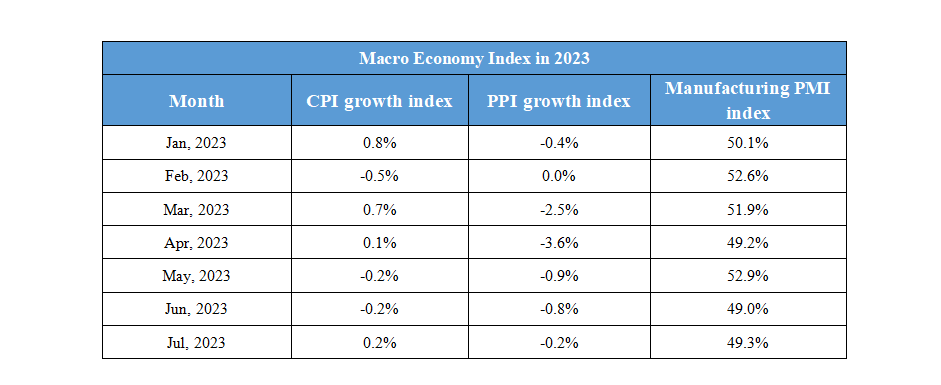

September 11th Macroeconomic Index: Global Manufacturing PMI Rebounds, German Factory Orders Plunge

Daily Macro Economy News

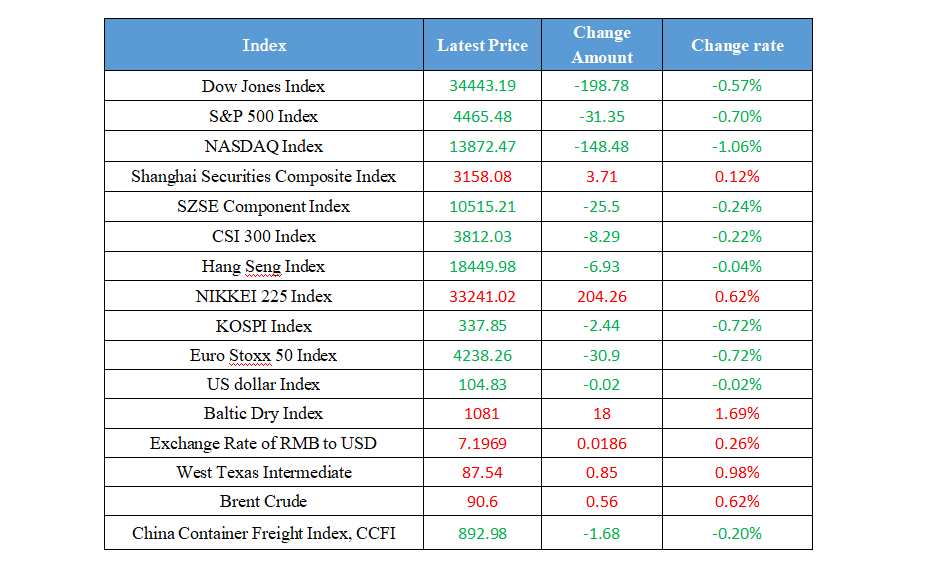

Latest Global Major Index

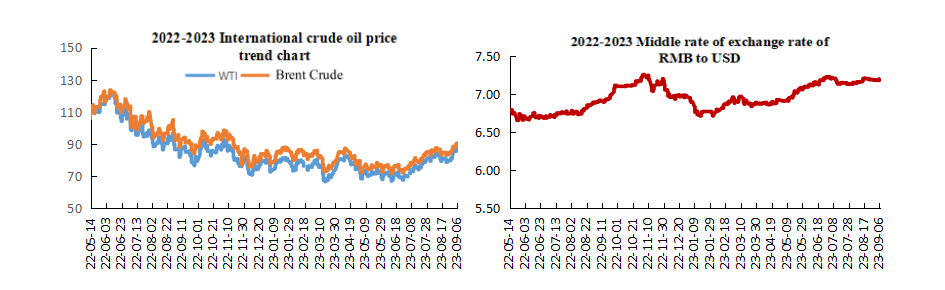

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The Task Force on Promoting Stock Market Liquidity is reported to meet in the afternoon or discuss relaxing the listing threshold

2. Zhuhai officially announced "recognizing the house but not the loan"

3. A-share closing review: The Shanghai Securities Composite Index rose 0.12%, and the concept of lithography surged

4. People's Daily: Timely Adjustment and Optimization of Real Estate Policies

International News

1. German factory orders fell 11.7% in the third quarter, jokingly referred to as the "sick man of Europe"

2. The Philippine Central Bank says it is prepared to resume tightening monetary policy if necessary

3. Global Manufacturing Purchasing Managers Index rebounded slightly from its low point in August, and global economic weakness was repaired

4. Institutional analysis: OPEC+ production reduction may ease core inflation

Domestic News

1. The Task Force on Promoting Stock Market Liquidity is reported to meet in the afternoon or discuss relaxing the listing threshold

According to source information quoted by Hong Kong media, the task force held its first meeting on Wednesday (6th) afternoon to conduct a comprehensive review of the liquidity of the Hong Kong stock market. The report indicates that the task force may consider relaxing the listing threshold and other proposals, as the Hong Kong Stock Exchange currently has the most stringent profit earning requirements for listing applicants compared to other regions around the world. The report also stated that the task force will discuss issues such as market trading volume, attracting IPO to Hong Kong, and and cutting stamp duty on stock transactions.

2. Zhuhai officially announced "recognizing the house but not the loan"

The notice on the recognition standard for the number of housing units in personal housing loans in Zhuhai is as follows: When a resident family (including the borrower, spouse, and underage children, the same below) applies for a loan to purchase commercial housing, if the family members do not have a complete set of housing under their names in our city, regardless of whether they have applied for the loan to purchase housing, banking and financial institutions will implement the housing credit policy for the first set of housing. This notice shall take effect at zero o’clock from the date of issuance, and if the original policy is inconsistent with this notice, this notice shall prevail. Before the implementation of this notice, and the personal housing credit policy shall be implemented according to the original regulations if the online signing and filing of commercial housing sales contracts or stock housing sales contracts have been completed.

3. A-share closing review: The Shanghai Securities Composite Index rose 0.12%, and the concept of lithography surged

The three major indices opened slightly lower, followed by a narrow and volatile trend. The Shanghai Composite Index bottomed out and rebounded to turn red, while the Growth Enterprise Index fell more than 1% during the session before narrowing its decline. As of the close, the Shanghai Composite Index rose 0.12%, the Shenzhen Composite Index fell 0.24%, and the Growth Enterprise Index fell 0.47%. On the market, sectors such as photoresists, semiconductors, components, and Huawei concept stocks saw the highest gains, while sectors such as transportation services, the internet, and media and entertainment saw the highest declines.

4. People's Daily: Timely Adjustment and Optimization of Real Estate Policies

According to an article published today by the People's Daily, in order to adapt to the new situation of significant changes in the supply and demand relationship in China's real estate market, recently, multiple regions and departments have issued articles frequently to adjust and optimize real estate policies in a timely manner in order to better meet the rigid and improved housing needs of residents and also have a beneficial impact on expanding consumption, driving investment and stabilizing economic growth. The interviewed experts stated that the current timely adjustment and optimization of real estate policies have opened up the market expectation window, and in the short term, both rigid and improving demand will be concentrated in the market. There may be a significant increase in market transaction volume before the end of the year. However, overall, the supply and demand relationship in the real estate market has undergone significant changes and is greatly affected by the macro environment, so it is necessary to view the development of the real estate market with a more rational attitude, which requires both confidence and patience.

International News

1. German factory orders fell 11.7% in the third quarter, jokingly referred to as the "sick man of Europe"

German factory orders significantly decreased in July, indicating that the difficulties of Europe's largest economy continued into the third quarter. Compared to June, the demand decreased by 11.7%, far below expectations, which is due to bulk orders, and if there were no bulk orders, the indicator would increase by 0.3%. Due to poor demand in Asia, the German manufacturing data scheduled for Thursday may also show sustained weakness, with economists' median forecasts expected to shrink for the third consecutive month. Previously, when asked about the nickname 'European Sick Man', the Bundesbank President Joachim Negl admitted that the current situation in Germany is not good.

2. The Philippine Central Bank says it is prepared to resume tightening monetary policy if necessary

The Philippine Central Bank says it is prepared to resume tightening monetary policy if necessary to maintain stable inflation expectations. Previously released data showed that inflation in the Philippines accelerated in August, suspending the previous six-month slowdown. The Philippine Central Bank will continue to remain vigilant, monitor new risks to the inflation outlook, and be prepared to resume tightening monetary policy to prevent second-order effect and maintain stable inflation expectations, "the Philippine Central Bank said in a report late Tuesday. The latest inflation data still aligns with the Central Bank's assessment that "the inflation rate is likely to approach the target range by the fourth quarter of 2023 in the absence of further supply shocks".

3. Global Manufacturing Purchasing Managers Index rebounded slightly from its low point in August, and global economic weakness was repaired

The China Federation of Logistics and Purchasing announced today (6th) the Global Manufacturing Purchasing Managers Index for August. The changes in the index indicate that the global manufacturing purchasing managers index rebounded in August compared to the previous month, but it is still at a lower level, and the global economy is showing a weak recovery trend. The global manufacturing purchasing managers index in August was 48.3%, an increase of 0.4 percentage points compared to the previous month. Although it has been rising for two consecutive months, the index is still at a relatively low level of around 48%. The global economy is showing a weak recovery trend, and the overall tightening environment has not changed. The pressure of demand contraction still exists.

4. Institutional analysis: OPEC+ production reduction may ease core inflation

Joseph Sykora, an analyst at Aptus Capital Consulting, said that although Saudi Arabia and Russia announced extended production cuts on Tuesday, leading to an immediate increase in oil and fuel prices, this may actually limit consumers' ability to purchase products other than fuel and other essential items, thereby suppressing core inflation. Obviously, the rise in energy prices has brought upward pressure on CPI. However, to some extent, the rise in energy costs poses a headwind to a broader economic growth, and they may cause some minor downward pressure on core CPI, "Sykora said in an email. For energy bulls, OPEC cooperation to reduce supply is certainly a good thing, but it would be even better if price pressure comes from the surge in terminal demand.

Domestic Macro Economy Index