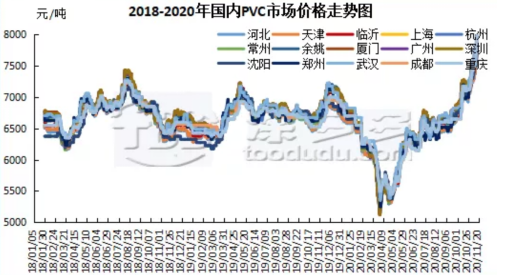

PVC prices weekly analysis Nov 16 to Nov 20

During this week there has been significant increases of PVC prices. Compared to last weekthe prices have increased from 450 to 500 RMB per ton in North and Eastern regions. In Southern region it saw a further increase of around 675RMB/ton. Carbide method PVC have came to a price of a staggering 8400 to 8450 RMB/ton. There are several reasons why the cost of the PVCs are so high.

First is that the raw materials of PVC have increased. Calcium carbide and ethylene prices have kept increasing. Calcium carbide have increased around 750 RMB VCM prices have already increased to around 990 USD for CFR prices in South East Asia. VCM prices have increased about 160 USD.

Secondly is because the current stock pressure of PVC is low as the manufacturers rarely keep their stock. Another reason is that PVC have continued to be shipped to abroad for export orders thus domestic market prices have increased. The only way to solve the problem currently is for the product to be presold, as there are always the case of low to no stocks available for the PVC products.

Third is the demand of PVC have rose considerably after limited economic recovery, but the scope of production have yet to meet these demand, and the continued shortage of PVC around the world. Especially in Europe, Turkish demand of PVC have already came to the highest prices in over 9 years.Its became a target for the worlds PVC export orders. International prices have reached around 1290 USD/ton. Asia market for PVC have increased from 10 to 60 USD per ton. Also currently the shipment prices have increased by a significant amount, CFR India prices have already increased by 100 USD per ton.

Domestic market analysis: This week PVC related materials workload should decrease due to reasons such as high cost of raw materials as well as PVC itself. Many downstream factories cannot open up. Many enterprises are operating at a loss. Some piping companies even have plans to stop shipment for the month of December entirely. Films, sheets and pipes have already cut production. Procurement for these enterprises are increasingly desperate. For hard materials the orders have been reduced by around 20 to 30 percent. For Soft product its already been cut to around 60 percent. Most are being kept at around 75 percent, with orders surrounding existing customers.

Currently PVC prices are likely to stay still due to the fact that theres no shortage of demand of the product, and stocks are low. The continued high prices have already exceeded the procurement abilities of many downstream enterprises.