September 6th Macroeconomic Index: Local Bond Issuance Surges, PBC Studies Housing Loan Rates, and MIIT Enhances SME Financing

Daily Macro Economy News

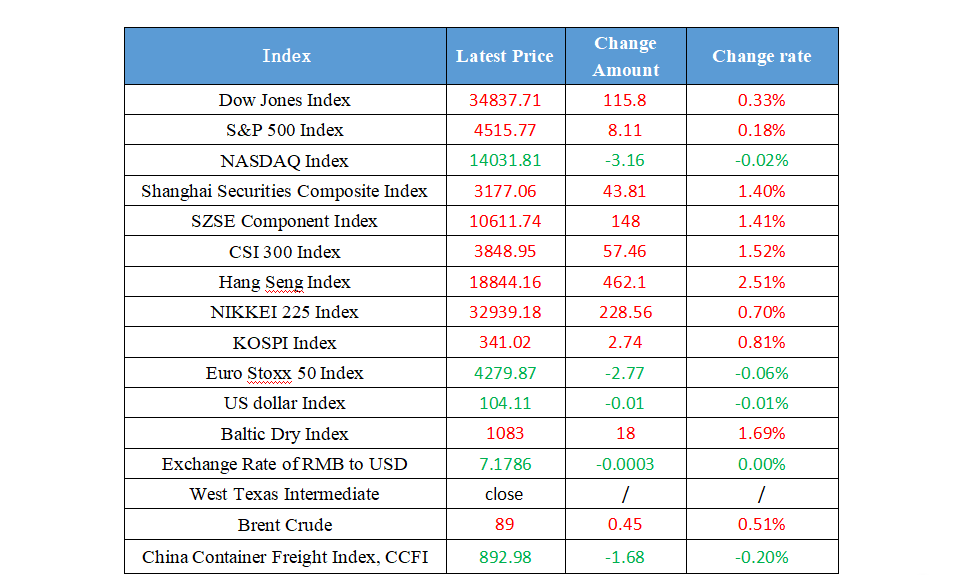

Latest Global Major Index

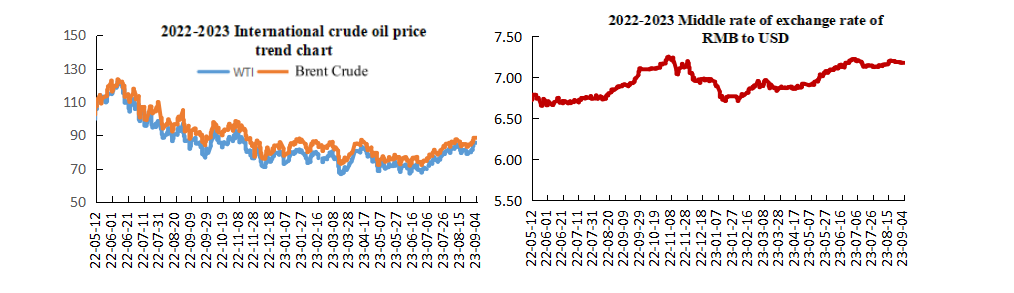

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The issuance scale of local bonds in August reached a new high of approximately 1.3 trillion yuan within the year

2. The Beijing Branch of the PBC is currently studying the adjustment plan for the interest rate of existing housing loans before the LPR reform, which will be announced to the public before September 25th

3. Ministry of Industry and Information Technology: Strengthen cooperation with the financial sectors and broaden financing channels for enterprises

4. The National Development and Reform Commission will accelerate the issuance of supporting policies proposed in the "Opinions on Promoting the Development and Growth of Private Economy" by relevant parties as soon as possible

International News

1. JP Morgan: Downward risks to Australia's GDP growth in the second quarter are accumulating

2. CICC: It is expected that the excess savings of US residents will be exhausted in Q2 next year

3. NatWest Group: The eurozone economy is almost stagnant, and the European Central Bank is expected to suspend interest rate hikes at its September meeting

4. British media: The London Stock Exchange has formulated a blockchain-based digital asset business plan

Domestic News

1. The issuance scale of local bonds in August reached a new high of approximately 1.3 trillion yuan within the year

In order to better leverage the stable economic growth effect of investment, the central government has requested local governments to accelerate the issuance of bonds. In August, local government bond issuance reached its peak within the year. According to public bond issuance data, the issuance scale of local government bonds nationwide in August this year was about 1.3 trillion yuan, reaching a new high for the year, mainly due to a significant acceleration in the issuance of new special bonds. In the first eight months of this year, the issuance scale of local government bonds nationwide was about 6.3 trillion yuan, a slight increase (3%) compared to the same period last year, setting a new historical high for the same period.

2. The Beijing Branch of the PBC is currently studying the adjustment plan for the interest rate of existing housing loans before the LPR reform, which will be announced to the public before September 25th

The reporter learned from relevant insiders at the Beijing branch of the the PBC that before the LPR reform, the minimum limit of interest rates for various banks in Beijing was not completely unified. Some banks with concentrated mortgage business may have higher minimum limit interest rates than other banks. How to handle this inconsistency between different banks is still under research, but it will be announced to the public before September 25th.

3. Ministry of Industry and Information Technology: Strengthen cooperation with the financial sectors and broaden financing channels for enterprises

Xu Xiaolan, Deputy Minister of Industry and Information Technology, stated at the press conference that the next step will be to strengthen the precise supply of services. Establish a national network of small and medium-sized enterprise services that connects the national, provincial, municipal, and county public service systems, widely gathering information on policies and services for small and medium-sized enterprises so as to achieve precise match with small and medium-sized enterprises. Implement financing promotion activities, carry out investment and financing docking activities, strengthen cooperation with financial departments, and broaden financing channels for enterprises. We will also focus on cultivating high-quality enterprises, especially focusing on specialized enterprises, excellent and refined enterprises and innovative enterprises to promote the high-quality development of private small and medium-sized enterprises.

4. The National Development and Reform Commission will accelerate the issuance of supporting policies proposed in the "Opinions on Promoting the Development and Growth of Private Economy" by relevant parties as soon as possible

Cong Liang, deputy Director of the National Development and Reform Commission, stated at the press conference that a series of necessary supporting policies were proposed on “Opinions on promoting the development and growth of private economy”. And the division of labor plan clarified the responsible units and proposed time limits, so we will step up efforts to promote the relevant parties to introduce a series of supporting policies as soon as possible.

International News

1. JP Morgan: Downward risks to Australia's GDP growth in the second quarter are accumulating

Economists are considering lowering their forecasts for Australia's second quarter GDP after both the inventory growth and company profit data are weaker than the expectation. Australia's inventory decreased by 1.9% in the second quarter, while corporate profits decreased by 13% during the same period. Both of the results disappointed market expectation. Profits are generally weak, and it has caused severe impact on the mining and hotel industries. Tom Kenya, the senior economist of JP Morgan, pointed out that he is now less optimistic about the Q2 GDP data released on Wednesday, and has lowered the bank’s quarterly growth forecast by two tenths to 0.3%.

2. CICC: It is expected that the excess savings of US residents will be exhausted in Q2 next year

CICC Research reported that the San Francisco Federal Reserve's calculation results show that the excess savings of US residents will be exhausted by 3Q 2023. However, following the calculation method of Aladangady et al., the current cumulative size of excess savings is 770 billion US dollars, and it will be completely depleted by 2Q 2024. Structurally, low-income groups "can't make ends meet", and their excess savings have been depleted by the end of last year; The income and expenditure of the middle-income group are basically stable, so there is still a large amount of excess savings retained; The acceleration of excessive savings consumption among high-income individuals is driven by lower income growth rates and increased consumer spending. The support of excess savings for consumption will gradually weaken, and the general direction will still slow down in the future.

3. NatWest Group: The eurozone economy is almost stagnant, and the European Central Bank is expected to suspend interest rate hikes at its September meeting

The National Westminster Bank(NatWest Group) of the UK stated that the European Central Bank is currently in a "data dependency mode", but the data released since the last meeting has been mixed. The bank still expects the ECB to suspend interest rate hikes at its next meeting, but acknowledges the possibility of "raising interest rates by another 25 basis points and then ending the rate hike cycle". The GDP of the eurozone has almost stagnated in recent quarters, and it seems that the third quarter will maintain this state or even worse. With the release of September data, it is expected that both the overall and core inflation rates in the eurozone will significantly decrease. Although this is too late for the interest rate resolution on September 14th, it indicates that regardless of the September decision, there will be no interest rate adjustment at the October meeting.

4. British media: The London Stock Exchange has formulated a blockchain-based digital asset business plan

According to the Financial Times, the London Stock Exchange has developed a new digital markets business plan, saying it will make it the first major exchange to offer extensive trading of traditional financial assets on blockchain technology. Ross, the group's head of capital markets, said the London Stock Exchange had been researching the potential of blockchain-powered trading venues for about a year and had now reached a turning point in deciding to advance the plan. Ross stressed that exchanges are definitely not building anything around asset encryption, but rather want to use the technology underpinning popular tokens like Bitcoin to improve the efficiency of purchasing, selling, and holding traditional assets. BlackRock CEO Fink said earlier this year that the next-generation market is characterized by the tokenization of assets.

Domestic Macro Economy Index