Key Domestic and International Economic Updates on August 29th

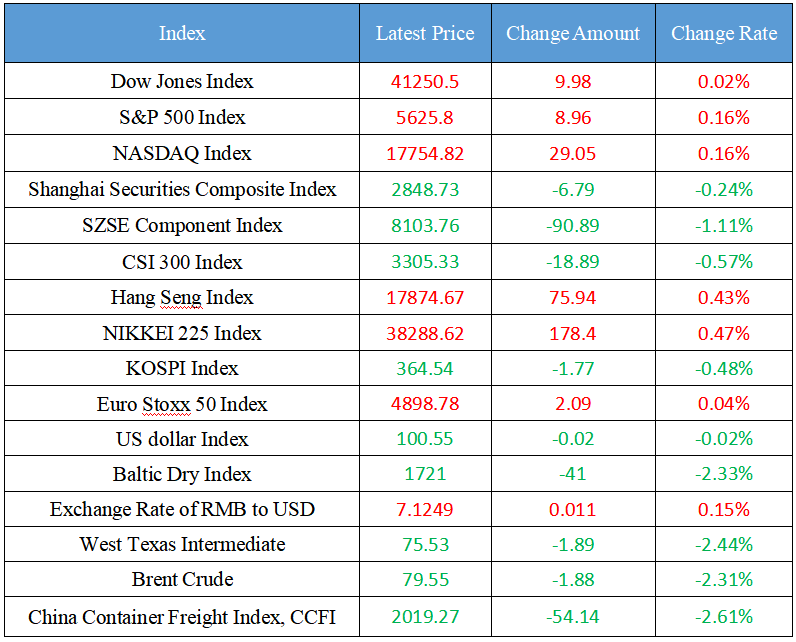

Latest Global Major Index

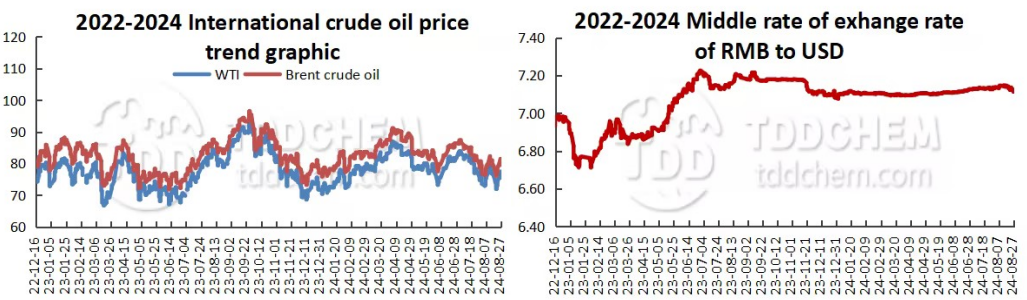

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The four major state-owned banks will issue TLAC non-capital bonds within the year, and the issuance quota is planned to reach 160 billion yuan

2. Economic Daily: Manage and make good use of housing pensions

3. A-share companies are enthusiastic in the medium term dividends, and dividend assets have attracted the attention of institutions

4. Integration was found in the off-season of fund sales, and commission agencies skillfully play the "insurance card"

5. A number of bank stocks have set a new historical record in stock prices, and dividend assets have staged a game of "shrinking the circle".

International News

1. The net value has returned significantly, and QDII is cautious about changes in overseas markets

2. Venezuela reshuffles its cabinet with half of the cabinet members remain in office

3. Zelensky: F-16 was used when the Russian army launched a strike on August 26

4. Trump confirmed his participation in the debate with Harris on September 10

5. The attack on the capital of Sudan's Northern Darfur State killed 25 people

Domestic News

1. The four major state-owned banks will issue TLAC non-capital bonds within the year, and the issuance quota is planned to reach 160 billion yuan

On August 28, the four major state-owned banks of Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China and China Construction Bank have all issued the first phase of TLAC non-capital bonds during the year, and the funds raised by the bonds will be used to enhance the issuer's total loss absorption capacity (i.e., "TLAC"). According to the previous approval of the State Administration of Financial Supervision and Administration, up to now, four major state-owned banks have been approved to issue a total of 310 billion yuan of RMB or equivalent foreign currency TLAC non-capital bonds. For example, the Agricultural Bank of China will issue 30 billion yuan according to the basic issuance scale, and the total amount of TLAC non-capital bonds issued by the four major state-owned banks will reach 160 billion yuan, and the issuance progress will reach 51.61% of the approved amount.

2. Economic Daily: Manage and make good use of housing pensions

It is said that China is currently studying the establishment of housing physical examination, housing pension, housing insurance system, these "three systems" will help build a long-term mechanism for housing safety management throughout the life cycle. The establishment of a housing pension system can also continue to broaden the source of funds by broadening the mind. For example, the balance of the income from the appreciation of the house maintenance fund can also be included. There are also public spaces and public facilities in the community, such as shops, parking lots, billboards, sports facilities leasing and operating income, etc., which can be used as a source of housing pension. In addition to the source of funds, how to use the housing pension well with appropriate management and supervision will be the problems faced by the construction of the housing pension system. It is expected that the housing pension system will be improved day by day, and the safety of housing will be effectively guaranteed, so that people can live more comfortably.

3. A-share companies are enthusiastic in the medium term dividends, and dividend assets have attracted the attention of institutions

The 2024 semi-annual reports of A-share companies are being intensively disclosed, and the medium-term dividend plans of listed companies have attracted much attention from the market. According to the data, as of August 26, the number of A-share companies planning to carry out interim dividends in 2024 has reached 369, with a total planned cash dividend amount of more than 160 billion yuan, of which 22 companies have implemented cash distribution. Last year, only 194 companies paid interim dividends. A number of institutions said that listed companies are actively paying dividends, and the intensity has been strengthened, and the dividend strategy still has long-term investment value. Fan Jingwei, fund manager of Penghua Fund, said that with the strong support and encouragement of the policy, it is foreseeable that more and more listed companies will pay dividends in the A-share market in the future.

4. Integration was found in the off-season of fund sales, and commission agencies skillfully play the "insurance card"

The semi-annual report data of listed companies confirmed that the fund sales environment in the first half of the year was not easy. Under such circumstances, institutions that have both fund and insurance agency licenses have increased the integration of agency business, and have played the "insurance card" while making efforts to sell funds. Under such circumstances, Internet platforms that have both fund and insurance distribution licenses have increased the integration of fund and insurance distribution businesses, trying to achieve the "flywheel effect" of the overall distribution business. Integrating fund and insurance agency business and helping to build a reasonable portfolio in the form of multi-asset allocation has gradually become the choice of many institutions. Some fund distributors believe that "cross-border" cooperation is conducive to the formation of a "1+1>2" effect, which will increase the overall distribution income while improving the effect of wealth management services.

5. A number of bank stocks have set a new historical record in stock prices, and dividend assets have staged a game of "shrinking the circle".

Recently, the dividend asset market has shown a divergent trend. Although the performance of some varieties is not satisfactory, and individual stocks such as banks and utilities have a strong trend, they have gradually become an important position after the "shrinkage" of the dividend asset market. Recently, a number of bank stocks have set new stock price records. According to the analysis of industry insiders, the essence of this round of dividend pricing is "value grouping", if the rise of bank stocks is behind the rise of passive long funds, then for public services, its pricing is more of the factor of active long funds. For this round of dividend asset "shrinkage", funds prefer debt-like low-volatility varieties, industry practitioners said, which shows that the current market risk appetite is low. The recent level of excess returns for debt-like low-volatility varieties has begun to converge, which also shows that the market is looking for a new direction. In the view of the strategy team of SDIC Securities, the behavior of capital holding does not rule out the possibility that the core varieties of dividend assets are gradually being promoted to enter the "bubble pricing stage".

International News

1. The net value has returned significantly, and QDII is cautious about changes in overseas markets

Since August, the S&P 500 index and the Nasdaq index have rebounded significantly, benefiting from the recovery of the U.S. stock market, a number of QDII products that retreated significantly in July rose. Wind data shows that as of August 26, the net value of some QDII products has rebounded by more than 10% compared with the stage low in early August. Recently, Federal Reserve Chairman Jerome Powell said at the annual meeting of global central banks that "the time has come to adjust monetary policy". According to industry participates, the Federal Reserve is about to end its current high-interest rate monetary policy and start a cycle of interest rate cuts. However, for ordinary investors, the market may still fluctuate before and after the Fed's interest rate cut cycle really starts, and it is necessary to pay close attention to market changes.

2. Venezuela reshuffles its cabinet with half of the cabinet members remain in office

Local time on August 27, Venezuela President Maduro appointed to replace a number of cabinet members, and half of the cabinet members remained in office. Maduro announced that Vice President Delsi· Rodriguez is also Minister of Oil. Diosdado·Cabello is Minister of the Internal Affairs and Justice. Anabel· Pereira· Fernández became Finance Minister. On the same day, Maduro also made new appointments to Ministers in various ministries such as industry, tourism, women and sports.

3. Zelensky: F-16 was used when the Russian army launched a strike on August 26

Ukraine President Volodymyr Zelensky said at a press conference on August 27 that on August 26, Ukrainian troops used F-16 fighters to shoot down missiles and drones when the Russia armed forces launched a strike, and Zelensky once again complained that Western assistance was still too little. On the morning of August 26, the Russian army used air-based and sea-based high-precision long-range weapons, tactical aviation of the Aerospace Forces and unmanned aircraft attack weapons to launch a large-scale strike on key energy infrastructure used to ensure the operation of Ukraine's military industry.

4. Trump confirmed his participation in the debate with Harris on September 10

Former United States President Trump said on the social platform Truth Social that he confirmed that he will attend the presidential election debate with United States Vice President Harris on September 10 (next Tuesday), which was hosted by the United States Broadcasting Corporation (ABC). Trump had previously accused the ABC of bias and at one point threatened to withdraw from the debate altogether. As for the rules of the debate, Harris spokesman Brian Fallon said on Monday that the campaign wants the microphone to remain open throughout the whole process of debate, rather than being turned off when the other side spoke, as was the case in the last CNN debate. In his statement today, Trump said the rules of the debate will be the same as last time, candidates will not be allowed to bring notes or "cheat sheets," and neither side will be given questions in advance. Trump also said that a third debate, which could be hosted by NBC News, has not yet been agreed by the Democrats.

5. The attack on the capital of Sudan's Northern Darfur State killed 25 people

On August 28, government officials in Sudan's Northern Darfur State said on the 27th that Sudan's Rapid Support Forces shelled the city of El Fasher, the capital of the state, on the 26th, killing 25 people and injuring about 30 people. The Minister of Health of Northern Darfur Khatir issued a statement on the 27th, saying that the Sudanese Rapid Support Forces carried out an artillery shelling of the city of El Fasher on the night of the 26th that lasted about four hours, and four shells fell on a market in the Abu Shouk refugee camp in the north of the city, killing 25 people and injuring about 30 people. The injured have been taken to nearby health centres and hospitals for treatment.

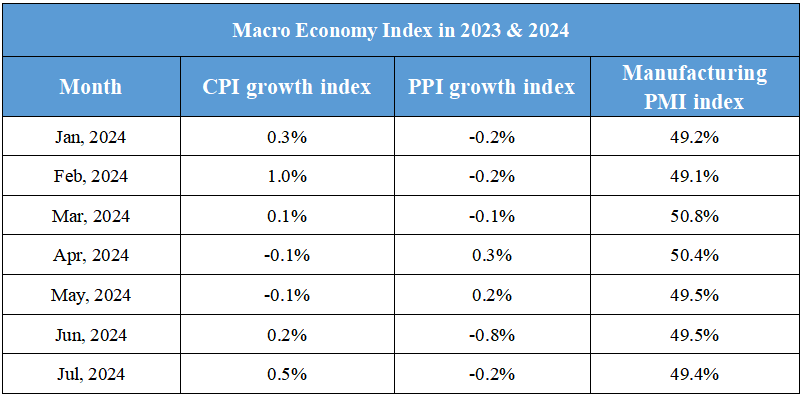

Domestic Macro Economy Index