Polypropylene PP: Spot prices have risen slightly, and the inventory on the market is low(December 31, 2024)

Domestic petrochemical inventory: The inventory of polyolefins of the two oils is 520,000 tons, down 30,000 tons from yesterday.

PP futures analysis: PP2505 opening price on December 31: 7400, highest price: 7480, lowest price: 7393, position: 467325, settlement price: 7445, yesterday's settlement: 7392, increase: 53, daily trading volume: 361876 lots, deposited funds: 2.446 billion, capital outflow: 107 million.

PP market drawing mainstream quotation:

Propylene market price list

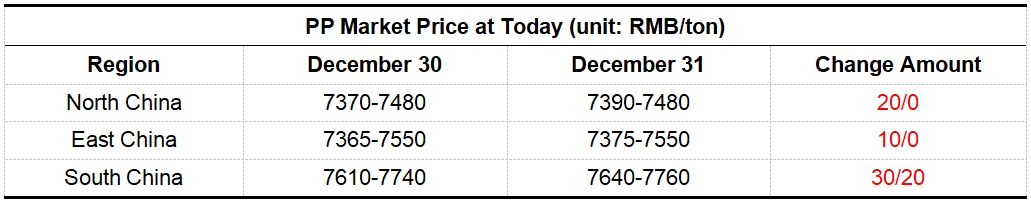

PP domestic spot market analysis: Today, the domestic PP market as a whole showed a narrow consolidation trend, among which the price in the North China market maintained yesterday's quotation, the market price in the East China region rose slightly, and the market price in the South China region fell. In terms of price: the mainstream price of domestic polypropylene ranged from 7365 to 7740 yuan/ton. International oil prices have risen, and the cost side still has favorable support. In addition, the inventory of polyolefins from the two oils maintained a positive destocking rhythm before the New Year's Day. The impact of the shutdown of the PP unit remained at around 15%. There was no significant supply pressure in the market for the time being, and the downstream purchase of raw material PP maintained rigid demand for replenishment, and the willingness to stock up was average. However, the sales pressure of traders eased at the end of the month, and some quotations rose, and the trading situation in the market improved.

PP spot trend forecast: In terms of raw materials, the crude oil market is affected by multiple factors. Among them, the positive factors include the expectation of economic improvement in Asia and the expected cold weather in the northeastern United States, which is expected to boost crude oil consumption demand. The negative factors include the poor global demand outlook and the easing of the geopolitical situation. It is also necessary to pay attention to the release of important economic data such as China's manufacturing PMI. In terms of supply, there are no PP units planned for maintenance in the market in the short term. In addition, three PP units of Sino-Korea Petrochemical are planned to resume operation. In addition, the expectation of the gradual expansion of multiple new PP units is expected. The supply of goods in the market may increase, and it is necessary to continue to pay attention to the release of new production capacity and changes in inventory data. On the demand side, as the end of the year approaches, downstream orders are limited, and downstream factories may maintain early production, and the enthusiasm for purchasing raw material PP may continue to decline. Overall, it is expected that the polypropylene market may fluctuate and weaken in the short term.

Domestic PP Index: According to Tuduoduo data, the domestic PP spot index was 7532.50 on December 31, up 13, a range of 0.18%.

Shenhua auction transaction situation: Shenhua Coal Chemical's auction volume today is 400 tons, down 11.11% from yesterday; the transaction volume is 300, up 50.00% from yesterday, and the transaction rate is 75.00%, up 30.56% from yesterday.

- Gasoline Market Analysis(April 3, 2025)1147

- Titanium Products Market Quotation(April 3, 2025)1202

- Sulfuric Acid Market Price Analysis(April 3, 2025)1211

- The Supply and Demand Side is under Pressure, and the Expectation of Improvement in Carbon Black is Limited(April 3, 2025)1103

- Analysis of rubber spot market(March 28, 2025)1047