Polypropylene Weekly Report: Spot market rose slightly during the week, and cost support was strengthened(January 2, 2025)

Chapter 1 Review of the polypropylene market this week

1. Analysis of the trend of the domestic polypropylene market

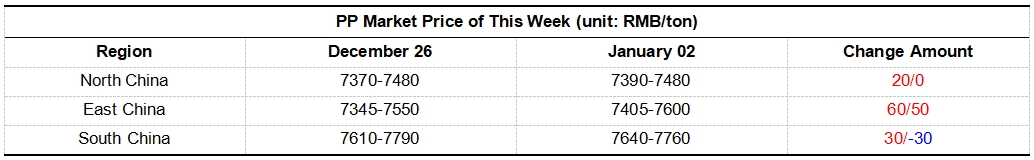

This week, the domestic polypropylene market showed a trend of small rise and repair. Compared with the same period last week, the market prices in various regions rose overall, with an adjustment range of 30-60 yuan/ton. As of Thursday this week, the domestic drawing price ranged from 7390 to 7760 yuan/ton.

The main factors affecting price fluctuations during the week are: 1. On the cost side, international oil prices showed an upward trend during the week, gradually breaking through US$71/barrel. The crude oil market was boosted by factors such as improved demand in Asia and the cold weather in the United States that boosted crude oil demand. The cost support of the PP market remained strengthened. 2. On the supply side, in the early part of the week, affected by the shutdown and maintenance of Jinneng Chemical and Ningxia Baofeng PP units with a production capacity of about 950,000 tons, the impact of the shutdown of PP units increased. In the late part of the week, Sino-Korea Petrochemical and Ningxia Baofeng PP units were restarted, and the Northern Huajin PP unit was shut down for maintenance. At the end of the month, the polyolefin inventory of the two oils maintained a good destocking rhythm, and the supply level of the field was relatively unchanged. 3. On the demand side, the return of funds at the end of the year has limited the circulation of goods to a certain extent, and the downstream enthusiasm for purchasing raw material PP is insufficient, maintaining rigid demand for replenishment, and the market support for PP is limited.

2. Propylene market price list

3. Analysis of polypropylene futures market trend

This week, the main polypropylene PP2505 contract showed a trend of three consecutive increases, with a fluctuation range of 136 points during the week. Specifically: the PP2505 contract opened at 7376 on December 30, and the highest point during the week appeared on January 02, with the highest point of 7507; the lowest point during the week appeared on December 30, with the lowest point of 7371. As of January 02, the settlement price was 7489. From the perspective of transaction status: 22.7% of long openings were short openings, 25.0% of short openings were short openings, and 21.2% of long closings were short closings, and 19.9% of short closings were short closings.

Chapter 2 Polypropylene Trend Forecast

In terms of raw materials, the protective atmosphere brought by OPEC+ production cuts in the crude oil market still exists, ensuring that oil prices are unlikely to fall sharply, and the expectation of improved demand in Asia brings positive support, but the continued global demand pressure and the strong US dollar may suppress the upward momentum of oil prices. It is expected that international oil prices may have room for a small increase. It is also necessary to pay attention to the relevant impact of the US President's policies on international oil prices after he officially takes office. In terms of supply, the Zhejiang Petrochemical PP unit with a production capacity of about 450,000 tons is planned to be overhauled in the market next week. In addition, the PP units of Sino-Korea Petrochemical, Jinneng Chemical, Fujian United and other PP units are planned to resume operation one after another. Combined with the gradual increase in the volume of new production, the supply of goods in the market may increase. In terms of demand, as the Spring Festival holiday approaches, downstream orders are coming to an end. Most product companies mainly focus on destocking finished products at the end of the year. In addition, under the influence of capital recovery and risk aversion, the intention to replenish raw material PP may gradually weaken. At the same time, facing the impact of future overseas tariffs, it is expected that terminal demand will slow down, and the PP market will operate in a stalemate under weak demand. Under the comprehensive influence, it is expected that the polypropylene market will consolidate weakly next week.

- Gasoline Market Analysis(April 3, 2025)1147

- Titanium Products Market Quotation(April 3, 2025)1202

- Sulfuric Acid Market Price Analysis(April 3, 2025)1211

- The Supply and Demand Side is under Pressure, and the Expectation of Improvement in Carbon Black is Limited(April 3, 2025)1103

- Analysis of rubber spot market(March 28, 2025)1047