March 15th Macroeconomic Index: China's Coal Sales Surge, Hangzhou Eases Housing Restrictions, Huawei Reports Strong Revenue Growth

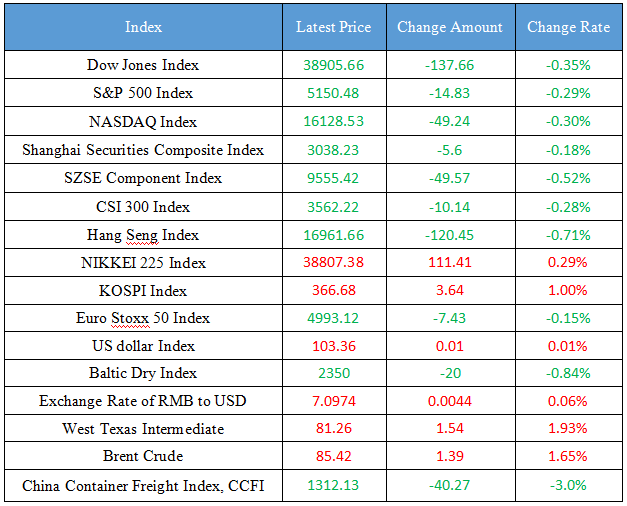

Latest Global Major Index

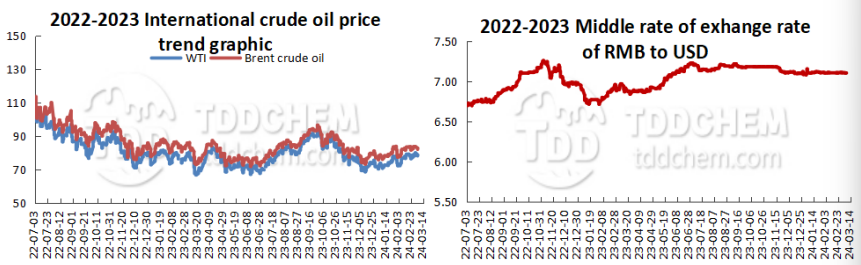

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Shaanxi Coal Selling and Transportation Corporation sold 44.432 million tons of coal in the first two months of 2024

2. Hangzhou's liberalization of second-hand housing purchase restrictions, institutions: it will promote the normal circulation of new housing and second-hand housing markets

3. Wang Tao, Executive Director of Huawei: Huawei's sales revenue exceeded 700 billion yuan in 2023, a year-on-year increase of more than 9%

4. From now on, China will try visa-free access to six countries, including Switzerland, to send a strong signal of openness

International News

1. South Korea amends regulations to support business appreciation plans of companies

2. JPMorgan Chase: Gold is reaching $2,500 during the year, which is the first bulk commodity to be launched

3. Rengo, the Japanese trade union, announced the results of the first round of salary negotiations on Friday and held a press conference

34 Capital Economics: The Federal Reserve's economic forecast will be "slightly hawkish"

Domestic News

1. Shaanxi Coal Selling and Transportation Corporation sold 44.432 million tons of coal in the first two months of 2024

According to Shaanxi Coal Industry News, in the first two months, the transportation and marketing group sold a total of 44.432 million tons of coal, a year-on-year increase of 4.1%, of which the total amount of rail transportation was 25.522 million tons, a year-on-year increase of 7.7%, achieving a balance between production and sales. In the first two months, the supply of thermal coal in the province was 3.372 million tons, an increase of 19.3% year-on-year.

2. Hangzhou's liberalization of second-hand housing purchase restrictions, institutions: it will promote the normal circulation of new housing and second-hand housing markets

On March 14, Hangzhou issued the "Notice on Further Optimizing the Real Estate Market Regulation Measures", which fully liberalized the restrictions on the purchase of second-hand houses and reduced the cost of taxes and fees. The executive vice president of the East China Region of the China Index Research Institute said that the reason why it is only for the second-hand housing market is that the inventory of new houses in Hangzhou is healthy, and the hidden inventory clearance cycle is only 10 months, while the current second-hand residential listings have nearly 140,000 units, and the inventory pressure is huge. Gao Yuansheng believes that the new policy will further activate the second-hand housing market, and at the same time smooth the second-hand housing replacement chain and promote the normal circulation of the new housing and second-hand housing market. (Securities Times)

3. Wang Tao, Executive Director of Huawei: Huawei's sales revenue exceeded 700 billion yuan in 2023, a year-on-year increase of more than 9%

Huawei's 2024 Partner Conference was held in Shenzhen. In the keynote speech, Wang Tao, Executive Director of the Board of Directors and Chairman of the ICT Infrastructure Management Committee, said that after years of hard work, Huawei has withstood severe tests. In 2023, Huawei's operations basically returned to normal with overall stable operations, with global sales revenue exceeding RMB 700 billion, achieving a growth of more than 9%. Among them, Huawei's enterprise business revenue in China has achieved a rapid growth of more than 25%. (Bond China Agency)

4. From now on, China will try visa-free access to six countries, including Switzerland, to send a strong signal of openness

Since March 14, China has tried to implement a visa-free policy for holders of ordinary passports from six countries: Switzerland, Ireland, Hungary, Austria, Belgium and Luxembourg. This is the second expansion of China's visa-free "circle of friends" after the China-Thailand mutual visa free agreement officially came into effect on the 1st of this month. As of early March, China had concluded visa exemption agreements with 157 countries covering different passports, and concluded agreements or arrangements with 44 countries on visa simplification. (CCTV)

International News

1. South Korea amends regulations to support business appreciation plans of companies

The National Pension Service (NPS) supports the government's "Business Appreciation Program" direction, which aims to address the so-called "Korea Discount" problem, which helps to improve the profitability of its stocks and bonds. NPS will continue to enlarge the proportion of risk assets and overseas assets, and diversify its investments in alternative assets. In addition, NPS's overseas investments focus on risky assets, and increasing the proportion of risky assets and diversifying investments are the two main investment strategies to improve NPS's profitability. The NPS is in the process of transforming the fund's management system with a "reference portfolio", which is expected to be approved by the Commission by May.

2. JPMorgan Chase: Gold is reaching $2,500 during the year, which is the first bulk commodity to be launched

Natasha Kaneva, head of global commodities research at JPMorgan Chase, said gold was the company's first choice in the commodities market. Natasha Kaneva said they expect gold to rise to $2,500 this year because the market tends to get too excited. To achieve this price target, one needs to confirm US inflation and employment data continue to slow and that the Fed is indeed cutting interest rates.

3. Rengo, the Japanese trade union, announced the results of the first round of salary negotiations on Friday and held a press conference

Rengo, Japan's largest labor union, will announce the results of the first round of wage negotiations on Friday, March 15, with a press conference at 16:15 (15:15 Beijing time), and the results of the second round of wage negotiations on Friday, March 22, and a press conference at 17:00 (16:00 Beijing time). The level of salary increase demanded by the union is 5.85%.

4. Capital Economics: The Federal Reserve's economic forecast will be "slightly hawkish"

Andrew Hunter, an analyst at Capital Economics, said in a note that the Fed's new economic forecast, scheduled for release next week, is not expected to change much, but “could become slightly more hawkish.” Hunter is sticking to his forecast that the Fed will cut interest rates for the first time in June, although this may depend on better news on inflation in the coming months. The Fed's GDP growth will improve slightly this year, and inflation will reach its 2% target “sooner than the Fed expects” (the Fed's December economic projections suggest that inflation will not reach its 2% target until 2026.

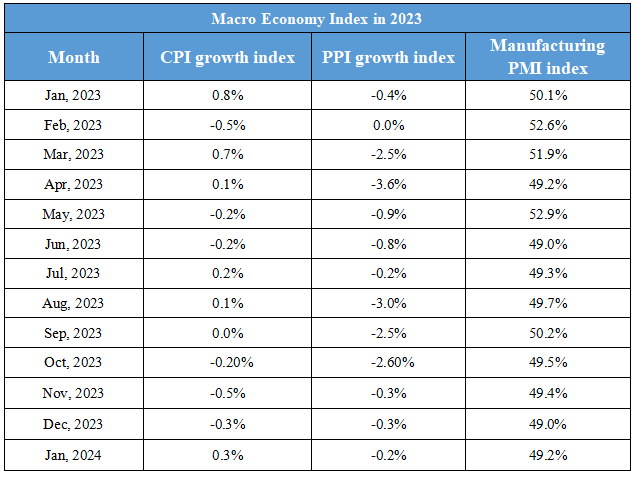

Domestic Macro Economy Index