January 29th, Global Economic Highlights and Trends

Daily Macro Economy News

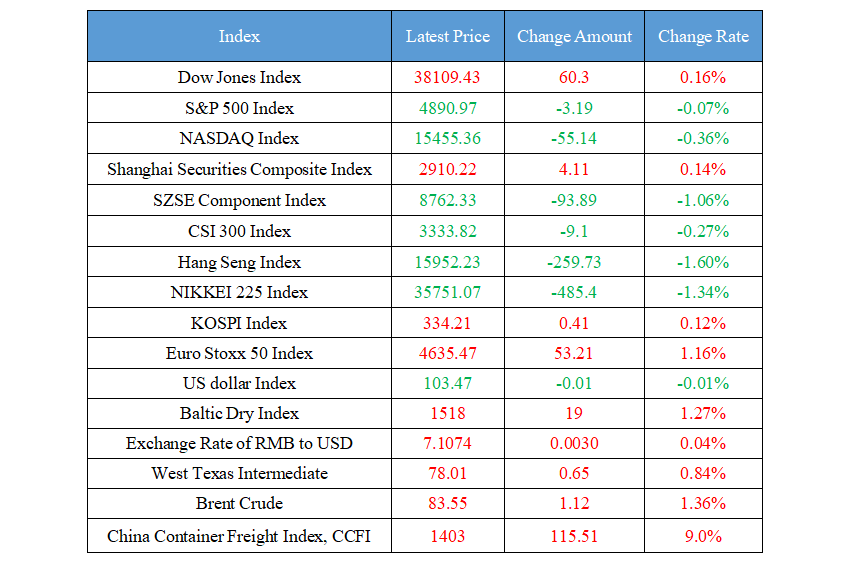

Latest Global Major Index

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Bank of America: Chinese equity funds have seen inflows of $11.9 billion in the past week, the largest amount since July 2015

2. State Administration of Foreign Exchange: In December, China's import and export of balance of payments goods and services was 4,339.1 billion yuan

3. Chinese Central Bank: In 2023, the balance of loans of microfinance companies was 762.9 billion yuan, a decrease of 147.8 billion yuan for the whole year

4. Since the "14th Five-Year Plan", China has built more than 10,000 kilometers of new pipelines

International News

1. RMB will enter the real-time payment and settlement system in Bangladesh from February 4

2. Nordic Bank of Sweden: The trend of core PCE lower than core CPI in the United States may continue in the next 1-2 quarters

3. The geopolitical conflict intensifies, and oil prices are set to record the largest weekly increase since October last year

4. Tesla's market value evaporated by more than $200 billion this month

Domestic News

1. Bank of America: Chinese equity funds have seen inflows of $11.9 billion in the past week, the largest amount since July 2015

Emerging market equity fund inflows reached a record $12.1 billion in the week ended Jan. 24, Bank of America reported, citing EPFR data. China equity funds attracted $11.9 billion in inflows for the week, the largest scale since July 2015 and the second largest in history. Global equity funds attracted $17.6 billion in inflows, while U.S. equity funds saw inflows of $5.3 billion and European equity funds saw outflows of $1.9 billion for the fourth consecutive week.

2. State Administration of Foreign Exchange: In December, China's import and export of balance of payments goods and services was 4,339.1 billion yuan

Statistics from the State Administration of Foreign Exchange show that in December 2023, China's import and export of balance of payments on goods and services was 4,339.1 billion yuan, a year-on-year increase of 2%. Among them, exports of goods were 2,056.8 billion yuan, imports were 1,646.8 billion yuan, and surpluses were 409.9 billion yuan, while exports of services were 228 billion yuan, imports were 407.6 billion yuan, and deficits were 179.6 billion yuan. The main items of trade in services are: 171.1 billion yuan in import and export of travel services, 158.8 billion yuan in transportation services, 122.6 billion yuan in other commercial services, and 67.4 billion yuan in telecommunications, computer and information services.

3. Chinese Central Bank: In 2023, the balance of loans of microfinance companies was 762.9 billion yuan, a decrease of 147.8 billion yuan for the whole year

The Chinese Central Bank released the 2023 statistical report on microfinance companies. As of the end of December 2023, there were 5,500 microfinance companies in the country. The balance of loans was 762.9 billion yuan, a decrease of 147.8 billion yuan for the whole year.

4. Since the "14th Five-Year Plan", China has built more than 10,000 kilometers of new pipelines

In recent years, China has vigorously promoted the construction of oil and gas pipeline network infrastructure, and a batch of national key projects have been accelerated and successfully put into operation, with a total mileage of more than 10,000 kilometers of new pipelines were constructed since the beginning of the "14th Five-Year Plan", a record high. The middle section of the China-Russia East Line, the Zaoyang-Xiantao section of the West-East Gas Transmission Third Line, the Qianjiang-Shaoguan gas pipeline and a number of interconnection projects will be completed and put into operation in 2023. The Turpan-Zhongwei section of the West-East Gas Transmission Fourth Line, the Zhongwei-Xiantao section of the West-East Gas Transmission Third Line, and the Sichuan-East Gas Transmission Second Line started construction in 2023.

International News

1. RMB will enter the real-time payment and settlement system in Bangladesh from February 4

Bangladesh's Central Bank announced on January 25 that from February 4 this year, the RMB will be traded on the country's real-time payment and settlement system. In September 2022, Bangladesh launched auto-liquidation business in five foreign currencies, including the US dollar, British pound, euro, Japanese yen and Canadian dollar.

2. Nordic Bank of Sweden: The trend of core PCE lower than core CPI in the United States may continue in the next 1-2 quarters

Sweden's Nordic Bank announced today's data includes the core PCE price index in the United States for December. Core PCE has been significantly below core CPI for quite some time, and we expect this to continue in the near term. Core CPI rose 0.3% month-on-month in December, but we believe the core PCE will also be lower in December month-on-month due to the lower weighting of rent and car insurance (which are drivers of inflation) in PCE. The trend of lower core PCE compared to core CPI is likely to persist over the next 1-2 quarters. On average, the monthly change in core PCE is in line with, or even slightly below the inflation target.

3. The geopolitical conflict intensifies, and oil prices are set to record the largest weekly increase since October last year

Oil prices witnessed their largest weekly gain since October last year amid ongoing geopolitical tensions, falling U.S. crude inventories and a continued economic recovery in key crude importers. Brent crude surged 3% in previous trading, initially breaking out of the recent tight volatility range and is now holding steady around $82 a barrel. WTI crude oil prices remained near $77 a barrel, near a two-month high. However, many traders remain cautious given the ample supply from non-OPEC producers and the slowdown in demand growth from major importers, including India.

4. Tesla's market value evaporated by more than $200 billion this month

Tesla (TSLA. O) shares plunged more than 12% on Thursday, evaporating more than $80 billion in market value in a single day, and losing a total of $210 billion in market value this month. Previously, Musk warned that sales growth would slow down this year despite the price cuts. Tesla's price cuts have hurt margins and raised concerns among investors about weak demand. Tesla short-sellers have made $3.45 billion in profits so far this year, making it the most profitable short-seller in the U.S., according to analytics firm Ortex. Some analysts said valuations could become difficult to justify if Tesla's sales growth and profit margins weaken further. At least nine investment banks have recently downgraded the stock and seven have upgraded it to an average hold rating with a median target price of $225.

Domestic Macro Economy Index