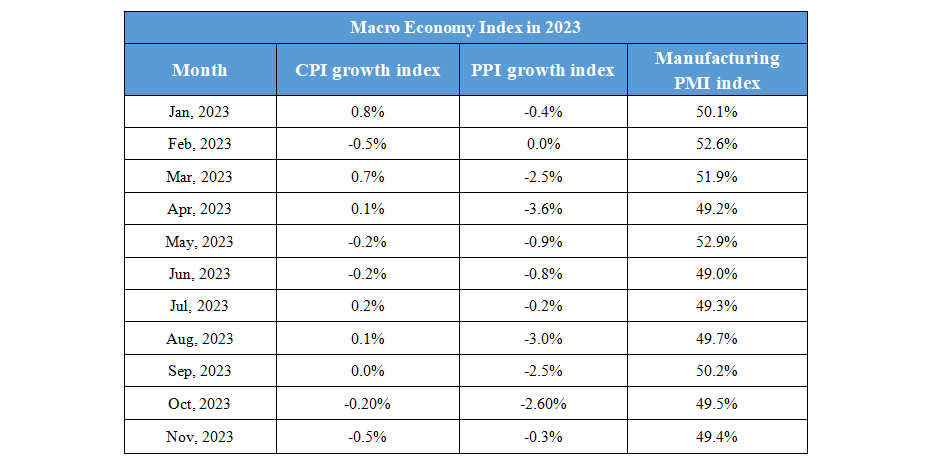

January 3rd, 2024: Key Updates in Domestic and International Macro Economy

Daily Macro Economy News

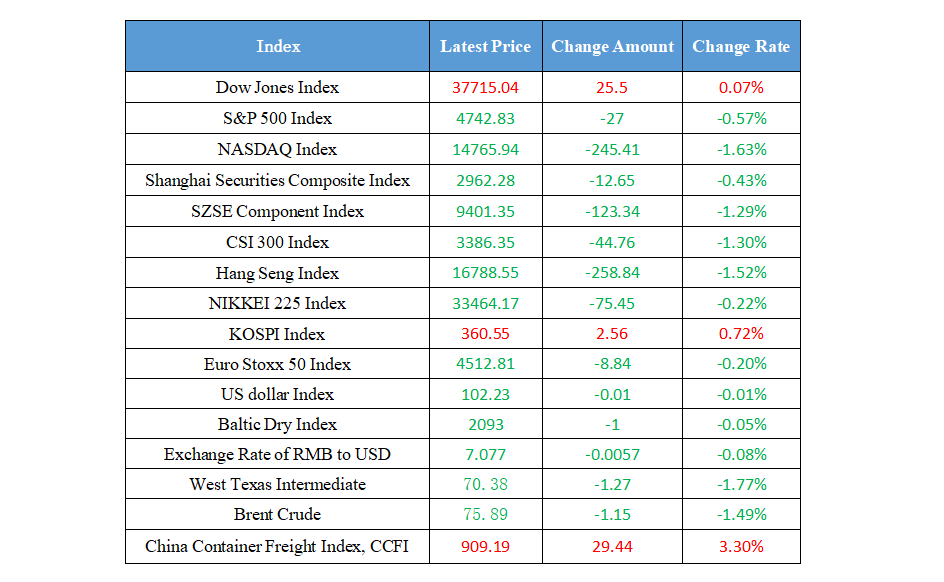

Latest Global Major Index

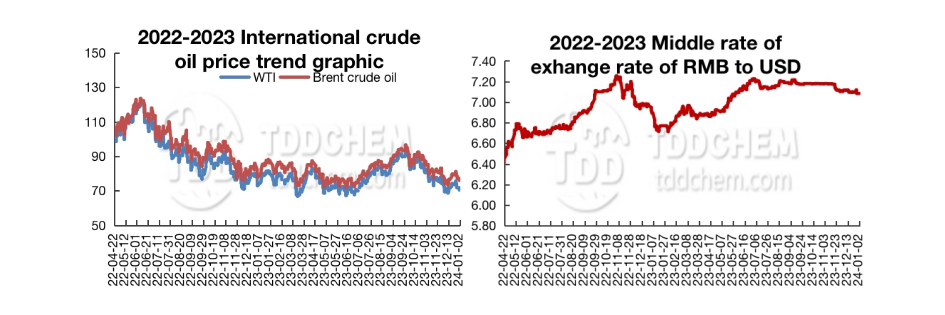

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Dongtai, Jiangsu: Increase the subsidy for “house tickets” for expropriation and relocation, and support the purchase of houses and settlements

2. Chongqing: From January to November, the added value of industrial enterprises above designated size increased by 6.6% year-on-year

3. China's shipping boom report for the fourth quarter of 2023: the shipping industry has returned to the boom range

4. Liaoning: The comprehensive tourism income during the New Year's Day holiday was 5.16 billion yuan, a year-on-year increase of 203.8%

International News

1. Did the United States asked the Netherlands to stop exporting a certain type of lithography machine to China? The Ministry of Foreign Affairs: China will pay close attention to relevant intentions.

2. Danske Bank: The weakening of the dollar will not be reversed for the time being

3. Citi: Singapore's GDP in the Q4 unexpectedly rose to support the HKMA's hawkish stance

4. Shipping giant Maersk: will continue to arrange the Suez route

Domestic News

1. Dongtai, Jiangsu: Increase the subsidy for “house tickets” for expropriation and relocation, and support the purchase of houses and settlements

Dongtai City, Jiangsu Province issued the "Measures to Further Promote the Healthy and Orderly Development of the Real Estate Market in Dongtai City". The policy clearly supports the purchase of a house to settle down; and for those who purchase a new commercial housing in the urban area, they need to provide the the record contract of the online signing of purchase, the full amount of the invoice, the property maintenance fund payment voucher, after the Municipal Bureau of Housing and Urban-Rural Development issued the relevant certificates, the Municipal Public Security Bureau handle the settlement procedures and the Municipal Education Bureau arrange to study in the school corresponding to the purchase of housing in the school district. In addition, we will explore the "same right to rent and sell", and encourage companies in the towns and state-owned enterprises to lease newly built commercial housing for affordable rental housing and talent apartments. The real estate projects of state-owned enterprises develop different types of products according to the rental market, develop long-term rental housing business, and meet the needs of all kinds of new citizens and young people. New citizens who have registered for rent and have no property rights in our city can apply for settlement.

2. Chongqing: From January to November, the added value of industrial enterprises above designated size increased by 6.6% year-on-year

According to data from the Chongqing Municipal Bureau of Statistics, from January to November, the added value of the city's industrial enterprises above designated size increased by 6.6% year-on-year, an increase of 1.1 percentage points from January to October. Among them, the year-on-year growth in November was 18.6%, an increase of 15.4 percentage points from October. By industry, the automobile and motorcycle industry increased by 9.9 percent year-on-year, the equipment industry increased by 4.9 percent, the material industry increased by 10.8 percent, and the consumer goods industry increased by 7.0 percent, while the electronics industry decreased by 0.3 percent, a decrease of 0.8 percentage points from January to October.

3. China's shipping boom report for the fourth quarter of 2023: the shipping industry has returned to the boom range

According to the Shanghai International Shipping Research Center, in the fourth quarter of 2023, China's shipping prosperity index was 109.97 points, an increase of 15.19 points from the previous quarter, and the China shipping confidence index in the fourth quarter of 2023 was 97.64 points, an increase of 21.9 points from the previous quarter. Overall, China's shipping industry has returned to the boom range, and the business conditions of enterprises are improving.

4. Liaoning: The comprehensive tourism income during the New Year's Day holiday was 5.16 billion yuan, a year-on-year increase of 203.8%

According to big data estimates, Liaoning received a total of 7.376 million tourists during the New Year's Day holiday, an increase of 157.6% year-on-year, an increase of 46.8% over the same period in 2019 on a comparable basis, and a comprehensive tourism income of 5.16 billion yuan, a year-on-year increase of 203.8%, and a 45.8% increase over the same period in 2019 on a comparable basis. Both last year and 2019 were higher than the national average. Among them, compared with 2019, they were 37.4 and 40.2 percentage points higher than the national average, respectively.

International News

1. Did the United States asked the Netherlands to stop exporting a certain type of lithography machine to China? The Ministry of Foreign Affairs: China will pay close attention to relevant intentions.

According to reports, the United States has asked the Dutch lithography machine manufacturer ASML to stop exporting certain types of lithography machines to China, and Foreign Ministry spokesman Wang Wenbin responded that China has always opposed the United States to generalize the concept of national security and coerce other countries to engage in a technological blockade against China under various pretexts. Semiconductors are a highly globalized industry, and in the context of the deep economic integration of various countries, the US side's hegemonic and bullying behavior seriously violates international trade rules, seriously undermines the global semiconductor industry pattern, and seriously impacts the security and stability of the international industrial and supply chains. China will pay close attention to relevant developments and resolutely safeguard its legitimate rights and interests.

2. Danske Bank: The weakening of the dollar will not be reversed for the time being

Jesper Fjaerstedt, senior analyst for foreign exchange strategy at Danske Bank, noted in a note that the inversion of the US Treasury yield curve and the weakening of the US dollar may have been somewhat excessive in the short term, although the data released this week is unlikely to promote a reversal of the trend. Fjaerstedt said that the market may now be looking for confirmation of a downward trend in inflation to justify an inverted money market curve and a weaker dollar. The supply of US Treasury bills has been hitting the market since the end of January, potentially triggering a reversal in front-end rates and EUR/USD.

3. Citi: Singapore's GDP in the Q4 unexpectedly rose to support the HKMA's hawkish stance

The surprisingly upside of Singapore's GDP data in the Q4 has supported MAS's hawkish bias in January, Wei Zhen said in a note. He noted that Singapore's GDP MoM and YoY growth reported this morning were 1.7% and 2.8% respectively. These figures imply a higher starting point for 2024 GDP data, which is likely to drive year-on-year comparisons until at least the first half of the year. Citi retains MAS's base forecast of keeping policy unchanged until 2024, preferring to steer the Singapore currency nominal effective exchange rate higher within the policy range, the economist added, although hawkish risks are likely to persist.

4. Shipping giant Maersk: will continue to arrange the Suez route

Danish shipping company Maersk still plans to make more than 30 container ships through the Suez Canal and the Red Sea in the coming period, according to a schedule released late Monday by the company, despite an attack on one of its ships in the region over the weekend.

Domestic Macro Economy Index