September 19th Macroeconomic Index: China's Foreign Exchange Reserves Decrease, Domestic Economic Policies Strengthen

Daily Macro Economy News

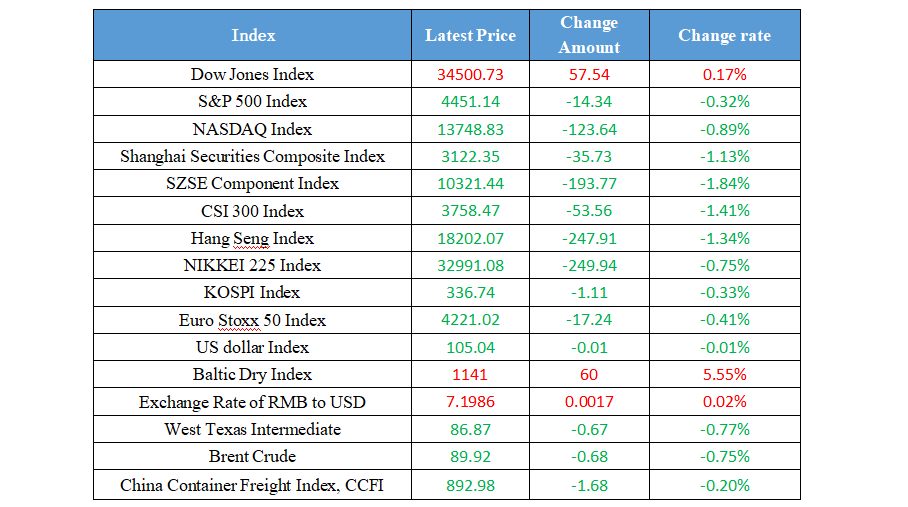

Latest Global Major Index

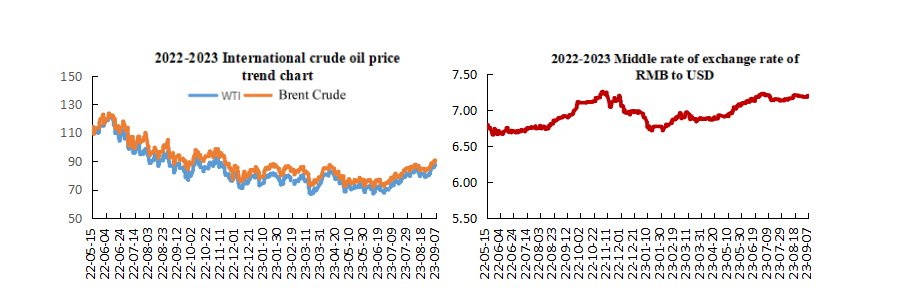

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Shanghai Introduces Housing Provident Fund Support for Urban Renewal Policy

2. The Bank of Communications issued an announcement on matters related to reducing the interest rate of the first set of existing housing loans

3. State Administration of Foreign Exchange: As of the end of August 2023, the scale of China's foreign exchange reserves is 3.1601 trillion US dollars

4. The State Administration of Taxation: From January to July this year, the newly added policies of tax and fee reduction and tax refund and deferred payment have covered 1.05 trillion yuan nationwide

International News

1. The US dollar climbed to a six-month high, while US stock index futures fell

2. Due to a decline in exports, the GDP of the Eurozone in the second quarter showed almost no growth

3. JP Morgan: Investors' allocation of gold has reached its highest level since 2012

4. The economic crisis lingers, and industrial production in Germany has been declining for the third month in a row

Domestic News

1. Shanghai Introduces Housing Provident Fund Support for Urban Renewal Policy

The 69th plenary meeting of the Shanghai Housing Provident Fund Management Committee reviewed and approved the "Notice on Adjusting the Maximum Loan Term for Purchasing Existing Housing with Housing Provident Fund in the City" and the "Notice on Housing Provident Fund Support for Urban Renewal Policies in the City". Among them, it is clear that the implementation of housing provident fund support policies for old housing renovation projects included in the scope of urban renewal in this city, which mainly includes three aspects: firstly, support for the withdrawal of housing provident fund after the purchase of renovation housing; Secondly, support the extraction of rental housing provident fund during the project construction period; Thirdly, expand the scope of applicants for extraction.

2. The Bank of Communications issued an announcement on matters related to reducing the interest rate of the first set of existing housing loans

Floating rate loans issued from October 8, 2019 (inclusive) to May 14, 2022 (inclusive) with LPR pricing will be adjusted to the lower limit of the national first home loan interest rate policy, which means that the corresponding term LPR will not be added; If the lower limit of the first home loan interest rate in the city where the original loan was issued is higher than the LPR, the lower limit of the first home loan interest rate in the city where the original loan was issued shall be implemented, and the contract interest rate shall be implemented according to the corresponding LPR increase point.

3. State Administration of Foreign Exchange: As of the end of August 2023, the scale of China's foreign exchange reserves is 3.1601 trillion US dollars

According to statistics from the State Administration of Foreign Exchange, as of the end of August 2023, the scale of China's foreign exchange reserves was $3.1601 trillion, a decrease of $44.2 billion or 1.38% compared to the end of July. In August 2023, affected by factors such as macroeconomic data and monetary policy expectations from major economies, the US dollar index rose and global financial asset prices declined overall. The combined effects of exchange rate translation and changes in asset prices have led to a decrease in the size of foreign exchange reserves for the month. China's economy has maintained a rebound and positive trend, with strong economic resilience, great potential, and abundant vitality. The long-term positive fundamentals have not changed, which is conducive to maintaining basic stability in the size of foreign exchange reserves.

4. The State Administration of Taxation: From January to July this year, the newly added policies of tax and fee reduction and tax refund and deferred payment have covered 1.05 trillion yuan nationwide

Luo Tianshu, chief accountant of the State Administration of Taxation, said at the regular briefing on the State Council's policies that according to statistics, from January to July this year, the newly added policies of tax and fee reduction and tax refund and deferred payment have covered 1.05 trillion yuan nationwide. Recently, together with the Ministry of Finance, we issue the "Guidelines for Preferential Tax Policies to support the development of Small and Micro Enterprises and Individual Industrial and Commercial Enterprises (1.0)", which centralizes policies and provides a clear interpretation of them to facilitate the timely understanding and search for various taxpayers. At the same time, a number of private enterprise tax service stations are promoting the establishment, and the policy of not collecting withholding income tax for the reinvestment of domestic distribution profits by foreign investors is implemented in an orderly manner. A series of measures to benefit enterprises and facilitate the people have been implemented in a timely, accurate and effective manner to better serve the development and growth of the private economy.

International News

1. The US dollar climbed to a six-month high, while US stock index futures fell

As investors increase their bets on further tightening policies by the Federal Reserve, US stock index futures have slightly declined. While the European stock market regained ground, rising slightly by 0.2% after six consecutive days of decline. After Germany's industrial output fell again in July, the European Stoxx 600 index opened lower, but as utilities and construction stocks rose, the index also regained ground during the trading day. The US dollar continued its rise, reaching a 6-month high, and investors focused on the strong economic growth prospects of the United States. On Wednesday, the United States released data on ISM service sector activity that exceeded expectations.

2. Due to a decline in exports, the GDP of the Eurozone in the second quarter showed almost no growth

The eurozone economy showed almost no growth in the second quarter as new data showed sluggish export performance, forcing the overall growth figures in the region to be revised downwards. In the three months to June, the eurozone GDP grew by only 0.1%, while the previous data is 0.3%. The report on Thursday will provide stronger evidence of the continued weakness of the eurozone economy for European Central Bank policymakers. Prior to this, there were concerns at the July meeting that stagflation may continue, and new data may make this outlook even more ominous.

3. JP Morgan: Investors' allocation of gold has reached its highest level since 2012

JP Morgan analysts Nikolaos Panigrtzoglou and others stated in their report that driven by Central Bank purchases, gold investment has grown over the past year, and the overall implied allocation of gold of non-bank investors has reached its highest level since the end of 2012. In fact, since the outbreak of the epidemic, the implied gold allocation has been on the rise. Compared to the historical standards, this proportion seems quite high. Analysts pointed out that people need to assume that the structural growth in the demand of the Central Bank exceeds historical standards (due to concerns about sanctions or about diversifying investment from G7 government bonds) in order to be bullish on gold. But this is currently being challenged as evidence suggests that the Central Bank will normalize gold purchases in the second quarter of 2023, and it remains to be seen whether this is temporary. Undoubtedly, the speed at which Central Bank purchase gold is now the most important factor in measuring the future trend of gold prices.

4. The economic crisis lingers, and industrial production in Germany has been declining for the third month in a row

Germany's industrial output fell again in July, further dragging down the growth of Europe's largest economy and casting a shadow over the start of the third quarter. According to data from the Bureau of Statistics, the production has decreased by 0.8% compared to June. Due to sluggish demand, worker shortages, rising interest rates, and the lingering aftermath of last year's energy crisis, German factories are experiencing long-term weakness. This has put pressure on the overall economy, and it is expected that the German will be the only country in the G7 to experience economy contraction this year. Analysts from the Kiel Institute predicted on Wednesday that after experiencing a winter recession and three months of economic stagnation until June, the German economy will decline again this quarter. On the day before the decline in output in Germany, data in July showed the largest decline in orders from factories in the country since the pandemic in 2020.

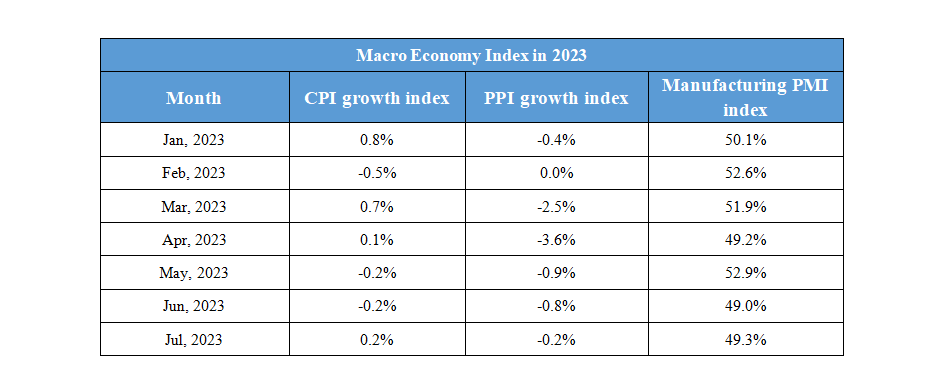

Domestic Macro Economy Index