July 12th Macroeconomic Index: China Builds World's First 6G Trial Network, Consumption Tax Reform Advances

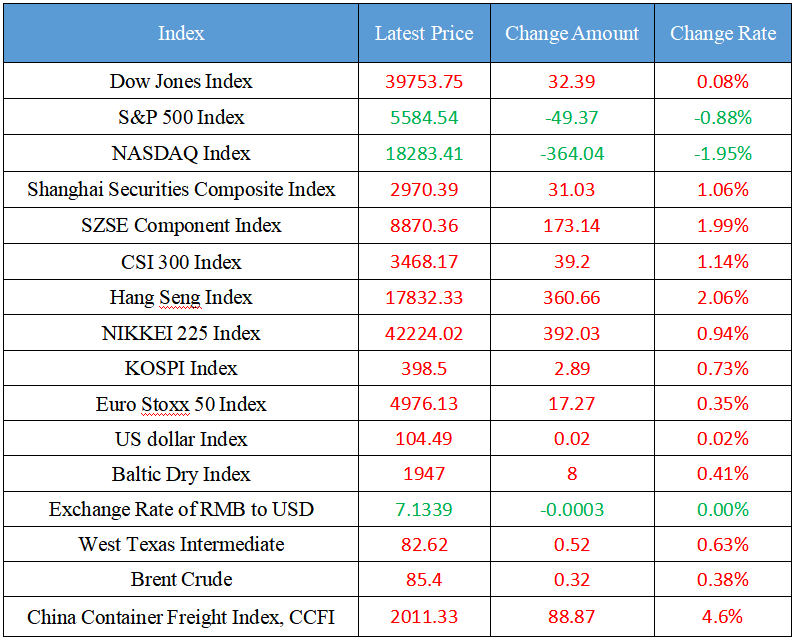

Latest Global Major Index

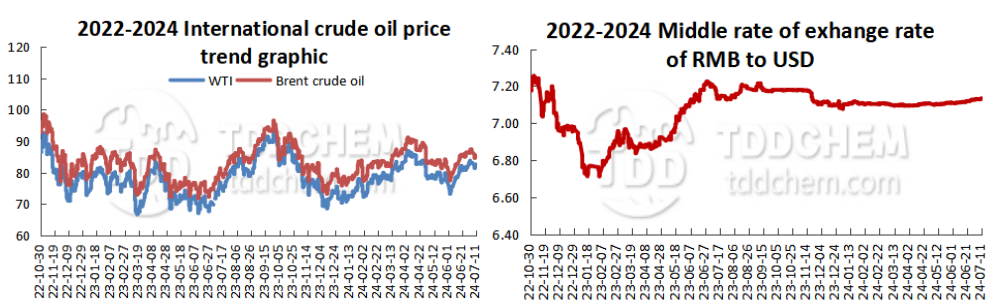

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The Ministry of Commerce responds to the question about China's electric vehicle subsidies

2. The front page of the Securities Times: The local tax collection was postponed, and the consumption tax reform needs to be broken

3. China has successfully built the world's first 6G trial network that integrates telecommunication and intelligence

4. Ministry of Housing and Urban-Rural Development: From January to May, 22,600 old urban communities were newly renovated across the country

5. China has successfully built the world's first 6G trial network integrating both telecommunication and intelligence

International News

1. SEA: India's palm oil imports increased by about 3% month-on-month in June

2. Japan's 40-year government bond yield witnessed 3% for the first time

3. Netherlands International: The United Kingdom yield inversion may not be over yet

4. US media: A ceasefire agreement between Palestine and Israel seems to be just around the corner

5. The IEA lowered its oil demand growth forecast for 2025 and raised its supply forecast

Domestic News

1. The Ministry of Commerce responds to the question about China's electric vehicle subsidies

The Ministry of Commerce held a regular press conference. A reporter asked, recently foreign media reported that the EU's anti-subsidy investigation report on China's electric vehicles is a confirmation of the fact that Chinese car companies accept subsidies from the Chinese government, thus creating unfair price advantages for European car companies. Does the spokesperson have any comment? He Yongqian, spokesman for the Ministry of Commerce, said that at present, China and the EU are negotiating on the anti-subsidy case for electric vehicles, and facts and rules are the two pillars of the consultations. The facts here refer to the objective facts recognized by both parties, not the so-called "facts" determined unilaterally. It is hoped that the EU side will face up to the fact that China's competitive advantage in electric vehicles does not come from subsidies, the fact that China-EU cooperation in the automotive industry is conducive to common development, and the fact that the EU industry opposes trade protectionist measures, and truly make a reasonable and objective decision based on facts and rules.

2. The front page of the Securities Times: The local tax collection was postponed, and the consumption tax reform needs to be broken

In recent years, the direction of consumption tax reform has been confirmed by the Ministry of Finance many times, and it is also highly anticipated by the market. The interviewed experts pointed out to reporters that under the current economic situation, consumption tax should become the "vanguard" of a new round of local tax system reform, expand local revenue sources, and guide local governments to improve the consumption environment. In terms of specific operation, on the premise of ensuring the stability of the existing financial resources of the central and local governments, the proportion of income distribution between the central and local governments of consumption tax will be redivided. Reform is bound to be accompanied by challenges, which can be met by appropriately expanding the scope of taxation or by differentiating tax rates to a greater extent. In order to adapt to a series of challenges brought about by the reform, the interviewed experts suggested that the scope of consumption tax should be appropriately expanded, and the tax rate should be levied or increased on certain luxury goods that have not yet been included in the scope of collection or have a low tax rate; At the same time, the tax rates of cigarettes, alcohol, refined oil, passenger cars and other commodities that account for a large proportion of the current consumption tax will be basically stable. (Securities Times)

3. China has successfully built the world's first 6G trial network that integrates telecommunication and intelligence

Good news in China's communication field: the key 6G technology marked by the integration of telecommunication and intelligence has ushered in a new breakthrough, and 4G and 5G communication links are expected to have 6G transmission capabilities. China took the lead in building the world's first 6G field test network that integrates communication and intelligence, realizing the overall improvement of communication performance in major 6G scenarios. At the academic seminar on "Information Theory: Classics and Modernity" held by the China Institute of Communications in Beijing on the 10th, the release of a new achievement attracted the attention of the industry. (Xinhua News Agency)

4. Ministry of Housing and Urban-Rural Development: From January to May, 22,600 old urban communities were newly renovated across the country

According to the Ministry of Housing and Urban-Rural Development, in 2024, the country plans to start renovating 54,000 old urban communities. According to the statistics reported by various places, from January to May, 22,600 old urban communities were newly renovated across the country. In terms of regions, the operating rate of 8 regions, including Jiangsu, Shandong, Hebei, Liaoning, Zhejiang, Shanghai, Hubei and Chongqing, exceeded 50%.

5. China has successfully built the world's first 6G trial network integrating both telecommunication and intelligence

Good news in China's communication field: the key 6G technology marked by the integration of telecommunication and intelligence has ushered in a new breakthrough, and 4G and 5G communication links are expected to have 6G transmission capabilities. China took the lead in building the world's first 6G field test network that integrates telecommunication and intelligence, realizing the overall improvement of communication performance in major 6G scenarios. At the academic seminar on "Information Theory: Classics and Modernity" held by the China Institute of Communications in Beijing on the 10th, the release of a new achievement attracted the attention of the industry. (Xinhua News Agency)

International News

1. SEA: India's palm oil imports increased by about 3% month-on-month in June

The Japan Bank of China may cut its economic growth forecast for this year in July, but expects inflation to remain near its 2% target in the coming years, keeping the possibility of a rate hike this month increases. Three people who are familiar with Japan Central Bank's thinking said that a rare surprise by the central bank Japan a downward revision of historical GDP data could lead to a small downward revision of the Japan Central Bank's economic growth forecast for the current fiscal year. But they said the central bank may not make significant adjustments to its GDP forecasts for fiscal 2025 and 2026 and stuck to the view that the economy will still recover modestly. "The downward revision of GDP is a thing of the past and will not have much impact on the Japan bank's economic assessment," one of the sources said, and another shared the view. "Overall, everything is on track." In addition, the Bank of Japan will also broadly maintain its forecast that inflation will remain around its 2% target by early 2027. "There isn't much data asking the Bank of Japan to change its view on the overall price trend," a third source said.

2. Japan's 40-year government bond yield witnessed 3% for the first time

Japan's 40-year government bond yield hit 3% for the first time since the product began to be issued in 2007. At present, there is selling pressure in the market (some from overseas investors), and domestic institutions such as life insurance companies are also cautious ahead of the Bank of Japan's July 31 decision. Yields on three 40-year Japan government bonds rose to 3% on Wednesday and showed no signs of falling on Thursday. The continued weakness of the yen has intensified speculation that the Bank of Japan will take further monetary policy normalization measures, and major investors, including life insurance companies, are cautious about investing in Japanese bonds.

3. Netherlands International: The United Kingdom yield inversion may not be over yet

The decline in two-year United Kingdom yields since early July means that the yield curve for two to ten year United Kingdom bonds is no longer inverted (inverted i.e. short-term yields are higher than long-term yields), Netherlands rates strategists wrote in a note. This is in stark contrast to the fact that the yield curves of German and US bonds are still inverted. However, it is too early to say that the United Kingdom yield curve inversion is over. Considering that the US Treasury yield is only slightly above 4.3%, the United Kingdom 10-year yield at 4.1% is indeed high. In the short term, this could mean that the yield curve has steepened too much, potentially leading to a "bull market" flattening, where long-term bond yields fall faster than short-term bond yields.

4. US media: A ceasefire agreement between Palestine and Israel seems to be just around the corner

Washington Post columnist David Ignatius wrote that after months of hard negotiations, the Biden administration appears to be on the verge of brokering a ceasefire agreement between Palestine and Israel that would halt major fighting in Gaza, release some Israel hostages and provide more humanitarian aid to Palestinian civilians. A senior United States official said the framework for the ceasefire agreement had been agreed and that the parties were now "negotiating the details of how to implement the framework." McGork, a consultant on Middle East affairs, and Burns, the director of the CIA, have been shuttling between regional capitals since last November.

5. The IEA lowered its oil demand growth forecast for 2025 and raised its supply forecast

The International Energy Agency (IEA) lowered its forecast for oil demand growth next year and raised its forecast for oil supply, a situation that could lead to an oversupply in the market, reinforcing the agency's expectations of a severe oil oversupply over the next decade. The IEA said its forecast for oil demand growth next year will be lowered to 980,000 b/d from 1 million b/d previously, saying it now expects total demand to average 104 million b/d. This year, oil demand is expected to grow at 970,000 b/d, driven by developing countries, slightly higher than the previous forecast of 960,000 b/d. In addition, total oil supply is now expected to average 103 million b/d this year and 104.8 million b/d in 2025, up from previous forecasts of 102.9 million b/d and 104.7 million b/d. Non-OPEC+ countries will continue to lead global supply, with production now expected to increase by 1.5 million b/d in 2024 and 1.8 million b/d in 2025, the agency said.

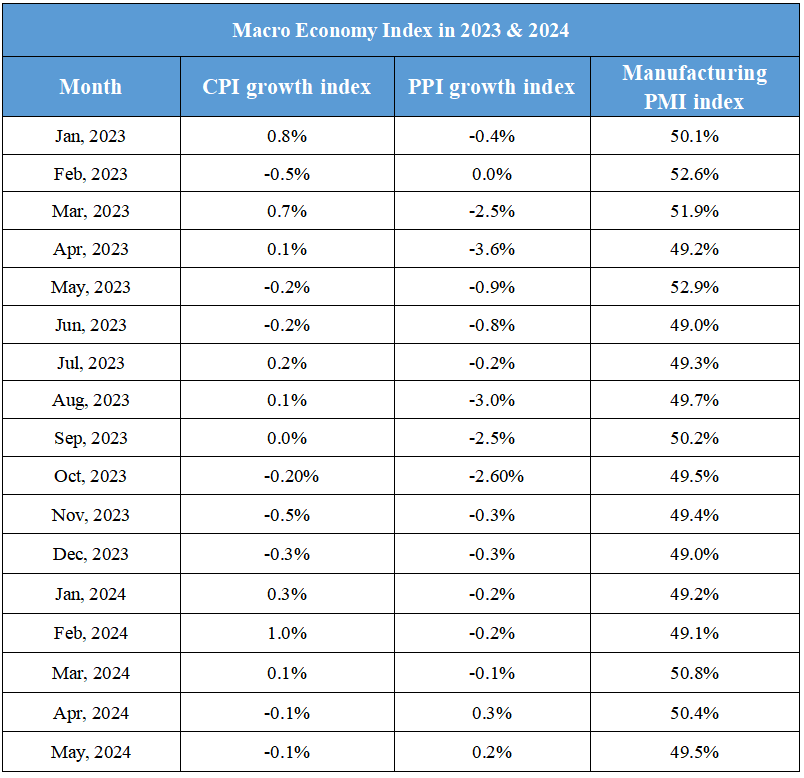

Domestic Macro Economy Index