Global Economic Highlights on May 21st

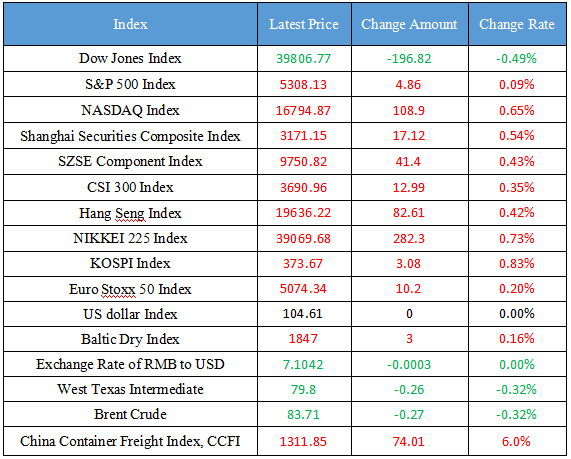

Latest Global Major Index

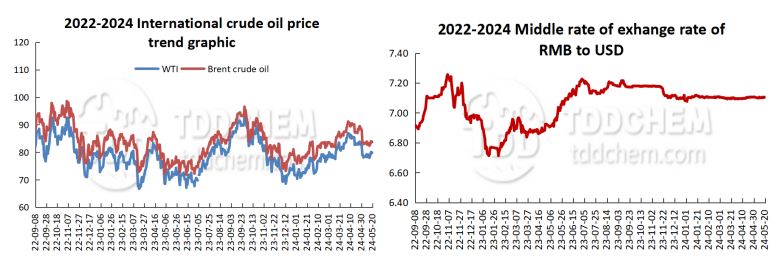

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. National Data Bureau: In 2027, the digital transformation of cities across the country will achieve remarkable results

2. The Shanghai Exchange held a symposium on the high-quality development of steel futures

3. China Shipbuilding Industry Association: In the first quarter of 2024, the three major indicators of China's shipbuilding grew simultaneously

4. Shanghai Gold Exchange: Adjust the margin ratio and price limit of some contracts

5. Positive factors appear, and the real estate sector rose again

International News

1. Short-covering in the U.S. natural gas market is likely to continue

2. Shipping prices change every week, and the supply and demand pattern of shipping is expected to turn around in the fourth quarter

3. ING: UK services inflation in April may be stronger than expected

4. Deputy Governor of the Bank of England: The UK may cut interest rates this summer

5. Oil prices rose but still fluctuated in a narrow range

Domestic News

1. National Data Bureau: In 2027, the digital transformation of cities across the country will achieve remarkable results

The National Data Bureau held a special press conference this afternoon to introduce the "Guiding Opinions on Deepening the Development of Smart Cities and Promoting the Digital Transformation of Cities". Wu Xiaoning, Director of the Department of Digital Economy of the National Data Bureau, introduced that the goal of promoting the digital transformation of cities is that by 2027, the digital transformation of cities across the country will achieve remarkable results, and a number of livable, resilient and smart cities with their own characteristics will be formed to strongly support the construction of digital China. By 2030, the digital transformation of cities across the country will make a comprehensive breakthrough, the people's sense of gain, happiness and security will be comprehensively improved, and a number of Chinese-style modern cities with global competitiveness in the era of digital civilization will emerge. (Beijing News).

2. The Shanghai Exchange held a symposium on the high-quality development of steel futures

On May 20, the opinions of relevant enterprises at the symposium mainly focused on three aspects, one is to improve the efficiency of risk management and delivery, and solve the problem of contract discontinuity. The second is to optimize the delivery mechanism, and the layout of the delivery warehouse and the regional discount mechanism are further close to the market. The third is to improve the hedging system guarantee of iron and steel enterprises, continue to strengthen the education and training of basic futures knowledge and hedging accounting, and cultivate futures professionals. On the basis of fully considering the opinions and needs of all parties, the Shanghai Futures Exchange will continue to optimize the trading and delivery mechanism, enhance the continuity of contracts, and further facilitate the participation of entities in the hedging and delivery of steel futures. In terms of optimizing delivery resources, we will steadily expand the registration of delivery brands and study and promote the registration of group brands. In terms of facilitating delivery and reducing delivery costs, the regional layout of delivery warehouses will be optimized, and further research will be carried out to reduce delivery costs.

3. China Shipbuilding Industry Association: In the first quarter of 2024, the three major indicators of China's shipbuilding grew simultaneously

From January to March 2024, the national shipbuilding completion volume was 12.35 million deadweight tons, a year-on-year increase of 34.7%; the number of new orders was 24.14 million deadweight tons, a year-on-year increase of 59.0%; As of the end of March, the hand-held order volume was 154.04 million deadweight tons, a year-on-year increase of 34.5%. From January to March, China's shipbuilding completions, new orders and hand-held orders accounted for 53.8%, 69.6% and 56.7% of the global total in terms of deadweight tonnage, respectively. China's 6, 5 and 6 enterprises have entered the top 10 in the global shipbuilding completion, new orders and hand-held orders respectively.

4. Shanghai Gold Exchange: Adjust the margin ratio and price limit of some contracts

According to the announcement of the Shanghai Gold Exchange, starting from the closing of the liquidation on May 21, 2024 (Tuesday), the margin ratio of Au (T+D), mAu (T+D), Au (T+N1), Au (T+N2), NYAuTN06, NYAuTN12 and other contracts will be adjusted from 9% to 10%, and the limit of the rise and fall from the next trading day will be adjusted from 8% to 9%; The margin ratio of Ag (T+D) contracts will be adjusted from 12% to 13%, and the limit of the price increase and decrease will be adjusted from 11% to 12% on the next trading day.

5. Positive factors appear, and the real estate sector rose again

On May 20, the real estate logic lies in the blessing of the equity market is very obvious. Although the response of domestic investors to the recent real estate policy is relatively flat, from the perspective of foreign investment, it is a blockbuster positive. Looking at the secondary market, consumer stocks are clearly stronger. The positive logic of real estate will boost income expectations, and the reversal of income expectations is an important fulcrum for the strength of the price index. Therefore, this is also the starting point of the logic of inflation. And the fulcrum of the inflationary logic is "pork". In early trading today, the pork index in the secondary market also rose sharply. At present, most funds may not be aware of the implications of this intensity of property policy. The expectations released by these policies may not be limited to the real estate sector, but to support the entire economy. This also means that if the follow-up policy effect is less than expected, there will be stronger measures. In this process, the equity market does not rule out a process of spike. (Brokerage China)

International News

1. Short-covering in the U.S. natural gas market is likely to continue

US natural gas futures extended gains due to strong cooling demand and lower-than-expected inventory growth in the previous two weeks. Eli Rubin, an analyst at EBW Analytics, said in a note that although the market looks overbought, the large short-covering seen over the past two weeks is likely to continue, and a consolidation is long overdue. "Production is likely to continue to rise as maintenance work slowly comes to an end and higher gas prices spur a recovery in production."

2. Shipping prices change every week, and the supply and demand pattern of shipping is expected to turn around in the fourth quarter

Recently, a number of shipping giants have issued announcements announcing an increase in sea freight prices, with many routes increasing by about $1,000 to $2,000. The relevant person in charge of a freight forwarding company said that the shipping price of African routes jumped by 2,000-3,000 US dollars a week, and some positions needed to be booked a month in advance. In the first four months of this year, domestic exports of new containers increased sharply. The shipping market is hot, and many shipowners have purchased additional containers to increase capacity. Business traders believe that with the continuous increase in capacity, the supply and demand pattern of shipping is expected to reverse in the fourth quarter. (CCTV Finance)

3. ING: UK services inflation in April may be stronger than expected

The Russian government has finally decided to suspend a temporary ban on gasoline exports due to ample supply in the market, the Russian business news agency reported on Monday, citing people familiar with the matter. It added that the Ministry of Energy had confirmed the information. Russia banned gasoline exports for six months from March 1, but the Moscow-led economic union and some countries that have direct intergovernmental agreements with Russia on fuel supplies are not restricted. "The temporary gasoline export ban that began on March 1 will be lifted due to the saturation of the domestic market and the completion of unscheduled maintenance at refineries," the Ministry of Energy and Resources said. RBC, citing a source, said the decision to suspend the ban would be announced early this week, but the source did not specify the timeframe for the new decision. According to the Russian Ministry of Energy, refineries and oil depots have built up stocks of gasoline for motor vehicles, which can fully meet the needs of the domestic market. As of May 15, gasoline inventories stood at 2.1 million tonnes and diesel fuel inventories stood at 3.4 million tonnes.

4. Deputy Governor of the Bank of England: The UK may cut interest rates this summer

Deputy Governor of the Bank of England, Broadband, said UK interest rates could be cut this summer as long as economic data continues to develop as officials expect. He expects inflation to fall to the 2% target, though he's not sure how long the impact of the second wave of inflation on prices will last, [but] interest rates will have to be cut at some point in the future to ease the drag on economic activity from borrowing costs." "The direct impact of the pandemic and the conflict on inflation has now subsided, and after both, the ups and downs in tradable prices are also the main reason for the decline in inflation. We are now facing a more persistent second-round effect of earlier surges in domestic inflation, and it is unclear how long this will last. ”

5. Oil prices rose but still fluctuated in a narrow range

Oil prices rose, but remained in a small range. Brent oil rose 0.4% to as high as $84.17 a barrel, and WTI crude rose 0.4% to a high of $79.90 a barrel. Oil prices have been trading in a range of less than $3.50 since early May, and OPEC+ and its output policies for the second half of the year may need more clarity to provide momentum for the market to break out of the near-term range, analysts said. Markets are awaiting OPEC's next move, with three possible scenarios for the June 1 meeting: extending, cutting, or completely eliminating the voluntary 2.2 million barrels per day cut.

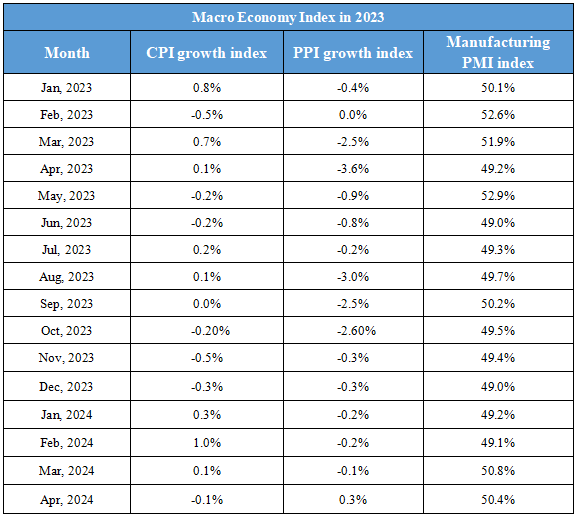

Domestic Macro Economy Index