On August 23rd, Global Economic Highlights and Domestic Market Updates

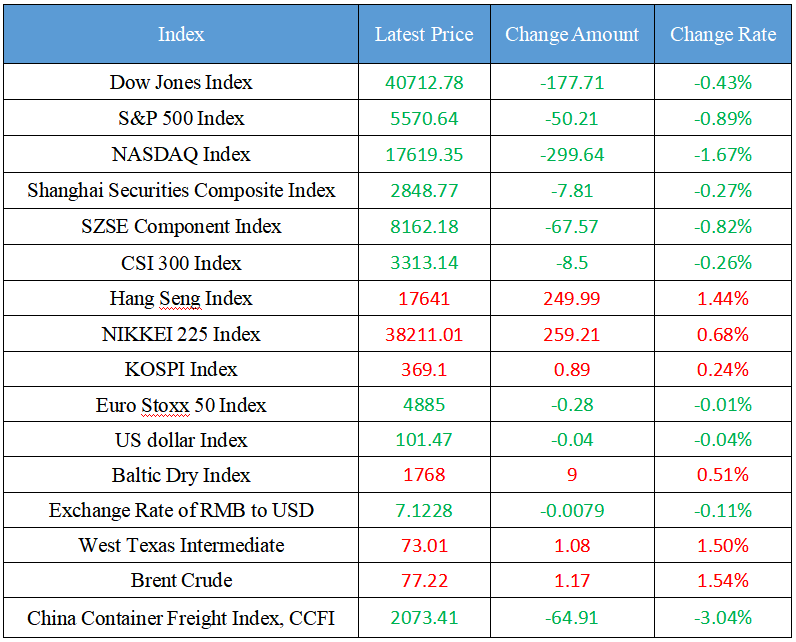

Latest Global Major Index

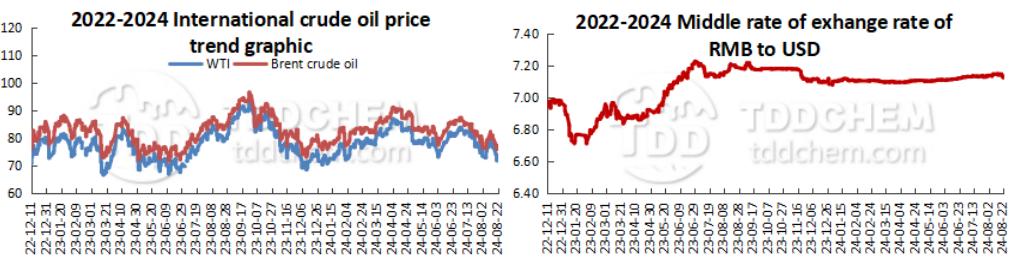

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The number of cruise voyages operating in August reached more than 30 voyages, and many companies have released new shipping routes

2. The kick-off meeting of the Sino-US Circular Economy Expert Dialogue was held in Beijing

3. A number of central enterprise index ETFs will issue ETF linkage funds, and fund companies will purchase at least 10 million by themselves

4. Hong Kong Airlines will resume direct flights between Hong Kong and Australia's Gold Coast, and explore returning to the North American market

5. Give full play to the function of the exchange bond market. The exploration and innovation of ABS for holding real estate continues to advance

International News

1. United States jobless claims rose last week

2. Global demand concerns intensify. Oil prices remained near January lows

3. Korea's total monthly production fell below 300,000 units for the first time in 23 months

4. ECB meeting minutes: September is the best time to decide whether to cut interest rates or not

5. The Federal Reserve is about to cut interest rates, and money market funds are still hot

Domestic News

1. The number of cruise voyages operating in August reached more than 30 voyages, and many companies have released new shipping routes

This summer, Shanghai's cruise tourism ushered in a peak. As of July 31, Shanghai Wusongkou International Cruise Port has operated a total of 94 voyages this year, and the number of cruise voyages operating in August reached more than 30. A number of cruise companies have released new global cruise routes, such as domestic cruise ships were increased from 2 nights and 3 days to 5 nights and 6 days cruise routes, expanding destinations from Japan and South Korea to many popular tourist destinations such as Hong Kong and Vietnam; International cruise ships have added inbound routes to China with destinations of China.

2. The kick-off meeting of the Sino-US Circular Economy Expert Dialogue was held in Beijing

On August 21, 2024, the Sino-U.S. Climate Action Working Group on Circular Economy held a kick-off meeting of the Sino-U.S. Circular Economy Expert Dialogue in Beijing. Zhao Chenxin, Vice Director of the National Development and Reform Commission and the Chinese Leaders of the Task Force, and Rick · Duke, Deputy Special Presidential Envoy for Climate United States, attended the meeting and delivered speeches. Zhao Chenxin said that the development of circular economy is of great significance to respond to climate change and achieve sustainable development, and the launch of the expert dialogue marks a new chapter in the exchange and cooperation of China-US circular economy, and hopes that the expert teams of both sides will deepen technical exchanges, serve policy dialogue, drive pragmatic cooperation, and make greater contributions to Sino-US climate cooperation and circular economy development. Rick · Duke said that he expects the expert teams of the two sides to strengthen communication and deepen research cooperation, and provide strong support for the Sino-US intergovernmental policy dialogue on circular economy.

3. A number of central enterprise index ETFs will issue ETF linkage funds, and fund companies will purchase at least 10 million by themselves

Today, a number of central enterprise index ETFs announced that they will issue ETF linkage funds, and all of them will be raised in the form of initiating funds, and the fund company will purchase at least 10 million yuan. According to the relevant announcement, the CSI Guoxin Hong Kong Stock Connect Central Enterprises Dividend ETF Initiator Fund will be issued from August 26 to September 10, and the Bosera CSI Guoxin Central Enterprises Modern Energy ETF Initiator Fund will be issued from August 26 to November 25, and both funds will issue A and C shares at the same time. Wind data shows that in recent years, central enterprise theme ETFs have been frequently launched. As of press time, there are 25 ETF products containing the word "central enterprise". Of these, more than half were established after 2023.

4. Hong Kong Airlines will resume direct flights between Hong Kong and Australia's Gold Coast, and explore returning to the North American market

Hong Kong Airlines announced that it will officially resume direct flights between Hong Kong and Australia's Gold Coast on 17 January 2025. Hong Kong Airlines Chairman Sun Jianfeng said the launch of the route marks the first step for Hong Kong Airlines to return to the long-haul market. Sun Jianfeng said that Hong Kong Airlines is gradually introducing more aircraft types to support the gradual expansion of its route network, including actively studying returning to the North American market and opening up routes such as Vancouver, Toronto, Los Angeles and Seattle.

5. Give full play to the function of the exchange bond market. The exploration and innovation of ABS for holding real estate continues to advance

Recently, CCB Housing Leasing Fund Holding Real Estate Asset-Backed Special Plan (hereinafter referred to as CCB Long-term Leasing ABS) was listed on the Shanghai Stock Exchange. The reporter learned that as the first property rights holding real estate ABS in the market, this product actively promoted investment and financing docking in the issuance stage, and carried out a number of mechanism exploration and innovation in secondary market transactions and liquidity support, forming a certain market demonstration effect. "In the product design of ABS for holding real estate, the liquidity support mechanism and the active mechanism of the secondary market focus on the investment side, and strive to provide a profitable and stable allocation category for patient capital in the field of real estate infrastructure." The relevant person in charge of the Shanghai Stock Exchange told reporters.

International News

1. United States jobless claims rose last week

Initial jobless claims in the United States increased last week, but still indicate that the gradual cooling of the labor market has not changed. Initial jobless claims rose by 4,000 to 232,000 in the week ended Aug. 17, data showed on Thursday, compared with market expectations of 230,000. The latest data should continue to ease concerns that the labor market is rapidly deteriorating, which first emerged after a sharp slowdown in employment growth in July. Fed officials said they were keeping a close eye on the labor market and realized that waiting too long for a rate cut could cause serious damage to the economy. Continuing claims for unemployment benefits rose by 4,000 to 1.863 million in the week ended Aug. 10.

2. Global demand concerns intensify. Oil prices remained near January lows

Oil prices held steady near their lowest close since January as concerns about a slowdown in the United States and a weaker outlook for the economy in 2025 outweighed the boost from falling inventories. United States job growth is likely to be much less robust than previous reports in the year to March, further suggesting that the world's largest consumer of crude oil is losing momentum. The recent plunge in oil prices comes against the backdrop of twin supply and demand concerns. OPEC+ will begin resuming supplies to the market in the next quarter, but the International Energy Agency (IEA) believes that inventories will increase next year even if the production increase plan is suspended. Harry Tchilingurian, head of research at Onyx Capital Group, said: "Markets are waiting for Powell's speech in Jackson Hole for hints on the Fed's next move. The Fed still has a tough task ahead of its dual mission, with inflation coming down but not on target, and labor market conditions worse than previously thought. ”

3. Korea's total monthly production fell below 300,000 units for the first time in 23 months

According to data released by the Korea Automotive and Mobility Industry Association (KAMA) on the 22nd, the total output of Korea domestic automakers in July was 290,910 units, down 17.6% from 352,972 units in the same period last year. Among them, the production of passenger cars decreased by 16.8% y/y to 269,942 units, and the production of commercial vehicles such as buses and trucks decreased by 26.2% y/y to 20,968 units. This is the first time that monthly production has fallen below 300,000 units this year, and it is also the first time in one year and 11 months since August 2022 (284,704 units) that it has fallen below 300,000 units.

4. ECB meeting minutes: September is the best time to decide whether to cut interest rates or not

The minutes of the ECB's July meeting, released on Thursday, showed that policymakers were in no hurry to cut interest rates at last month's meeting, believing that September was the next best time to review whether to cut rates. The ECB left interest rates unchanged last month and gave little hint at future policy moves, even as investors increasingly bet on policy easing on September 12. "The gradual easing of policy restrictions is a balancing move, as it is also important to avoid unduly damaging the economy by keeping interest rates at restrictive levels for too long," the minutes showed. "The September meeting is widely seen as a good time to reassess the level of monetary policy constraints," the ECB added. This meeting should be approached with an open mind. ”

5. The Federal Reserve is about to cut interest rates, and money market funds are still hot

Before the Fed began cutting interest rates, investors locked in high yields, pushing money market funds' assets to record highs. United States money market funds drew another $24.9 billion in the week ended Aug. 21, bringing inflows to about $106 billion this month, pushing total assets to an all-time high of $6.24 trillion, according to the latest data from the United States Investment Company Institute (ICI). High interest rates continue to attract money into these funds, despite traders betting that the Federal Reserve will start an easing cycle next month. While traders expect a rate cut of about 1 percentage point by the end of the year, Fed officials have said a gradual rate cut may be appropriate. Even if the Fed starts lowering interest rates, money market funds are likely to continue to gain popularity, as institutions such as institutional and corporate treasurers tend to outsource cash management during this time to reap the benefits rather than trying to figure it out themselves.

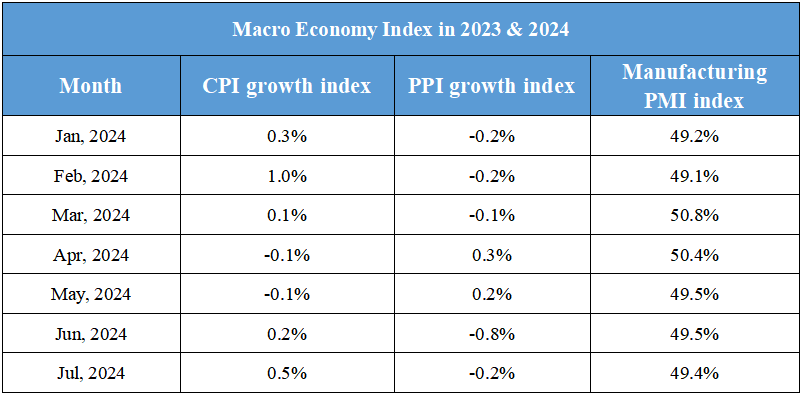

Domestic Macro Economy Index