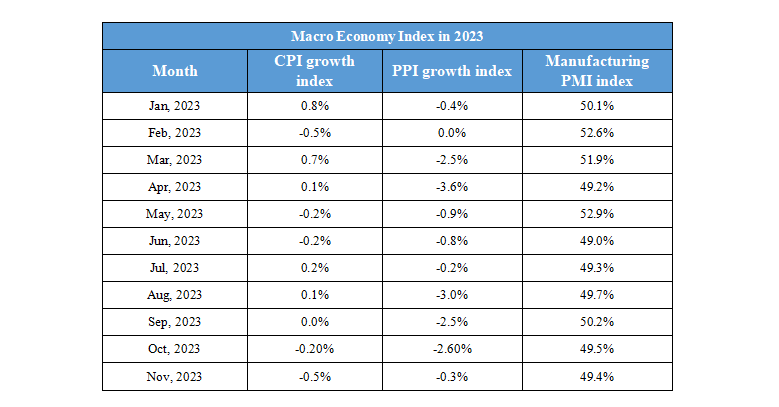

December 19th Macroeconomic Index: Red Sea Tensions Intensify, Impacting Shipping Sector; China Launches 15th Five-Year Plan Study

Daily Macro Economy News

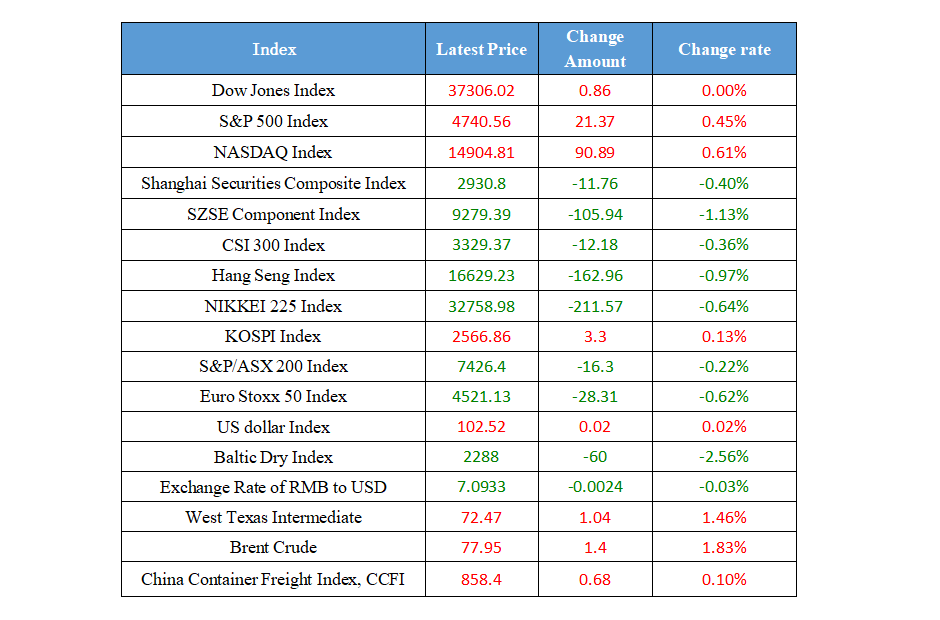

Latest Global Major Index

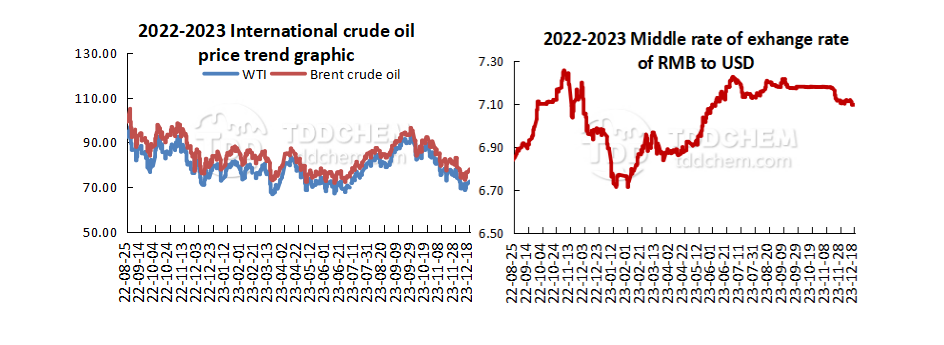

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. It is necessary to adhere to the principles of overall planning, and it should be intensive, efficient, convenient, burden-free, safe and reliable, and we should strengthen management of construction, usage and safety.

2. The floating interest rate began to collect reserves in advance, and most of the floating interest rates were concentrated in 5 to 15 basis points

3. The executive meeting of the State Council listened to the report on the progress of accelerating the construction of a unified national market

4. The National Development and Reform Commission has launched the preliminary study of the "15th Five-Year Plan".

International News

1. The tension in the Red Sea has intensified, "detonating" the shipping sector

2. The EIA expects U.S. shale oil production to decline slightly in January next year

3. The governor of the Bank of Canada made the clearest statement so far on the interest rate cut

4. Canada is expected to announce a new EV regulation this week.

Domestic News

1. It is necessary to adhere to the principles of overall planning, and it should be intensive, efficient, convenient, burden-free, safe and reliable, and we should strengthen management of construction, usage and safety.

Office of the Central Cyberspace Affairs Commission(CAC) issued the "Several Opinions on the Prevention and Control of "Formalism at the Fingertips", which is the mutation and renovation of formalism in the context of digitalization and the main manifestation of increasing the burden on the grassroots. Preventing and controlling "formalism at the fingertips" is of great significance for promoting the upward improvement of the party's style, political style, and social atmosphere; It is necessary to adhere to the principles of overall planning, and it should be intensive, efficient, convenient, burden-free, safe and reliable, and we should strengthen management of construction, usage and safety.

2. The floating interest rate began to collect reserves in advance, and most of the floating interest rates were concentrated in 5 to 15 basis points

In November, the interest rate adjustment of state-owned banks was relatively limited, the four major banks of China basically did not adjust, and the three-year deposit interest rate of the PSBC was raised. Overall, the average interest rate on deposits of one year or more increased month-on-month. The 3-month and 6-month deposit interest rates of urban commercial banks are the highest, the 1~3-year deposit interest rates of joint-stock banks are the highest, and the 5-year deposit interest rates of rural commercial banks are the highest. At the end of the year, some small and medium-sized banks began to collect deposits in advance due to the year-end assessment requirements, and most of the floating interest rates were concentrated in 5 to 15 basis points.

3. The executive meeting of the State Council listened to the report on the progress of accelerating the construction of a unified national market

The executive meeting of the State Council listened to the report on the progress of accelerating the construction of a unified national market, discussed and adopted the "Guiding Opinions on Promoting the High-quality Development of Disease Prevention and Control", and deliberated and passed the "Regulations on Coal Mine Safety Production (Draft)" and other laws and regulations. The meeting pointed out that it is necessary to speed up the improvement of basic systems in such areas as market access, property rights protection and transactions, data information, and social credit, actively and steadily promote reforms in key areas such as finance, taxation, and statistics, intensify the exploration of early pilot projects, and establish various systems and rules that are conducive to the construction of a unified national market.

4. The National Development and Reform Commission has launched the preliminary study of the "15th Five-Year Plan".

The National Development and Reform Commission (NDRC) has launched a preliminary study of the 15th Five-Year Plan to sort out and choose the major issues that need to be planned and studied as soon as possible during the 15th Five-Year Plan period. Explore innovative ideas and measures, especially focus on key blocking points, innovate ideas and methods, and study and put forward key tasks and major measures that "lead to a trigger and move the whole body".

International News

1. The tension in the Red Sea has intensified, "detonating" the shipping sector

Tensions in the Red Sea have intensified, "detonating" the shipping sector. International shipping giants have announced the suspension of Red Sea navigation due to attacks by Yemen's Houthi rebels as a number of ships sailed to the Red Sea waters. The Suez Canal, the "main artery" of shipping, is at risk of closure, pushing up shipping price expectations. On December 18, there is daily limit for multiple contracts of the container transportation index (European line). At the same time, the A-share shipping sector rose sharply against the trend, and many stocks such as Air China COSCO and COSCO Shipping Energy rose to the limit. US Secretary of Defense Lloyd Austin's visit to the Middle East this week will announce a Red Sea escort operation with the participation of several Arab allies.

2. The EIA expects U.S. shale oil production to decline slightly in January next year

The U.S. Energy Information Administration (EIA) expects total U.S. shale oil production to fall by about 1,000 b/d to 9.692 million b/d in January next year (down 2,000 b/d in December). Bakken crude oil production is expected to increase by 1,700 b/d to 1.308 million b/d (up 1,100 b/d in December), Eagle Ford crude oil production is expected to fall by 1,500 b/d to 1.149 million b/d (down 3,000 b/d in December), and Permian Basin crude oil production is expected to increase by 4,600 b/d to 5.986 million b/d (up 5,200 b/d in December).

3. The governor of the Bank of Canada made the clearest statement so far on the interest rate cut

Bank of Canada Governor Macklem said he expects rate cuts to start next year, but first needs to see a downward momentum in core inflation that lasts for months. "I think sometime in 2024," McCollum replied when asked when he would see the central bank cut interest rates. He added that policymakers need to see "not a month or two" but "months" of potential inflation deceleration before considering rate cuts. It was the clearest statement Macklem had made to date on the timeline for monetary policy easing, and it was in line with most economists' views on developments. It also highlights a shift in the mindset of officials, who have shifted their focus from how high interest rates must stay to how long they must remain at current levels.

4. Canada is expected to announce a new EV regulation this week.

Canada is expected to announce a new EV rule this week. The new regulations require zero-emission vehicles (including battery electric vehicles, plug-in vehicles and hydrogen-fueled vehicles) to account for 20% of all new car sales by 2026, 60% by 2030 and 100% by 2035.

Domestic Macro Economy Index