On September 5th, Domestic and International Economic Highlights

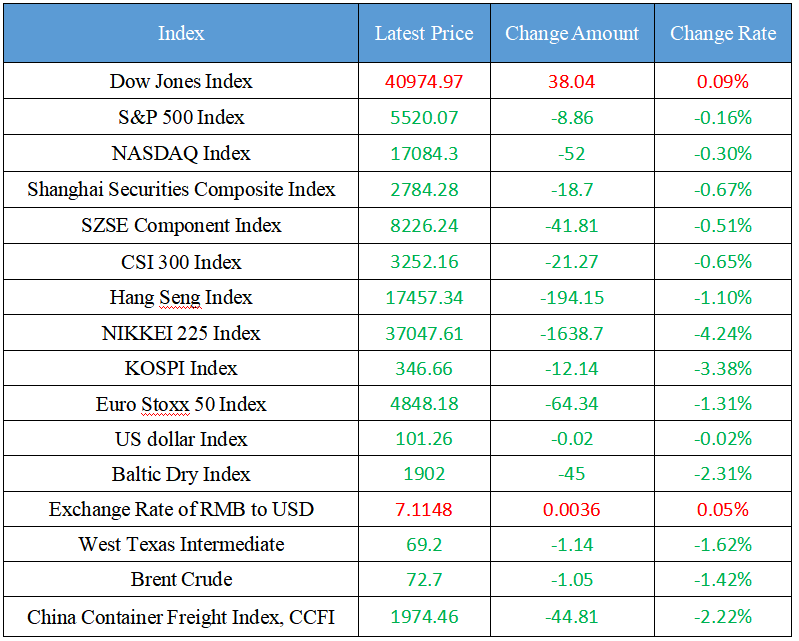

Latest Global Major Index

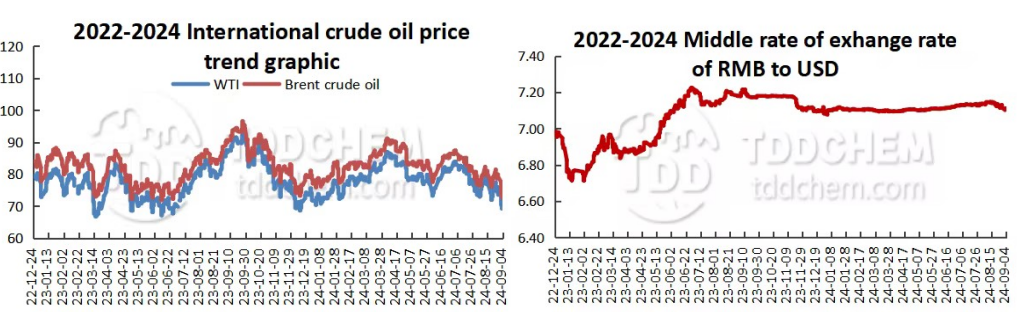

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The Shanghai-Kunming Air Corridor began to be officially opened today

2. Since the third quarter, there has been hot money speculation in many small and micro stock market

3. In August, the research enthusiasm of private equity institutions increased significantly

4. Huya announced a change in management

5. Anti-monopoly experts: Realize the combination of strict and soft anti-monopoly regulatory measures

International News

1. Egypt and Turkey signed 17 agreements to expand bilateral relations in various fields

2. High temperature and drought continue. Many places in Brazil have entered a red emergency with low humidity

3. Analysts: The Federal Reserve's Beige Book is more pessimistic, and the economy in most jurisdictions is flat or declining

4. The Federal Reserve's Beige Book: Employment levels are generally stable and consumer spending has declined

5. US media: The Biden administration is ready to block Japan Steel's steel trade with United States

Domestic News

1. The Shanghai-Kunming Air Corridor began to be officially opened today

Starting from 0:00 today (5th), the airspace optimization scheme for the east-west air traffic artery connecting China's Yangtze River Delta world-class airport cluster and Kunming International Hub was officially launched. The opening of this air corridor will make the air "sky road" along the line wider, with greater capacity, and the safety level of flight operation and flight efficiency will be further improved. In accordance with the idea of delineating the Shanghai-Kunming air route, the Shanghai-Kunming air corridor, which was opened at 0:00 today, has implemented a one-way parallel transformation of the H24 route, which is the busiest east-west route in China, and expanded from the original relative operation of the "single lane" to the "double lane" of one-way operation. The main body of the scheme consists of two parallel routes, the eastern section adopts the flexible use of airspace to connect the Shanghai terminal area, and the west side is directly connected to the air entry and exit points of China-Myanmar and China-Laos through the newly opened connecting routes, and multi-point connection realizes a new pattern of one-way circulation operation of the air backbone channel.

2. Since the third quarter, there has been hot money speculation in many small and micro stock market

On September 4, the A-share market fluctuated and adjusted, and the Shanghai Composite Index fell 0.67%, hitting a new low in the intraday adjustment. Since the third quarter, with the adjustment of the A-share market across the board, and in August to record a stage of land, a number of bull stocks such as Public Transportation, Dr. Glasses, Xiangxue Pharmaceutical, **st Jingfeng, Shenzhen Huaqiang, etc., have emerged under the weak market. Analysts say investors tend to turn to short-term trading when the market is weak and there is no clear trend, especially around thematic stocks with hype potential. However, most theme stocks also have a large correction after the surge, and ordinary investors should pay more attention to the fundamental analysis of the company, rather than being driven by short-term stock price fluctuations.

3. Analysts: The Federal Reserve's Beige Book is more pessimistic, and the economy in most jurisdictions is flat or declining

Although the A-share market continued to fluctuate in August, research enthusiasm of a large number of private equity institutions rose instead of declining, actively looking for structural opportunities. According to the statistics of the private placement network, in August, a total of 1,276 private equity institutions conducted research on A-share listed companies, covering 726 listed companies in 28 Shenwan first-class industries, with a total of 9,253 surveys. Compared with July, the number of surveys conducted by private equity firms has increased by nearly three times. In terms of specific industries, the pharmaceutical, biotechnology and electronics industries are favored by private equity institutions. Industry participates believe that private equity institutions have increased their front-line research efforts, which is conducive to them to grasp the pulse of the market faster and tap high-quality targets at a relatively low level in the market.

4. Huya announced a change in management

HUYA announced today that the Board of Directors of Huya has appointed Mr. Lei Peng as the Company's Acting Co-CEO and CFO, effective September 5, 2024. Mr. Lei Peng will succeed Ms. Wu Xin as Acting Co-CEO and share the responsibilities of CEO with Mr. Huang Junhong, Director, Acting Co-CEO and Senior Vice President of the Company. Following Mr. Lei's appointment, Ms. Wu Xin will continue to serve as the Company's Vice President of Finance.

5. Anti-monopoly experts: Realize the combination of strict and soft anti-monopoly regulatory measures

Shi Jianzhong, deputy head of the expert advisory group of the Anti-Monopoly and Anti-Unfair Competition Commission of the State Council, said in an article in the Economic Daily that the Alibaba Group monopoly case once again proves that law enforcement is the best way to popularize the law. On the one hand, we need to strictly enforce the law, strengthen the rigidity of anti-monopoly law enforcement, and continuously improve the anti-monopoly regulatory system and mechanism. On the other hand, we also need to make full use of other anti-monopoly regulatory tools, such as administrative talks, administrative guidance, reminders and urgings, and regulatory quality and effectiveness assessments, so as to achieve a combination of rigid and soft anti-monopoly regulatory measures, and form a synergy between government supervision, corporate compliance, and industry self-discipline, so as to cultivate a culture of fair competition. At the same time, we should also note that the technology supporting the platform economy is booming, and the platform economy model is constantly evolving. However, as long as we adhere to the normalization, precision and echelon of anti-monopoly supervision, draw the "red line" and turn on the "green light", we can provide a sound and legal competition environment for the innovation and development of the platform economy.

International News

1. Egypt and Turkey signed 17 agreements to expand bilateral relations in various fields

On the afternoon of the 4th local time, Egypt President Abdel Fattah el-Sisi paid his first official visit to Turkey, which was the first visit by an Egypt president to Turkey in 12 years. During the meeting, the leaders of the two countries held in-depth discussions on the Palestinian-Israeli conflict, the provision of humanitarian assistance to Gaza, bilateral trade, and strengthening cooperation between the two countries in various fields. The first meeting of the high-level strategic cooperation council of the two countries was also held on the sidelines of the meeting, which was attended by a number of Ministers from both sides. During the meeting, Turkey and Egypt signed 17 agreements covering finance, environment, urban planning, energy, civil aviation, employment, tourism, health, agriculture and other fields.

2. High temperature and drought continue. Many places in Brazil have entered a red emergency with low humidity

On September 3, local time, the latest meteorological report released by the National Meteorological Institute of Brazil showed that due to the relative humidity below 12%, Mato Grosso do Sul, Mato Grosso do Sul, São Paulo, Minas Gerais, Goiás and the Federal District of the Capital OF Brazil entered a red state of emergency, and many areas with relative humidity below 30% entered an orange or yellow state of emergency. The report also shows that winter temperatures in some cities in Brazil are currently close to 40 degrees. The high temperature and drought conditions throughout Brazil are expected to continue to intensify on the 4th.

3. Weak data once again triggered concerns about economic slowdown, and U.S. stocks had a "black start" in September

Macro strategist Cameron Crise said that throughout the post-pandemic period, the Fed's Beige Book has been pessimistic about economic growth, and the most optimistic comment on the United States economic expansion is "moderate." The latest Beige Book states that three regions have seen "modest" economic growth, while the other nine regions have seen flat or negative growth. This is slightly inferior to the previous report. It sounds terrible, and it's certain that the Fed can use this as an excuse to adjust interest rates this month, but it's not all that different from much of the past few years. In any case, the market can easily use this as an excuse to pour more money into the bond market.

4. The Federal Reserve's Beige Book: Employment levels are generally stable and consumer spending has declined

The Fed's Beige Book noted a slight increase in economic activity in three regions, while the number of regions reporting flat or declining economic activity increased from five in the previous quarter to nine in the current period. Employment levels are generally stable, although there have been individual reports of companies filling only necessary positions, reducing working hours and shifts, or reducing overall employment levels through attrition. Still, there have been few reports of layoffs. Overall, wage growth was modest, while increases in non-labor input costs and selling prices ranged from mild to modest. Consumer spending declined in most regions, while it remained generally stable in the last reporting period.

5. US media: The Biden administration is ready to block Japan Steel's steel trade with United States

According to the Washington Post, United States President Joe Biden is preparing to announce that he will formally block Japan Steel's $14.9 billion acquisition of United States Steel (X.N). The decision would be a shocking veto of a deal proposed by United States' allies that became a major political controversy ahead of the United States election in November. The Committee on Foreign Investment in the United States (CFIUS) has been investigating the proposed acquisition. The Wall Street Journal previously reported that the CEO of United States Steel said that if the plan to sell to Japan Steel fails, they will close the plant and possibly move its headquarters out of Pittsburgh. United States Steel (X.N) fell in volume, halted trading twice in the market, and the latest stock price was $29.2.

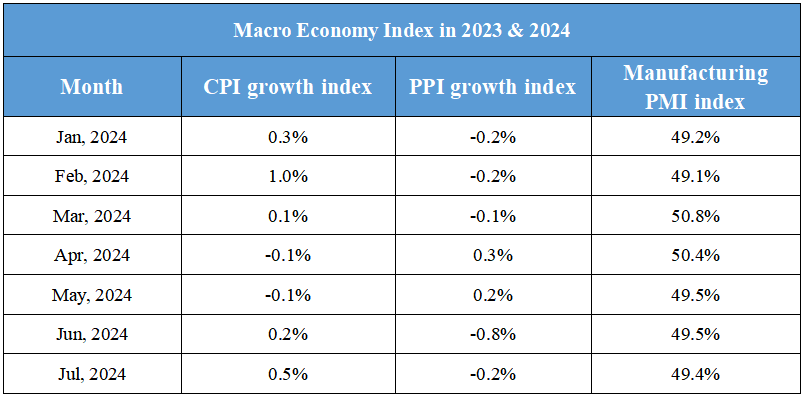

Domestic Macro Economy Index