February 22nd Macroeconomic Index: Ctrip Reports Strong Q4 Earnings, US Chip Stocks Rise, Fed Holds Rates Steady

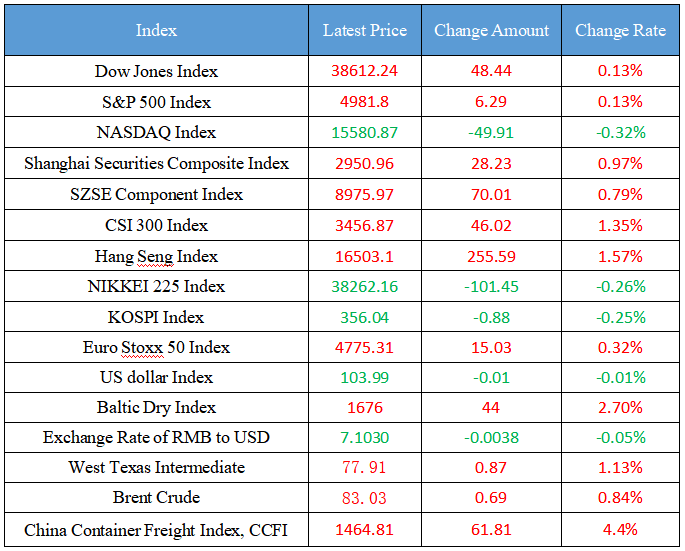

Latest Global Major Index

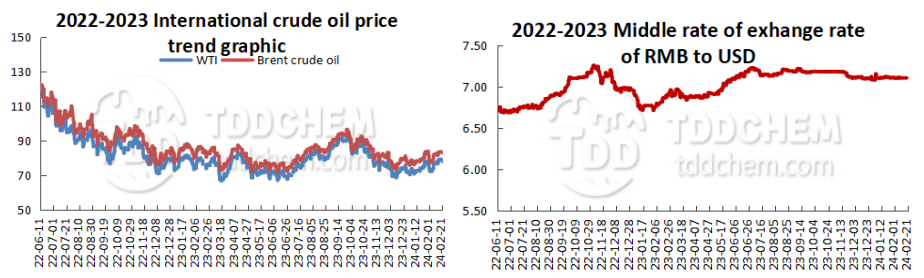

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Ctrip's financial report for the fourth quarter of 2023: International OTA platform bookings increased by more than 7% year-on-year

2. Industry News: Small and medium-sized banks have different deposit interest rate strategies, and there is still room for reduction in the future

3. Wang Yi: China and France agreed to carry out high-level exchange visits and strengthen strategic communication

4. China will accelerate the establishment of the normalized assistance mechanism to consolidate and expand the achievements of poverty alleviation

International News

1. U.S. chip stocks rose across the board

2. The probability that the Fed will not take any measures in March is 93.5%

3. AI has reached a "tipping point"! Nvidia's performance is excellent, jumping 7% in after-hour trading

4. JPMorgan Chase strategist Kolanovic: 1970s-style stagflation in the United States may come back again

Domestic News

1. Ctrip's financial report for the fourth quarter of 2023: International OTA platform bookings increased by more than 7% year-on-year

Trip.com Group announced its unaudited financial results for the fourth quarter and full year 2023. In the fourth quarter, the company's net operating income was 10.3 billion yuan, and the net operating income for the whole year of 2023 was 44.5 billion yuan, an increase of 105% and 122% year-on-year, respectively. In the fourth quarter, Ctrip's outbound hotel and air ticket bookings recovered to more than 80% of the same period in 2019, and the total bookings on Ctrip's international OTA platform increased by more than 70% year-on-year. For the full year of 2023, Ctrip's product R&D expenses reached 12.1 billion yuan, a year-on-year increase of 45%, accounting for about 27% of net operating revenue.

2. Industry News: Small and medium-sized banks have different deposit interest rate strategies, and there is still room for reduction in the future

Against the backdrop of the general decline in bank deposit interest rates, the deposit interest rate adjustment strategies of some small and medium-sized banks have diverged. Recently, a number of small and medium-sized banks have announced the adjustment of deposit interest rates, and on the whole, the longer the term, the greater the reduction. However, some banks have raised the interest rate of deposit products in stages. Industry experts said that in the context of the market-oriented reform of interest rates, it is normal for banks to flexibly adjust deposit interest rates according to their own operating conditions. Looking ahead, there is still room for further reductions in deposit rates, given the pressure on net interest margins faced by banks.

3. Wang Yi: China and France agreed to carry out high-level exchange visits and strengthen strategic communication

According to the website of the Ministry of Foreign Affairs, on February 21, 2024, Wang Yi, member of the Political Bureau of the CPC Central Committee and Minister of Foreign Affairs, was interviewed by Chinese media after attending the 60th Munich Security Conference and visiting Spain and France. Wang Yi said that during the visit, he met with President Macron, chaired a new round of China-France strategic dialogue with President Boehne's foreign affairs adviser, and held talks with the new French Foreign Minister Céjourne in Munich. The two sides reached a number of consensus on the next stage of high-level exchanges, bilateral and multilateral cooperation in various fields, and in-depth exchanges on international and regional issues of common concern. The two sides agreed to carry out high-level exchange visits, strengthen strategic communication, play a constructive role in promoting the resolution of international and regional hotspot issues, and make positive contributions to building an equal and orderly multipolar world. Both sides agreed to insist on "making the cake bigger", while continuing to deepen traditional cooperation in aerospace and nuclear energy, actively expand cooperation in emerging fields such as new energy and green development, and support enterprises of the two countries to invest in each other's countries.

4. China will accelerate the establishment of the normalized assistance mechanism to consolidate and expand the achievements of poverty alleviation

Tang Renjian, Minister of Agriculture and Rural Affairs, said on the 21st that it is necessary to adhere to the coordinated promotion of "keeping the bottom line, increasing momentum, and promoting revitalization", focus on enhancing the endogenous development momentum of poverty alleviation areas and poverty alleviation people, continue to strengthen the monitoring and assistance to prevent poverty return, accelerate the establishment of a normalized assistance mechanism for rural low-income populations and underdeveloped areas, and firmly guard the bottom line of not returning to poverty on a large scale.

International News

1. U.S. chip stocks rose across the board

Boosted by Nvidia's surge, U.S. chip stocks rose across the board after hours, and Arm (ARM. O) rose 8%, AMD (AMD. O) rose 3.6%, and TSMC (TSM. N) rose 2.6%, ASML (ASML. O) rose 2.5%, Intel (INTC. O) rose 1%.

2. The probability that the Fed will not take any measures in March is 93.5%

According to CME's "Fed Watch": the probability that the Fed will keep interest rates unchanged in the range of 5.25%-5.50% in March is 93.5%, and the probability of a 25 basis point rate cut is 6.5%. The probability of keeping interest rates unchanged by May is 72.9%, the probability of a cumulative 25 basis point rate cut is 25.6%, and the probability of a cumulative 50 basis point rate cut is 1.4%.

3. AI has reached a "tipping point"! Nvidia's performance is excellent, jumping 7% in after-hour trading

Nvidia (NVDA. O) reported earnings on Wednesday that revenue in the fiscal first quarter would be higher than expected, with expectations of high demand for its industry-leading AI chips and improved supply chain dynamics. The company expects Q1 revenue in 2025 to be $24 billion, plus or minus 2%, compared to analysts' average estimate of $22.1 billion, and Nvidia's fourth-quarter results also beat expectations, the company's stock price rose 7% after the US stock market. Nvidia CEO Jensen Huang said accelerated computing and generative AI have reached tipping point. Demand is soaring across companies, industries, and countries across the globe.

4. JPMorgan Chase strategist Kolanovic: 1970s-style stagflation in the United States may come back again

Marko Kolanovic, a strategist at JPMorgan Chase, said that the recent recovery in consumer prices and producer prices has clouded optimism about the U.S. economy, and investors' rhetoric may shift from expecting a "Goldilocks" scenario to a return to "stagflation" in the 1970s. He said in the report that higher inflation would not come as a surprise given the rise in the stock market, a tight labor market and high immigration and government spending. Previously, between 1967 and 1980, equity markets were nominally flat, while bond and credit markets significantly outperformed. This has a lot of similarities with the current era. He said that the United States has already experienced a round of inflation, and the question now is: can a second round of inflation be avoided while maintaining the current policy?

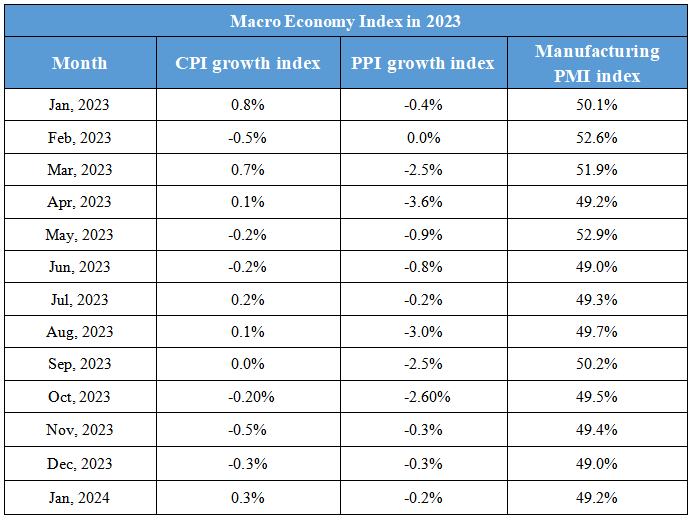

Domestic Macro Economy Index