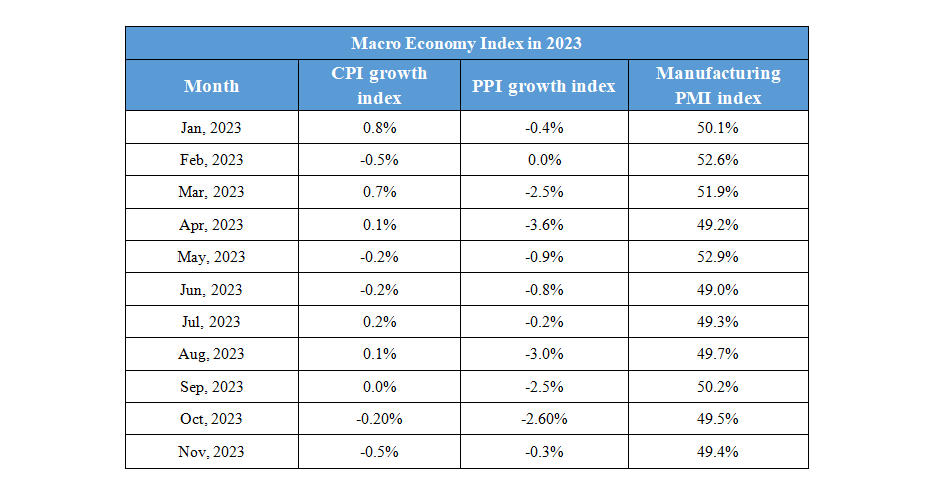

December 15th Macro Economy Update: Key Trends and Policy Adjustments

Daily Macro Economy News

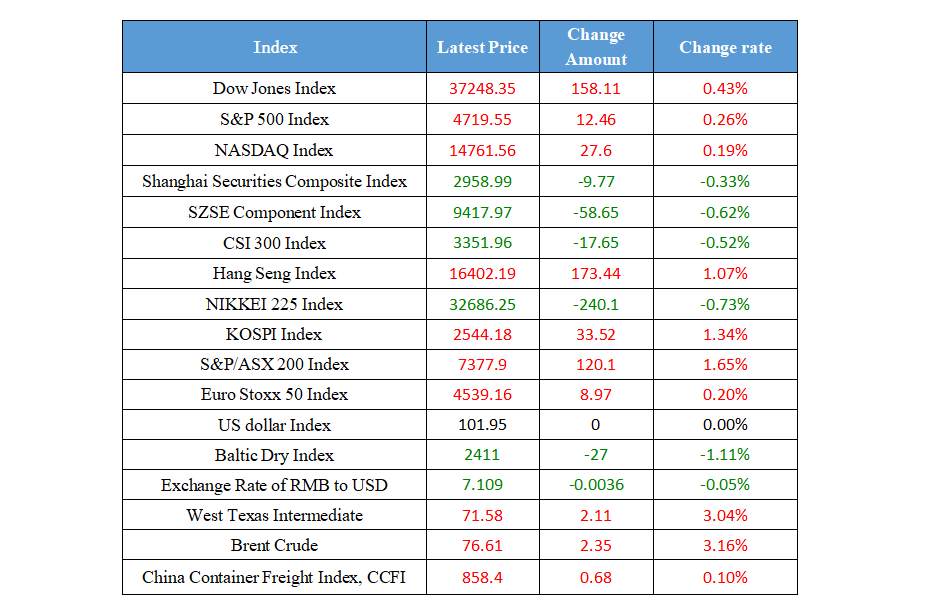

Latest Global Major Index

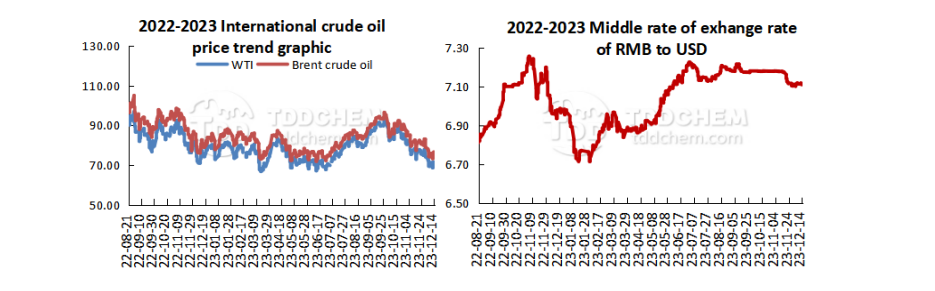

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Economic Daily: Automobile evaluation should highlight credibility

2. Eighteen centralized land supply cities have canceled price limits, and the land market will continue to diverge

3. Guide investment institutions to strengthen the counter-cyclical layout and strengthen "patient capital"

4. Beijing and Shanghai ushered in a number of property market policy adjustments

International News

1. Putin: The Russian economy has enough capacity to support its development

2. U.S. mortgage rates fell below 7% for the first time in four months, and the housing market may usher in vitality next year

3. A number of villages and towns on the southern border of Lebanon have been attacked by Israel

4. The Knesset agreed to an additional $7 billion war budget

Domestic News

1. Economic Daily: Automobile evaluation should highlight credibility

In recent years, with the rapid increase in the number of cars in China and the increasing attention of consumers to the quality of automobiles, there have been more and more tests on the performance indicators of automotive products, such as power, endurance and safety. Although these third-party evaluations led by the media or institutions are different from those carried out by manufacturers in the process of product access or product development, these test results are usually widely reported by the media, which not only attract the attention of consumers and affect consumer purchasing behavior, but also are variables that cannot be underestimated for the brand image and market position of automobile manufacturers. Therefore, credibility is very important. The controversy caused reminded relevant departments that while strengthening the supervision of nonstandard assessment of automobiles, it is also necessary to guide industry enterprises and professional testing institutions to cooperate and accelerate the establishment of a scientific and standardized new energy vehicle evaluation system. It not only reflects the protection of consumer rights and interests, but also the responsibility for the high-quality development of the industry.

2. Eighteen centralized land supply cities have canceled price limits, and the land market will continue to diverge

Since October 18, 22 cities that have implemented centralized land supply and centralized announcements have canceled land price limits and resumed the "the highest price wins" model, including Guangzhou, Chengdu, Hefei, Nanjing, Chongqing, Xiamen, Jinan, Wuhan and other cities. The remaining four cities are Beijing, Shanghai and Shenzhen, which have not yet been adjusted, and Ningbo, which has raised the upper limit of the premium rate from 15% to 30%. At present, the main reason for the lifting of land price caps is that the land and real estate markets have undergone significant changes, and the restrictive measures introduced during the market boom are gradually being phased out. Although the abolition of the price limit for land sales has heated up some high-quality land plots, the market will still be differentiated. High-quality land plots in hot cities, especially first- and second-tier cities with large population inflows, will attract more attention from enterprises, and prices are expected to rise. However, where the market demand is weak, especially in the first-class cities where the market is already saturated, the land market will continue to be moderate.

3. Guide investment institutions to strengthen the counter-cyclical layout and strengthen "patient capital"

Make every effort to maintain the smooth operation of the capital market. Adhere to comprehensive measures, treat both the symptoms and the root causes, and continue to work hard to enhance confidence and improve expectations. We will further promote the construction of first-class investment banks and investment institutions, put the promotion of dynamic balance of investment and financing in a more prominent position, vigorously promote the reform of the investment side, promote and improve the policy environment conducive to the entry of medium and long-term funds into the market, and guide investment institutions to strengthen the counter-cyclical layout and expand "patient capital".

4. Beijing and Shanghai ushered in a number of property market policy adjustments

Beijing and Shanghai ushered in a number of property market policy adjustments. Beijing has optimized the criteria for identifying ordinary housing, reducing the down payment ratio for the first home to 30% and the minimum down payment ratio for the second home to 40%, and abolishing the strict control of the mortgage term during the period when housing prices are rising too quickly, and restoring the maximum of 25 years to 30 years. The lower limit of the interest rate policy for new housing loans issued by commercial banks will also be adjusted, and the lower limit of the new interest rate policy will be implemented for new commercial personal housing loans issued from December 15. Since December 15, Shanghai has adjusted the standard of ordinary housing and optimized the differentiated housing credit policy, among which the minimum down payment for the first house is not less than 30%, and the minimum down payment for the second house is not less than 40%.

International News

1. Putin: The Russian economy has enough capacity to support its development

Russian President Vladimir Putin said at the "annual stocktake" event held in Moscow on the 14th that the Russian economy has enough capacity to support its development. Summing up the country's economic development situation, Putin said that Russia's GDP is expected to grow by 3.5% in 2023. Russia's industrial production and manufacturing sectors both grew, and the unemployment rate fell to 2.9% for the first time. Russia's foreign debt has dropped from $46 billion to $32 billion. "The country's foreign debt is declining, which is a testament to the stability of both macro economy and the financial system".

2. U.S. mortgage rates fell below 7% for the first time in four months, and the housing market may usher in vitality next year

The average interest rate on a 30-year fixed loan in the United States was 6.95%, down from 7.03% last week. Mortgage rates fell below 7% for the first time in four months, giving a breath to the U.S. housing market, which has been plagued by affordability issues. Borrowing costs have fallen for seven consecutive weeks, bringing interest rates back down from a high level of 7.79% at the end of October. The decline in mortgage rates has made it is more likely for buyers who are on the sidelines due to high interest costs to return to the market. Sam Khater, chief economist at Freddie Mac, said, "We may see a gradual improvement in the housing market in the new year, given that inflation continues to decelerate and the Fed now expects to cut its federal funds target rate next year."

3. A number of villages and towns on the southern border of Lebanon have been attacked by Israel

On December 14 local time, according to a report by Lebanese’s National News Agency, villages and towns on the southern border of Lebanon, such as Umtut, Bustan, Eta Shaab, Beitlev, and Lamia, were shelled by Israel on the same day. on the same day, It was reported that Israeli military used helicopters fired two missiles at the main road at the north of the town of Mez Jabbar. Four interceptor missiles fired by the Israeli side exploded over Etalyn on the Lebanese side. At present, there is no response from the Israeli side.

4. The Knesset agreed to an additional $7 billion war budget

On December 14, the Knesset voted 59 to 44 to approve a supplementary war budget of about $7 billion, which will be used to cover the costs associated with the armed conflict between Israel and the Palestinian Islamic Resistance Movement (Hamas). On the same day, Israeli Defense Minister Gallant said that it would take a long time to defeat Hamas in the Gaza Strip and that the fighting could last for several months.

Domestic Macro Economy Index