists and the Bank of England of 3.5%. Bank of England Governor Andrew Bailey has already said he needs to see further evidence that price pressures will continue to fall back to the 2% target before easing the benchmark lending rate. Officials are expected to keep interest rates at a 16-year high of 5.25% on Thursday, with financial markets only fully pricing in expectations of the first rate cut in August.

3. Bitcoin fell 11% this week, pointing to the $60,000 mark

According to the financial website Forexlive, as the selling pressure intensified, Bitcoin once fell below the $61,000 mark, and the market is now focusing on whether it will test the $61,000 mark. After approaching the $74,000 mark last week, it looks set for the first time since January that Bitcoin will record a two-week losing streak. Bitcoin has fallen by almost 11% this week alone.

4. The United States urges Israel to ensure the security of the Egypt-Gaza border as an alternative to the so-called "destroy Rafah" operation

According to the Times of Israel, on Tuesday, two senior U.S. officials revealed that the United States will come up with an alternative to how Israel can continue to pursue Hamas without launching a large-scale ground operation when it talks with a visiting Israeli delegation in Washington. One official said the U.S. was not simply saying, "No, you can't do this," but that "we're willing to work with you to find viable alternatives to help you achieve your goals." Another official elaborated on alternatives considered by the Biden administration, saying that Washington envisions Israel focusing on preventing weapons from being smuggled from Egypt into Gaza through the Philadelphia corridor. They said striking a new arrangement with Cairo and building the necessary infrastructure to cut off smuggling routes would be more important for dismantling Hamas than a large-scale ground offensive in Rafah.

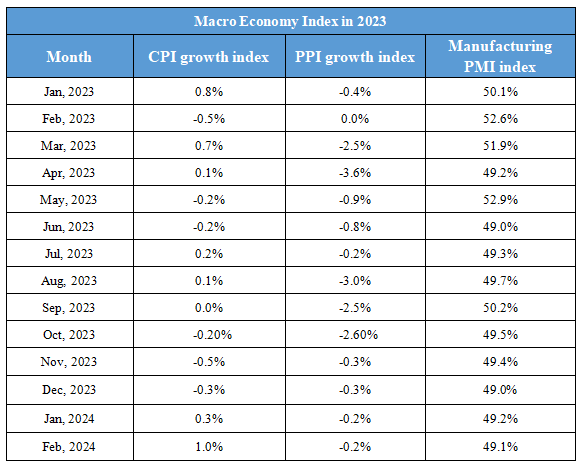

Domestic Macro Economy Index