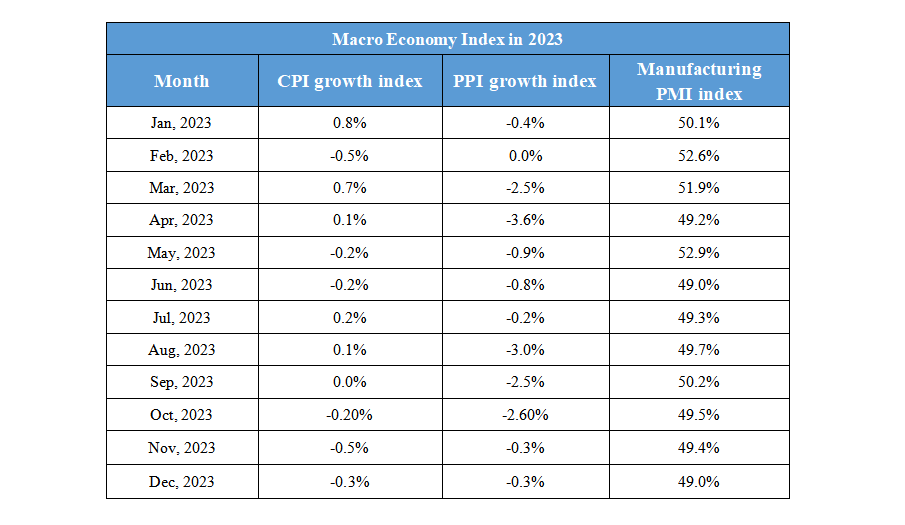

January 26th Macro Economic Overview

Daily Macro Economy News

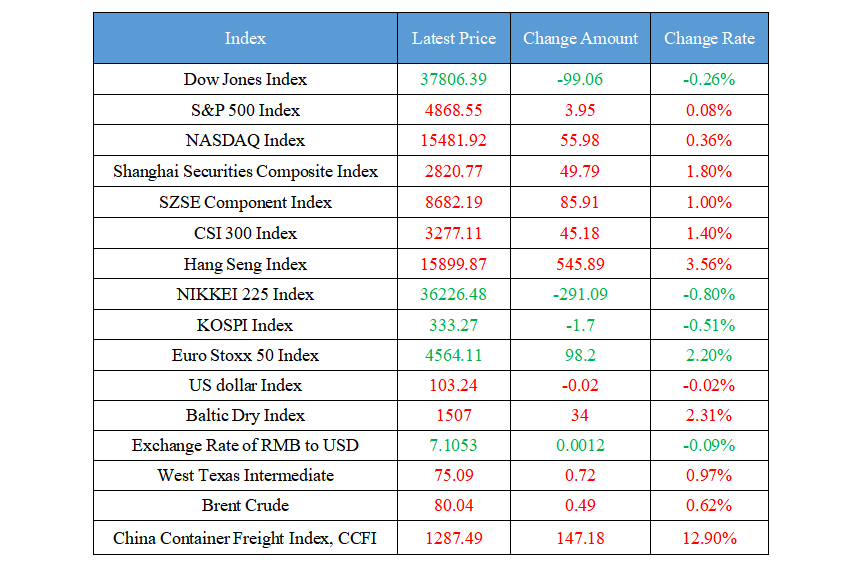

Latest Global Major Index

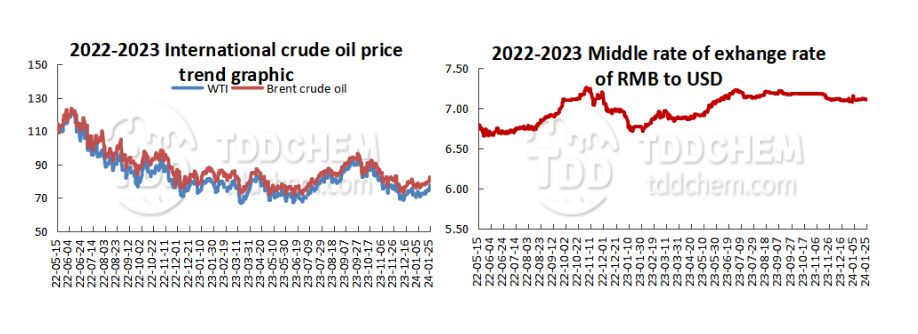

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. CICC commented on RRR cuts and structural interest rate cuts: the concessions space for entities has been further expanded

2. National Energy Administration: New energy storage has developed rapidly, and the installed capacity has exceeded 30 million kilowatts

3. Vice Foreign Minister Deng Li and Iraqi Deputy Foreign Minister Olum held the fourth round of political consultations between the Chinese and Iranian Foreign Ministries

4. China Gold Association: China's gold consumption in 2023 was 1089.69 tons, a year-on-year increase of 8.78%

International News

1. Bank of Korea: South Korea's economic growth rate was 1.4% in 2023

2. To extinguish the arbitrage space, the Federal Reserve raised the interest rate on bank emergency loans

3. Rabobank outlook ECB decision: the Red Sea crisis injects new uncertainty, and interest rate cuts may begin in September

4. Institutions: The market is too optimistic about the Fed's interest rate cuts, and the GDP data release may will be an opportunity for recalibration

Domestic News

1. CICC commented on RRR cuts and structural interest rate cuts: the concessions space for entities has been further expanded

CICC's research report believes that the loosening of the currency and the previous bank reserve requirement rate cuts will pave the road for the LPR to go down, and expand the space for concessions to entities, which will help stabilize growth, stabilize expectations and stabilize the market. In the downward phase of the financial cycle, demand is weak, and "tight credit" requires "loose currency" and "loose fiscal" hedging, and CICC expects monetary policy to continue to maintain an loosing posture. In order to give full play to the policy effect more effectively, it is also necessary to gradually shift monetary supply from credit to fiscal supply, and it is worth looking forward to the broad-based fiscal strengthening.

2. National Energy Administration: New energy storage has developed rapidly, and the installed capacity has exceeded 30 million kilowatts

According to the website of the National Energy Administration, Bian Guangqi, Deputy Director of the Department of Energy Conservation and Science and Technology Equipment, said that new energy storage is developing rapidly, and more than 30 million kilowatts of installed capacity have been put into operation. By the end of 2023, the cumulative installed capacity of new energy storage projects that have been completed and put into operation across the country reached 31.39 million kw/66.87 million kw/h, with an average energy storage duration of 2.1 hours. In 2023, the new installed capacity will be about 22.6 million kw/48.7 million kwh, an increase of more than 260% from the end of 2022 and nearly 10 times the installed capacity at the end of the 13th Five-Year Plan. From the perspective of investment scale, since the "14th Five-Year Plan", the new type of new energy storage capacity has directly promoted economic investment of more than 100 billion yuan, driven the further expansion of the upstream and downstream of the industrial chain, and become a "new driving force" for China's economic development.

3. Vice Foreign Minister Deng Li and Iraqi Deputy Foreign Minister Olum held the fourth round of political consultations between the Chinese and Iranian Foreign Ministries

Vice Foreign Minister Deng Li and Iraqi Deputy Foreign Minister Al Ulum held the fourth round of political consultations between the Chinese and Iraqi Foreign Ministries in Beijing. Deng Li said that Iraq was one of the first Arab countries to establish diplomatic relations with New China. Since the establishment of diplomatic relations 66 years ago, the two countries have always understood, trusted and supported each other. China highly appreciates Iran's support for China on issues related to Xinjiang, Taiwan, human rights and other issues concerning China's core interests, and stands ready to work with Iran to strengthen the synergy between the Belt and Road Initiative and Iran's "Development Path" plan, deepen cooperation in energy, infrastructure construction and finance, further strengthen people-to-people and cultural exchanges, and promote new progress in the China-Iran strategic partnership.

4. China Gold Association: China's gold consumption in 2023 was 1089.69 tons, a year-on-year increase of 8.78%

In 2023, the national gold consumption was 1,089.69 tonnes, an increase of 8.78% compared to the same period in 2022. Among them, 706.48 tons of gold jewelry, up 7.97% year-on-year, 299.60 tons of gold bars and coins, up 15.70% year-on-year, and 83.61 tons of industrial and other gold, down 5.50% year-on-year. It is understood that gold accessory processing and retail enterprises continue to innovate in the design of gold jewelry products, and small gram weights and new styles of gold jewelry are favored by consumers, promoting the promotion of gold jewelry consumption. The high interest in physical gold investment has led to a faster increase in gold bar and coin consumption at relatively low premiums.

International News

1. Bank of Korea: South Korea's economic growth rate was 1.4% in 2023

According to statistics released by the Bank of Korea on January 25, South Korea's annual economic growth rate in 2023 was 1.4%, which is the same as the annual growth forecast of the Bank of Korea and the South Korean government. It is reported that this is the lowest level in South Korea since 2020.

2. To extinguish the arbitrage space, the Federal Reserve raised the interest rate on bank emergency loans

The Federal Reserve raised the lending rate on the Bank Term Financing Program (BTFP), which was launched last year. In recent weeks, loan balances have increased significantly as institutions take advantage of financing conditions. The adjusted borrowing rate will be "no less than" the interest rate on the reserve balance in effect on the date the loan is drawn, effective immediately. The interest rate on reserve balances, which typically moves in tandem with the benchmark federal funds rate target, is currently 5.4%, while the interest rate on lending programs is 4.88%, which is linked to market rates. For banks, the drop in the cost of borrowing from BTFP means greater arbitrage opportunities, where institutions can borrow from the instrument and then deposit the proceeds into the Fed's account to earn interest on reserve balances. The Fed also said that the BTFP will end on March 11.

3. Rabobank outlook ECB decision: the Red Sea crisis injects new uncertainty, and interest rate cuts may begin in September

Rabobank noted that the ECB needs to have more confidence in the inflation outlook before easing policy. We are not disagreeing with the view that the ECB may start cutting rates in June, but we are still slightly inclined to cut rates in September. There needs to be a significant improvement in wage dynamics before we can fully agree to an early rate cut. In addition, attacks on ships in the waters of the Red Sea inject new uncertainty into the outlook. We do not expect a change in the ECB's policy stance at the January meeting.

4. Institutions: The market is too optimistic about the Fed's interest rate cuts, and the GDP data release may will be an opportunity for recalibration

The Canadian Imperial Bank of Commerce expects the preliminary U.S. real GDP to come in at 2.5% annualized QoQ for the fourth quarter, higher than the current consensus forecast of 2.0%, but in line with the Atlanta Fed's GDP Nowcast model forecast of 2.4%. Once again, most of the GDP growth came from the red-hot consumption we are seeing. But other components of U.S. domestic demand should also remain solid in the fourth quarter. The market is overly optimistic about how easing the Fed will be, and the GDP data is likely to be an opportunity for recalibration. Source data showed that US domestic demand grew strongly again, and while potential volatility in inventories and net exports could push the main data lower, it could be enough to price in the market for a pullback.

Domestic Macro Economy Index