November 13th Macroeconomic Index: China's Innovation Index Rises, Railway Passenger Numbers Hit Record High

Daily Macro Economy News

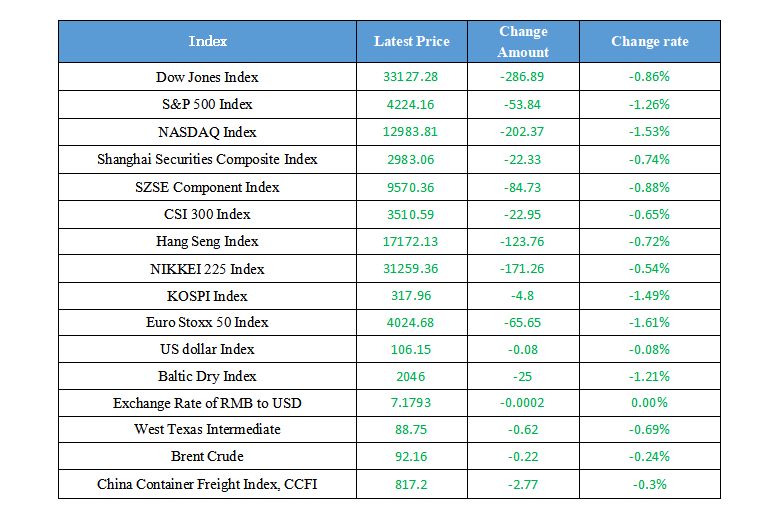

Latest Global Major Index

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. China's Innovation Index in 2022 increased by 5.9% over the previous year

2. The General Administration of Customs: From November 1, the filing of enterprises in the origin of export goods will be canceled

3. In the third quarter of 2023, the national railway hold 1.15 billion passengers, and a number of transportation indicators hit a record high

4. China Federation of Logistics and Purchasing(CFLP): logistics infrastructure has begun to take shape, and the construction of a modern logistics system has been accelerated

International News

1. The U.S. government is chasing oil prices at a high level! Strategic oil reserves will be replenished at no more than $79

2. Powell: U.S. inflation is still too high, and additional evidence of a strong economy may support interest rate hikes, but caution should be exercised

3. Brazil plans to launch a currency hedging tool to attract foreign direct investment within the year

4. Goldman Sachs: It is expected that the sell-off in U.S. Treasury bonds will end in the fourth quarter as oil prices rise

Domestic News

1. China's Innovation Index in 2022 increased by 5.9% over the previous year

National Bureau of Statistics: The result showed that taking 2015 as the base period, China's Innovation Index in 2022 was 155.7, and the four sub-sectors innovation index: innovation environment index, innovation input index, innovation output index and innovation effectiveness index was 160.4, 146.7, 187.5 and 128.2 respectively. Compared with 2015, China's innovation index grew at an average annual rate of 6.5 percent, 0.8 percentage points faster than the growth rate of gross domestic product (GDP) in the same period, and the average annual growth rate of the four sub-sectors was 7.0%, 5.6%, 9.4% and 3.6% respectively. Compared with 2021, the China Innovation Index increased by 5.9%, and the index in the four sub-sectors increased by 5.7%, 7.0%, 9.2% and 0.7% respectively.

2. The General Administration of Customs: From November 1, the filing of enterprises in the origin of export goods will be canceled

To further optimize the business environment for cross-border trade and enhance trade facilitation, the General Administration of Customs has decided to cancel the filing of enterprises in the origin of export goods from November 1, 2023, and applicants for certificates of origin can apply for certificates of origin directly through the "single window" for international trade, Internet + Customs, and the declaration system of the China Council for the Promotion of International Trade.

3. In the third quarter of 2023, the national railway hold 1.15 billion passengers, and a number of transportation indicators hit a record high

It was learned from China State Railway Group Co., Ltd. that in the third quarter, the national railway hold 1.15 billion passengers, an increase of 11.6% over the same period in 2019. On September 22, the railway app 12306 sold 26.952 million tickets, and on September 29, 20.098 million passengers were hold, and the number of single-day tickets and single-day passengers reached a record high, and the railway transportation was safe and orderly.

4. China Federation of Logistics and Purchasing(CFLP): logistics infrastructure has begun to take shape, and the construction of a modern logistics system has been accelerated

The relevant person in charge of the China Federation of Logistics and Purchasing introduced today at the 2023 China (Guangyuan) Logistics Industry Development Conference that China is accelerating the construction of a logistics operation system of "channel + hub + network", and the logistics infrastructure is beginning to take shape, and a number of hub economic demonstration zones are emerging, becoming a new growth pole of the regional economy. According to reports, up to now, there have been 5 batches of 125 national logistics hubs, 3 batches of 66 national backbone cold chain logistics bases, and 4 batches of 116 multimodal transport demonstration projects have been included in the scope of government support projects. China has initially formed a modern logistics operation system.

International News

1. The U.S. government is chasing oil prices at a high level! Strategic oil reserves will be replenished at no more than $79

The U.S. seeks to purchase 6 million barrels of crude oil by January 2024 to backfill the SPR, with the price of the purchased crude oil capped at $79/bbl. The United States will continue to backfill the SPR until at least May 2024. The U.S. Department of Energy said on Thursday local time that the Biden administration wants to buy 6 million barrels of crude oil for delivery in December this year and January next year to replenish the Strategic Petroleum Reserve. The latest plan caps the price of crude oil at $79 per barrel, which is a significant increase from the $70 target earlier this year, but significantly lower than the current crude futures price that around $90.

2. Powell: U.S. inflation is still too high, and additional evidence of a strong economy may support interest rate hikes, but caution should be exercised

Powell stated that the U.S. inflation has cooled down this summer, "which is a very favorable development", and the nominal PCE (personal consumption expenditures price index)was expected to increase by 3.5% year-on-year in September, which was unchanged from the previous value and halved from the peak of 7.1% in June 2022; Core PCE was expected to rise 3.7% year-on-year in September, down from 3.9% in August and lower than the peak of 5.6% in February last year. The relevant data will be released next week. He believed that the progress in inflation was related to both the easing of supply disruptions in the post-pandemic era and the cooling of strong demand from the 18-month aggressive interest rate hike cycle that began in March last year. But he warned that inflation could continue its downward trend in September, "though not very encouraging". Speaking about monetary policy, Powell reiterated that the Fed was "committed to a policy stance that is sufficiently restrictive to fully economic growth" and to keeping policy restrictive until it was confident that inflation is sustainably coming down to 2% target. But at the same time, he maintained a seemingly neutral position, but in fact somewhat ambiguous attitude.

3. Brazil plans to launch a currency hedging tool to attract foreign direct investment within the year

Brazilian Finance Minister Haddad stated that the Brazilian government is preparing to launch currency hedging tools this year to attract more long-term overseas investment and reverse the decline in foreign direct investment (FDI). He revealed that the government is currently working with the Central Bank to finalize the plan, which should be launched within the next 60 days.

4. Goldman Sachs: It is expected that the sell-off in U.S. Treasury bonds will end in the fourth quarter as oil prices rise

Goldman Sachs strategists reported that higher oil prices and the resumption of student loan repayments will lead to a slowdown in the U.S. economy for the rest time of the year, which could push the yield of the benchmark 10-year Treasury lower. Goldman Sachs noted that the yield on the 10-year Treasury was close to 5%, well above the fair value of 4.2% to 4.3%. The agency also said Treasury prices are likely to rebound as the economy hits a "pothole" in the fourth quarter.

Domestic Macro Economy Index