On August 21st, Global Markets and Interest Rate Developments

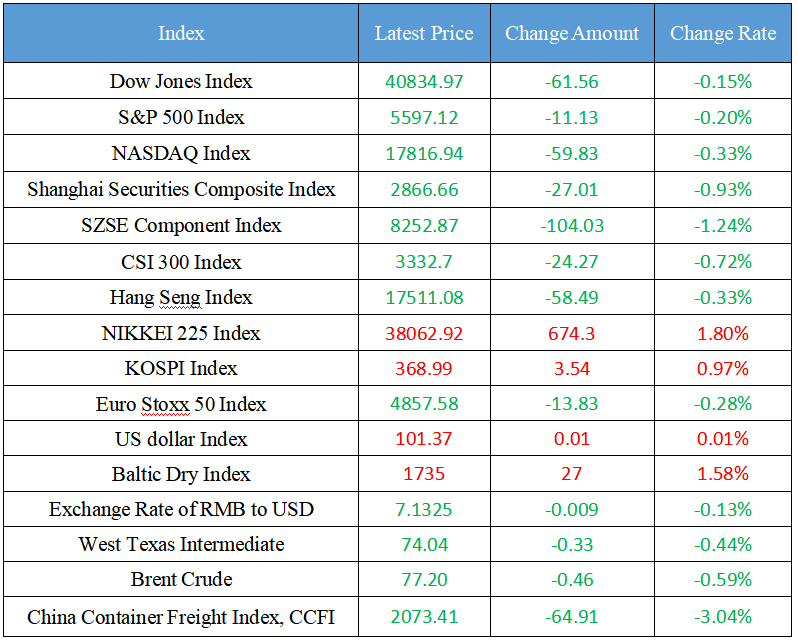

Latest Global Major Index

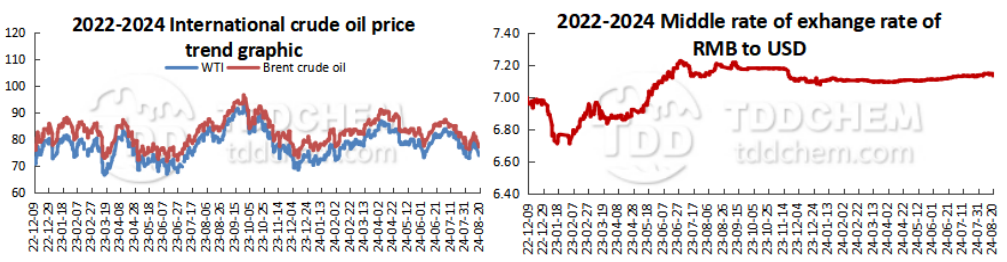

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Economic Daily: Deepen the market-oriented reform of interest rates

2. Sino-Ocean Group intends to adopt the "United Kingdom Restructuring Plan" to avoid liquidation, and it may become the first real estate company to be restructured in this way

3. The National Food and Material Reserve Work Promotion Conference was held in Beijing

4. The European Commission pre-disclosed the final ruling measures of the anti-subsidy investigation on China electric vehicles, and the Chinese Chamber of Commerce in the EU responded

5. New breakthroughs have been made in key equipment for liquid air energy storage in China

International News

1. The United States stock market ended its multi-day winning streak and closed lower, and the market paid attention to the central bank's annual meeting

2. The Fed's interest rate cut expectations continue to heat up. And many banks have lowered the interest rate of US dollar deposit products

3. Canada's inflation fell to a more than three-year low in July, supporting the central bank to cut interest rates again in September

4. United States stock index futures were basically flat, and the S&P 500 index took a break after rising for eight consecutive days

5. Panson Macro: Inflation easing is expected to cause the European Central Bank to cut interest rates in September

Domestic News

1. Economic Daily: Deepen the market-oriented reform of interest rates

According to the article, on the whole, the process of deepening the market-oriented reform of interest rates is gradual. To build a high-level socialist market economy system based on services, it is still necessary to continue to deepen the market-oriented reform of interest rates, eliminate unsuitable anti-competition policies, supervise and guide financial institutions to improve their market-oriented pricing capabilities, and better play the role of market mechanisms. Next, it is necessary to further improve the formation, regulation and transmission mechanism of market-oriented interest rates, enhance the authority of policy interest rates, study the appropriate narrowing of the width of the interest rate corridor, and send a clearer signal to the market on the target of interest rate regulation. At the same time, we should maintain the order of rational and orderly competition, smooth the channels for interest rate transmission, and create a good monetary and financial environment for the economic recovery and high-quality development.

2. Sino-Ocean Group intends to adopt the "United Kingdom Restructuring Plan" to avoid liquidation, and it may become the first real estate company to be restructured in this way

Recently, the overseas creditors of Sino-Ocean Group (03377.HK) published a full-page advertisement opposing Sino-Ocean's restructuring plan in the Hong Kong Economic Times. In order to avoid liquidation, Sino-Ocean Group tried to restructure through the "United Kingdom Restructuring Plan", that is, 75% of the creditors of a group agreed that Sino-Ocean Group could prove itself fair and optimal, and it was expected to obtain a judge's ruling that the restructuring plan would take effect, and there had already been successful cases of Hong Kong Airlines in Asia. Since the first cross-group binding case was introduced in 2021, the United Kingdom courts have repeatedly used their discretion to rule that restructuring cases are compulsory. At present, no real estate company has used this method for restructuring, and the successful Asian case is Hong Kong Airlines, which adopted the United Kingdom restructuring plan + Hong Kong scheme of arrangement to complete debt restructuring. If Sino-Ocean's restructuring is successful, it will become the first real estate company to be restructured in this way.

3. The National Food and Material Reserve Work Promotion Conference was held in Beijing

On the morning of August 20, the National Food and Material Reserve Work Promotion Conference was held in Beijing. The meeting emphasized that the food and material reserve system should thoroughly implement the decisions and arrangements of the Party Central Committee and the State Council, take further deepening the reform as a strong driving force, raise the benchmark, press ahead, grasp the key points, make breakthroughs, integrate the system, coordinate and link, better coordinate high-quality development and high-level security, and resolutely complete the goals and tasks of the development of the food and material reserves throughout the year.

4. The European Commission pre-disclosed the final ruling measures of the anti-subsidy investigation on China electric vehicles, and the Chinese Chamber of Commerce in the EU responded

Statement by the Chinese Chamber of Commerce in the European Union on the Commission's pre-disclosure of the final ruling measures of the anti-subsidy investigation on electric vehicles in China. The Chinese Chamber of Commerce in the EU noted that the European Commission pre-disclosed on August 20 the final measures of the anti-subsidy investigation on electric vehicles in China, proposing to impose countervailing duties on pure electric vehicles produced in China by China and the EU for a period of five years, ranging from 17% to a maximum of 36.3%. A 9% countervailing duty will be imposed on Tesla electric vehicles produced in China. The Chinese Chamber of Commerce in the EU expresses strong dissatisfaction and resolute opposition to the European Commission's trade protectionist approach. The Chinese Chamber of Commerce in the EU calls on EU institutions and EU member states to listen to the voices of the Chinese and European automotive industries, look at the development and market opportunities of China's electric vehicles in an objective and rational manner, and cancel the countervailing duty arrangements for electric vehicles made in China from the perspective of promoting free trade, respecting the development of globalization and helping the global green transition.

5. New breakthroughs have been made in key equipment for liquid air energy storage in China

Recently, the key equipment developed and produced by SBW Group for the 60MW liquid air energy storage demonstration project in Golmud, Qinghai Province - the horizontal split centrifugal compressor unit was successfully tested at one time, and the indicators of the mechanical operation test were better than the contract provisions and international standards, and were officially rolled off the assembly line under the witness of users. Qiang Tongbo, Chairman of China Green Development Qinghai Branch, said that the compressor units off the production line not only reached the international leading level in various technical indicators, but also reached 100% localization rate, which created favorable conditions for the project to be completed and connected to the grid at the end of the year, and also provided strong support for the promotion and sustainable development of China's liquid air energy storage industry.

International News

1. The United States stock market ended its multi-day winning streak and closed lower, and the market paid attention to the central bank's annual meeting

United States stocks closed slightly lower on Tuesday, ending a recent winning streak with little market-moving catalyst ahead of the Jackson Hole annual meeting of global central banks on Thursday. Chuck Carlson, CEO of Horizon Investment Services, said: "Last week was the best week for the stock market this year, and it can't help but wonder if the rally will continue. "But I don't think today is an indication of a change in the trend," he added, adding, "Investors take a break, and they're tired now after the carnival of the last few weeks." "Fed Chair Jerome Powell's speech on Friday will be scrutinized by market participants for hints on the number and timing of rate cuts this year and next. "The question is whether the rate cut will be 25 basis points or 50 basis points, and I think that's going to be the focus of a lot of interpretations," Carlson said. ”

2. The Fed's interest rate cut expectations continue to heat up. And many banks have lowered the interest rate of US dollar deposit products

Recently, the market's expectations for the Fed's interest rate cut in September have strengthened, and high-interest dollar deposits have also continued to attract attention. The reporter learned from the interview that although the Federal Reserve has not officially cut interest rates, some banks have lowered the interest rates on US dollar deposits; At the same time, the performance benchmark of individual US dollar wealth management products has also decreased compared with before. Industry participates suggest that the possibility of the Federal Reserve cutting interest rates is increasing, which means that the US dollar deposit rate will enter a downward channel in the later period.

3. Canada's inflation fell to a more than three-year low in July, supporting the central bank to cut interest rates again in September

Tuesday's data showed that Canada's CPI fell to a 40-month low of 2.5% in July, and the core CPI annual rate also slowed, which put the Bank of Canada on track for another rate cut in September. The slowdown in headline inflation in July was mainly driven by lower prices for tourism, passenger vehicles and electricity, the Bureau said. The current inflation rate is the closest to Canada's 2% target since March 2021, when it hit 2.2%. The Bank of Canada has previously decided to cut interest rates at two consecutive meetings, and monetary markets expect another 25 basis points cut on September 4. The Bank of Canada's preferred two underlying inflation measures – the median CPI and the CPI adjusted index – both slowed to their lowest levels since April 2021.

4. United States stock index futures were basically flat, and the S&P 500 index took a break after rising for eight consecutive days

United States stock index futures were generally flat, extending a strong move in the previous day as the market bets that the Federal Reserve will soon signal that it is ready to start cutting interest rates. After the S&P 500 strengthened for the eighth straight day on Monday, traders took a breather. Stock volume has declined, and investors are reluctant to bet big ahead of this week's Jackson Hole economic seminar. "What we've seen is that the recent flurry of data has eased concerns about a slowdown in United States economic growth, without raising fears of a renewed acceleration in inflation," said Kyle Rodda, senior market analyst at Capital.Com Inc.

5. Panson Macro: Inflation easing is expected to cause the European Central Bank to cut interest rates in September

Claus Vistesen of Panson Macro wrote in the note that inflation in the eurozone should ease in the future, allowing the ECB to cut interest rates again in September. Data showed on Tuesday that consumer prices in the eurozone rose 2.6% last month, slightly higher than in the previous month, largely due to the energy base effect. But energy inflation should ease in the coming months, bringing headline inflation closer to the ECB's 2% target, Vistesen said, "which should help with a rate cut in September." ”

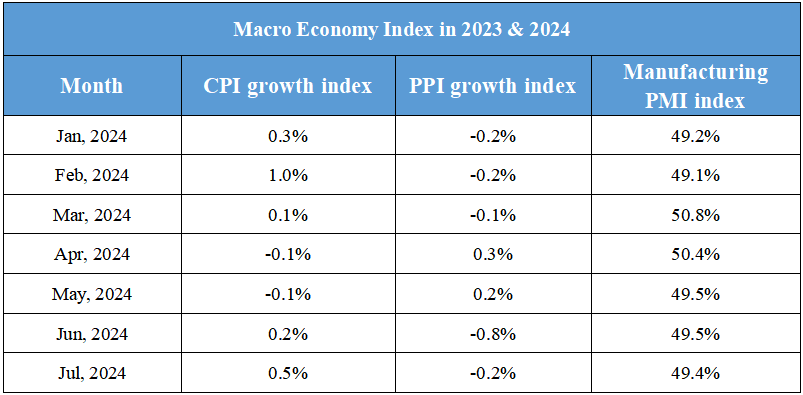

Domestic Macro Economy Index